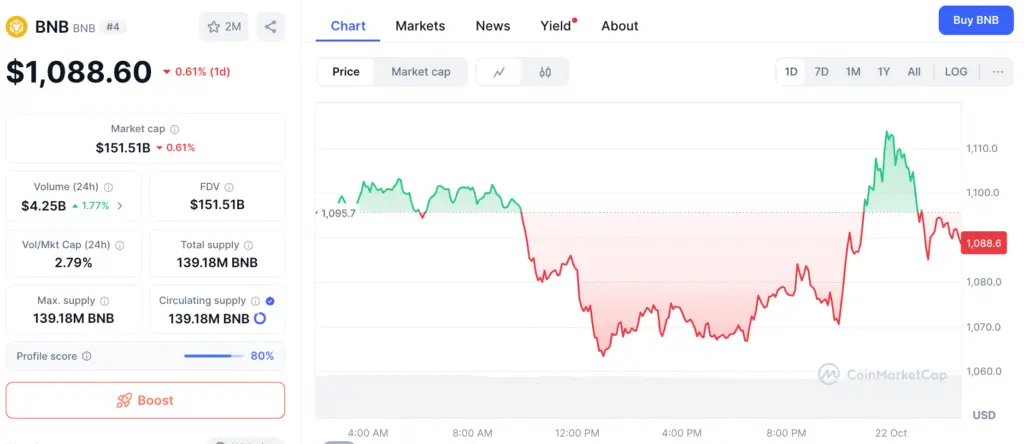

BNB Builds Momentum Toward $1,150 Resistance

Binance Coin (BNB) is gaining bullish momentum after a strong bounce back from lows in early October. Analyst Crypto Tony suggests that a return to $1,150 could confirm new momentum and set the stage for a medium-term rise towards $1,270–$1,320.

The 3-day chart indicates consistent trade buildup, suggesting a continued rally. Currently trading at $1,140, BNB is slightly below a critical resistance level. Experts believe the next goal may be $1,200 or $1,320 if the market breaks out. If bulls can get above this level, the next goal may be $1,200 or $1,320.

Chain Activity Surges as DEX Volume Crosses $2 Trillion

DefiLlama reports that the volume of decentralized exchanges (DEXs) on the Binance Smart Chain has reached $2 trillion, indicating continued growth and use of BNB-based protocols like PancakeSwap, Biswap, and ApeSwap. The average daily DEX volume is $2.83 billion, with $18.73 million in 24-hour inflows.

The total value locked (TVL) is $8.36 billion, and the capitalization of stablecoins across the chain is over $14 billion. This strong ecosystem attracts developers and liquidity providers despite market instability, making Binance one of the most active networks in the DeFi space.

BNB Consolidates Before Possible Breakout

BNB is consolidating between $1,110 and $1,130, potentially triggering another upward move. Recent increases from $1,090 to $1,140 indicate increased purchasing activity, and momentum suggests it might break out. If the market closes above $1,150 daily, it could push short-term goals to $1,180 and $1,200.

If resistance persists, the token may return to the $1,060–$1,000 support area, where purchasing activity has always returned. Trading volume has reached $3.02 billion, indicating significant involvement from traders and whales. The steady demand at key support levels suggests Binance Coin could lead the next wave of cryptocurrency recovery.

Recommended Article: BNB Price Nears $1,150 Breakout as Solana Patterns Reappear

BNB Holds $158B Market Cap as Core Pillar of Binance Ecosystem

Binance Coin is still the fourth-largest cryptocurrency in the world, with a market valuation of $158.84 billion. Its DeFi infrastructure keeps showing that it works well, can develop, and attracts new users, especially in cross-chain trading and staking apps.

BNB’s network utility, which includes discounts on transaction fees, token burning, and incentives for liquidity, keeps it relevant in a market that is becoming more focused on practical blockchain solutions. The cryptocurrency is the backbone of Binance’s huge ecosystem, which offers it a clear edge over its competitors. This means that both institutional and retail users will always want it.

Analysts Eye Q4 Rally Potential

Traders are keeping a careful eye on BNB to see if it can confirm a clean breakout over $1,150 while the larger crypto market settles down. If this strategy works, it might not only start BNB’s upward trend again, but it could also make other DeFi-linked cryptocurrencies feel more positive as we approach Q4 2025.

Binance Coin’s comeback may just be in its early stages, as seen by record DEX trading volume, growing on-chain inflows, and solid technical support. If momentum keeps going, BNB might reach its previous high of $1,320 and maybe even go higher as more people start using the network.

BNB Set Up for Long-Term Growth

Technical indicators, on-chain activity, and investment behavior all point to a positive future for Binance Coin. With DEX volume over $2 trillion, TVL over $8 billion, and buyers taking back control, BNB seems good for more gains once it breaks over the last barrier at $1,150.

As traders get ready for more activity in the market in late 2025, Binance Coin stays at the heart of the DeFi sector. It is a network-driven asset that has scalability, liquidity, and institutional appeal. The tone of the larger altcoin market in the next months will largely depend on whether it can keep going above $1,150.