Korea’s First Publicly Regulated Bitcoin Purchase

Bitplanet Inc. has officially entered Bitcoin accumulation, purchasing 93 BTC as part of its new daily buy program. The KOSDAQ-listed firm becomes Korea’s first publicly traded company to execute a regulated Bitcoin acquisition. Executives say this move marks a pivotal shift in the nation’s corporate approach to digital assets. Through full regulatory compliance, Bitplanet aims to lead institutional adoption of Bitcoin in Asia.

Setting a New Standard for Corporate Crypto Strategy

Co-CEO Paul Lee emphasized that transparency and structure define the firm’s approach. The company’s daily accumulation plan removes market timing risks, aligning Bitcoin accumulation with a disciplined, long-term framework. “Bitplanet’s initiative represents Asia’s first fully regulated institutional-grade Bitcoin treasury model,” Lee said. This announcement positions Bitplanet as a pioneer in compliant digital asset integration within corporate finance.

Targeting a 10,000 BTC Treasury Over Time

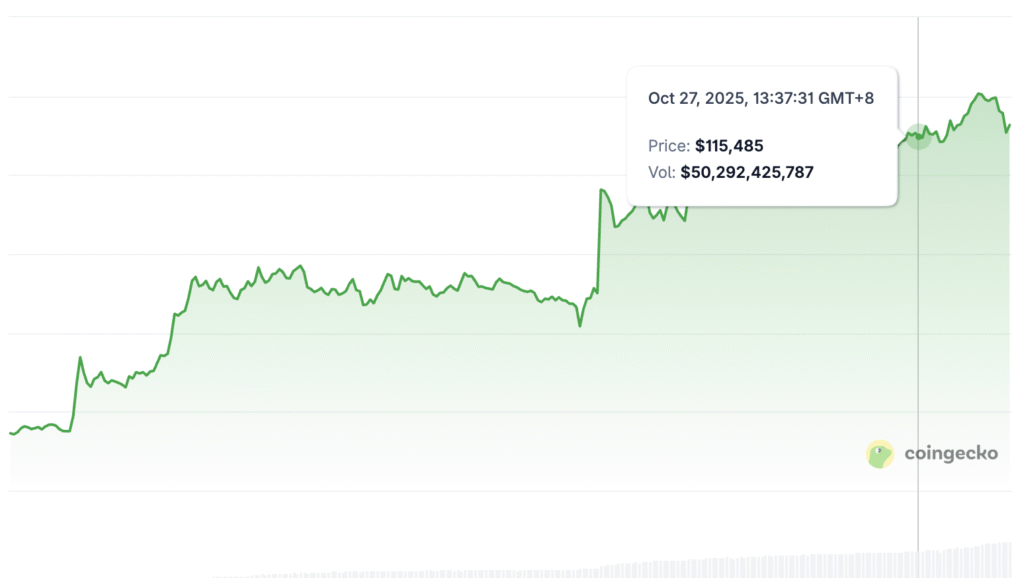

Bitplanet has unveiled an ambitious roadmap to build a 10,000 BTC reserve as a strategic balance-sheet asset. To support this plan, it raised $40 million in new capital in September 2025. These funds will fuel continued daily purchases and reinforce liquidity management. Executives believe this program will enhance shareholder value and provide long-term exposure to Bitcoin’s deflationary economics.

Recommended Article: Bitcoin Supply Crisis Looms as 8.3M Coins May Become Illiquid by 2032

Institutional Backing Underscores Market Confidence

Bitplanet’s investor base includes both traditional finance and digital asset leaders. Among the backers are Simon Gerovich of Metaplanet, AsiaStrategy, Sora Ventures, KCGI, Kingsway Capital, and ParaFi Capital. Their participation reflects growing confidence in institutional-grade crypto initiatives in Asia. This mix of investors also signals broader cross-sector interest in Bitcoin as a corporate treasury instrument.

From IT Services to Institutional Bitcoin Holdings

Formerly known as SGA Inc., Bitplanet evolved from an IT service provider into a blockchain-focused financial innovator. The company leverages its technology background to integrate compliance systems and risk controls within its Bitcoin operations. This transformation aligns with South Korea’s growing acceptance of blockchain within regulated finance. The firm’s rebranding symbolizes a forward-looking shift toward digital financial infrastructure.

Regulated Infrastructure Ensures Transparency

Bitplanet’s purchase was conducted entirely through regulated exchanges and custody platforms. This ensures that every transaction meets anti-money-laundering (AML) and know-your-customer (KYC) standards. The company describes its treasury program as both auditable and fully compliant with Korean financial law. Such transparency may help bridge the gap between regulators and blockchain enterprises.

Redefining Bitcoin as a Strategic Reserve Asset

Management clarified that this initiative is not speculative but strategic. By committing to daily accumulation, Bitplanet adopts a dollar-cost-averaging model that smooths volatility over time. The company aims to integrate Bitcoin into its reserve framework similarly to how firms hold gold or foreign currencies. In doing so, it hopes to institutionalize crypto exposure across Korea’s corporate ecosystem.

Implications for Asia’s Corporate Adoption Wave

Bitplanet’s move could catalyze a regional wave of Bitcoin treasury strategies. As regulatory clarity improves and infrastructure matures, more public companies in Asia may follow suit. Analysts believe this marks the beginning of a new era for digital asset management within listed corporations. If Bitplanet meets its 10,000 BTC goal, it could become a benchmark case for compliant Bitcoin accumulation in global finance.