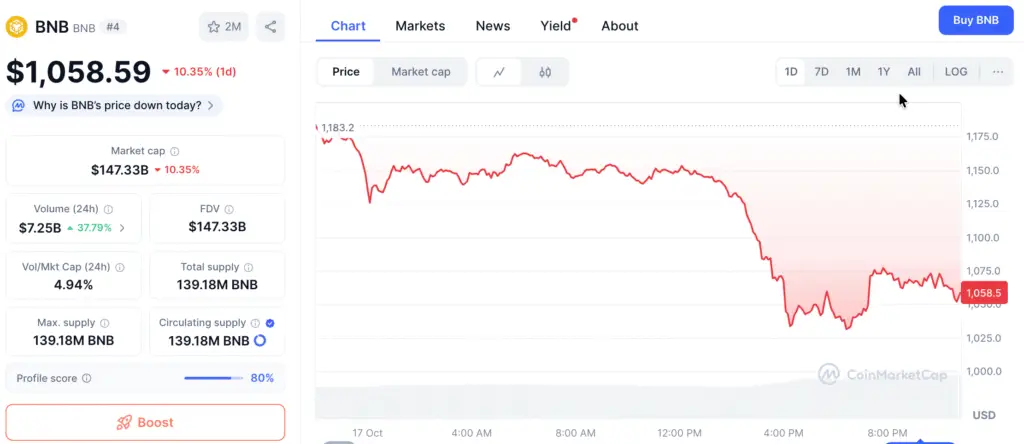

BNB Drops 15% Following Historic Highs

BNB, the native token of the Binance ecosystem, has experienced a 15% decline following its record highs, sparking discussions about whether this movement indicates a healthy consolidation phase or the onset of a more significant downturn. Recent data indicate notable volatility in both spot and derivatives markets, highlighting an increasing sense of uncertainty among investors.

The token experienced significant fluctuations in the short term, a trend that came on the heels of weeks marked by enthusiastic trading and speculative leverage. The significant drop has driven prices down to the $1,050–$1,000 range, a crucial support area where buyers and sellers are currently engaged in a technical impasse.

BNB Accumulation Rises in Spot Market as Futures Show Heavy Hedging

Recent analytics highlight a notable gap between spot and futures markets. The spot cumulative volume delta (CVD), which reflects the balance of buying and selling pressure, increased from $2.34 billion to $3.3 billion, indicating consistent accumulation. On the other hand, futures CVD decreased from –$41 billion to –$45.8 billion, reflecting ongoing hedging and short positions.

This divergence highlights the contrasting sentiments within the market: long-term investors are steadily building their positions, while professional traders prepare for potential further declines. A significant 36% decline in open interest, coupled with an overheated RSI, bolsters the case for a potential short-term correction should the buying momentum falter.

Fundamentals Remain Strong Despite Market Stress

In the midst of the chaos, BNB’s core principles continue to demonstrate strength. The BNB Chain has recently reduced its gas fees from 0.1 Gwei to 0.05 Gwei, enhancing efficiency for DeFi protocols and dApp developers. Institutional confidence remains strong, as evidenced by the reported influx of over $90 million on Binance and ongoing integration within partner ecosystems.

Market analysts assert that should the wider crypto landscape stabilize, BNB may potentially return to the range of $2,000–$2,100 in the long run. Historical parallels, like the 2021 rebound after a 70% correction, suggest a measured hope for recovery as selling pressure subsides.

Recommended Article: BNB Bull Run May Cool as Traders Raise Short-Term Concerns

Binance’s $400 Million Compensation Fund Ignites Controversy

To address the recent turmoil, Binance has unveiled a $400 million compensation fund aimed at supporting traders impacted by the flash crash. The initiative seeks to restore confidence and address reputational harm stemming from technical failures and a phishing incident on BNB Chain.

Nonetheless, experts hold differing opinions regarding its actual influence. Opinions are divided on whether the fund has the potential to boost demand and stabilize BNB’s price in the near term. Some view it as a stopgap solution that fails to tackle the underlying issues of liquidity fragility. The response from the market in the upcoming weeks will reveal if this action signifies a genuine shift or merely a temporary uptick.

Technical Indicators Suggest Volatile Weeks Ahead

BNB is presently priced at approximately $1,048, reflecting a decline of about 11% over the day, accompanied by varied indications from technical analyses. The RSI is currently high, indicating a lack of consensus among traders, while the Bollinger Bands suggest an increase in volatility ahead. If BNB maintains its position above $1,000, it may see a recovery toward $1,150; however, a failure to uphold support could lead to a decline toward $950 or even lower.

The situation is precarious as Binance faces challenges related to liquidity, security issues, and a broader trend of market deleveraging. A prolonged rebound will probably necessitate fresh capital inflows and steady on-chain engagement to validate investor trust.

BNB Faces Critical Turning Point as Market Sentiment Remains Fragile

BNB currently finds itself at a pivotal juncture. The strong fundamentals and Binance’s proactive strategies stand in stark contrast to the negative positioning in derivatives and the delicate sentiment prevailing in the market. Should the market absorb the recent fluctuations without triggering widespread sell-offs, a phase of recovery may be on the horizon.

Amid ongoing macroeconomic uncertainty and a notable aversion to risk from institutions, experts caution that a more significant correction remains a possibility. The upcoming weeks will be pivotal in determining if BNB’s downturn is merely a brief intermission or the onset of a more extended downward trend.