Bitcoin Price Action Turns Choppy

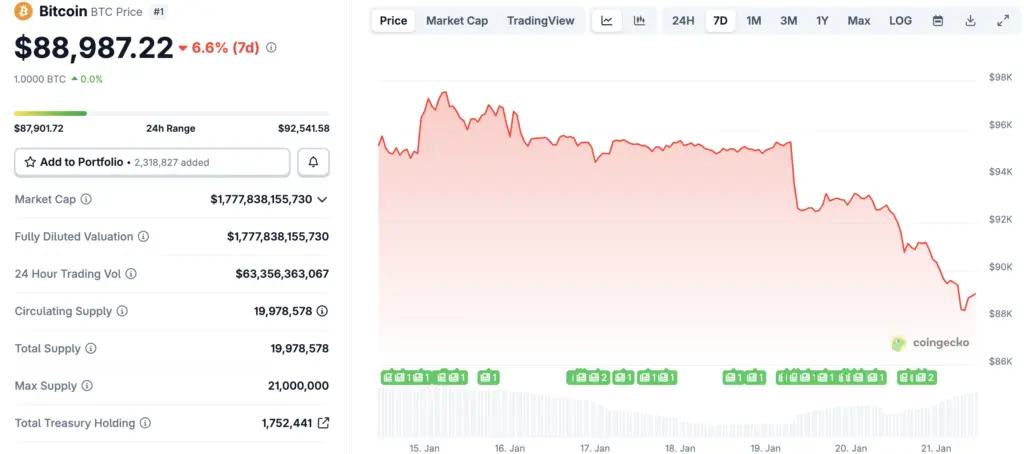

Bitcoin entered January 20, 2026, in a notably unsettled trading environment after weeks of relative stability. Prices oscillated sharply as buyers and sellers reacted to conflicting signals from global markets, highlighting the fragile balance between optimism and caution.

After briefly pushing higher earlier in the week, Bitcoin struggled to maintain momentum. The inability to sustain gains reinforced the sense that the market is searching for direction rather than committing to a decisive trend.

ETF Flows Send Mixed Signals to Investors

Spot Bitcoin exchange-traded funds remain a central force shaping sentiment. Recent sessions showed a split pattern, with some funds recording inflows while others experienced modest redemptions.

Rather than signaling panic, these movements suggest portfolio rebalancing among institutional investors. Many appear to be adjusting exposure in response to macro risks instead of abandoning the asset class outright.

Macro Uncertainty Weighs on Risk Appetite

Broader macroeconomic conditions continue to exert pressure on Bitcoin’s near-term outlook. Persistent inflation concerns, uneven global growth, and renewed trade frictions have dampened enthusiasm for risk-on assets.

Expectations surrounding monetary policy remain particularly influential. Even small shifts in interest-rate outlooks from central banks can ripple through crypto markets, amplifying volatility during periods of uncertainty.

Recommended Article: Bitcoin Volatility Returns as Investors Reprice Risk After Strong 2025 Rally

Interest Rates and Liquidity Remain Key Drivers

Bitcoin’s sensitivity to real interest rates has become increasingly evident. Higher yields on government bonds raise the opportunity cost of holding non-yielding assets, prompting some investors to reduce speculative positions.

At the same time, liquidity conditions remain supportive relative to historical tightening cycles. This dynamic helps explain why pullbacks have been orderly rather than disorderly, with buyers stepping in near key support levels.

Derivatives Markets Reflect Cautious Positioning

Futures and options data indicate a cooling of aggressive leverage. Funding rates have normalized, and open interest growth has slowed, suggesting traders are exercising restraint.

This shift contrasts with periods of euphoric rallies, when leverage builds rapidly. Historically, such measured positioning can either precede renewed volatility or signal an extended consolidation phase.

Long-Term Holders Stay Relatively Calm

On-chain indicators show limited distribution from long-term holders despite recent price swings. Older coins remain largely dormant, reinforcing the view that current volatility has not shaken core conviction.

Short-term traders, however, remain active, rotating positions quickly in response to headlines. This divergence underscores the gap between tactical trading behavior and longer-term investment theses.

What to Watch Next for Bitcoin

Bitcoin’s next major move will likely depend on clearer macro signals. Economic data releases, central bank commentary, and developments in global trade policy all carry the potential to shift sentiment rapidly.

For now, Bitcoin remains caught between structural institutional demand and near-term macro uncertainty. Stability above key technical levels suggests confidence has not collapsed, but sustained upside may require renewed clarity from the global economic landscape.