BNB Memecoins Rise as a Significant Market Trend

BNB memecoins have swiftly transformed into one of the most vibrant segments of the worldwide cryptocurrency landscape. Their achievements are driven by social momentum, wit, and the significant impact of Binance’s Changpeng Zhao.

In contrast to conventional tokens that emphasize utility, BNB memecoins flourish through active community engagement and the dynamics of viral culture. This combination of entertainment and blockchain innovation has positioned them as a key player in market engagement and speculative excitement.

CZ’s Leadership Drives Massive Trading Activity on BNB Chain

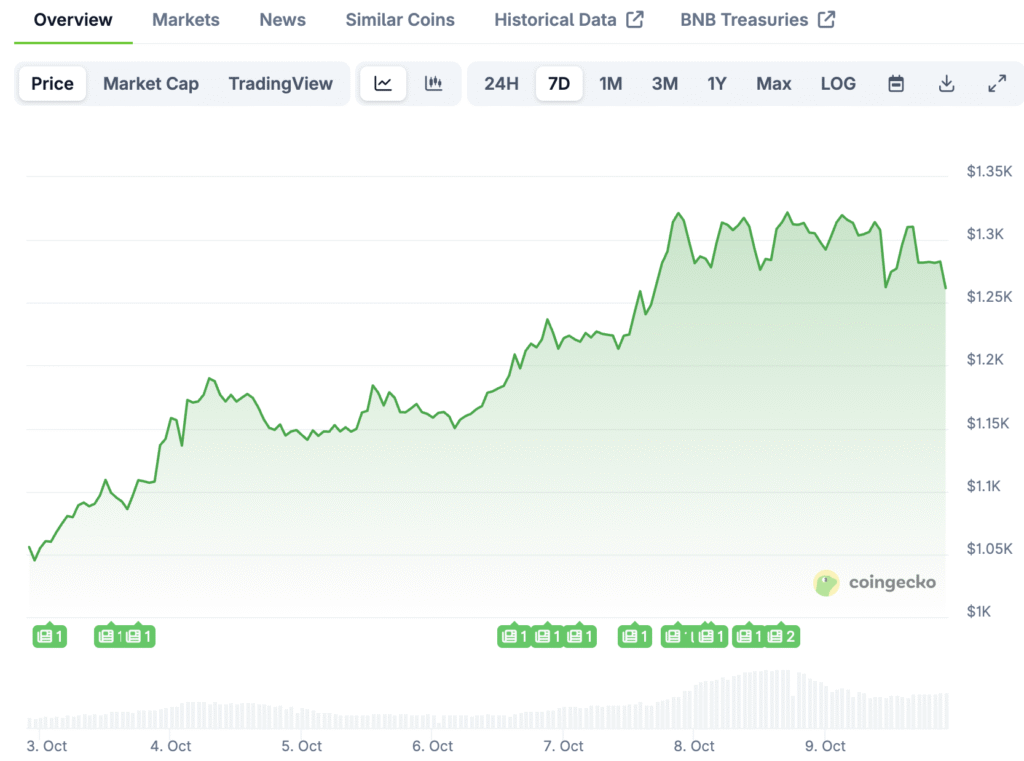

Changpeng Zhao’s remarks frequently trigger immediate responses, driving liquidity spikes and speculative surges in BNB-related tokens. His announcement of “BNB meme szn” sparked one of the most significant trading surges ever seen for community tokens.

BNB Chain currently represents about 11.4% of the total global memecoin activity, closely approaching Ethereum’s 12% share. More than 100,000 traders are actively engaged, indicating a rise in confidence as institutional investors delve into the network’s broadening token ecosystem.

Billion-Dollar Investments Validate the Growing BNB Ecosystem

The support from institutions has been crucial in driving the rapid expansion of BNB memecoins. YZi Labs has made a significant investment of $1 billion in BNB-based projects, highlighting confidence in the chain’s ability to lead in community-driven innovation.

The influx of capital highlights a growing readiness among institutions to explore cultural tokens. Investors recognize the scalability, reduced fees, and heightened user engagement of BNB Chain as distinct benefits over the slower legacy blockchain competitors.

Recommended Article: Ethereum vs BNB Which Crypto Holds Millionaire Maker Potential

Volatility and Speculation Remain Key BNB Memecoin Risks

Amid the enthusiasm, the unpredictable nature of the market continues to pose significant challenges for traders and startups involved with BNB memecoins. Rapid changes in sentiment can swiftly erase value, disheartening long-term investors and institutional players who are in search of stable returns.

A significant number of tokens on BNB Chain are devoid of substantial fundamentals, relying solely on their meme status. As excitement wanes, cash flow diminishes swiftly, heightening the risks for investors who are unready and pursuing quick gains without a robust plan.

BNB Chain Takes on Ethereum in Payroll and Transaction Speed

The scalability of BNB Chain enhances its competitiveness with Ethereum, particularly in the realm of decentralized payroll and transaction processing applications. The reduced gas fees and quicker confirmations facilitate economical transfers throughout international operations.

Companies have the ability to make payments using tokens that symbolize their brand or community, merging the dependability of stablecoins with the interactive nature of memecoins. This blended method elevates payroll to a cultural engagement, moving beyond mere transactional exchanges.

Regulatory Hurdles Test Fintech Startups Entering the BNB Space

The swift rise of BNB memecoins draws increased scrutiny from regulators worldwide. Fintech startups are required to adhere to anti-money laundering and know-your-customer regulations in regions such as Singapore, Japan, and South Korea.

Failure to comply with regulations can result in significant penalties and diminish the confidence of investors. To ensure ongoing adoption, startups need to create well-defined governance frameworks and uphold transparency in order to meet the evolving standards of crypto compliance.

BNB Memecoins Merge Culture and Utility as Innovation Drives DeFi’s Next Evolution

BNB memecoins embody a blend of cultural expression and blockchain functionality, marking a fresh era in decentralized finance. Their ongoing growth hinges on striking a balance between innovation and accountability while staying compliant with changing regulations.

Should BNB Chain’s ecosystem continue to innovate and curb speculative excess, it has the potential to transform crypto adoption. Achieving success will depend on maintaining user engagement and converting volatility into organized, long-term involvement in the market.