BNB Sustains Its Drive Close to Key Resistance

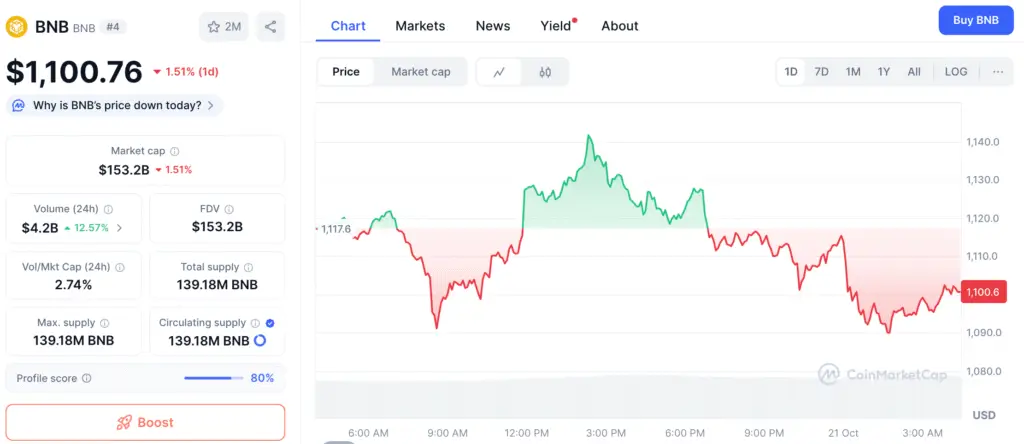

Binance Coin (BNB) continues on an upward trajectory, currently valued at approximately $1,116 after rebounding from the $1,080 support threshold. Analysts note that the asset is approaching a crucial resistance zone near $1,150, signaling a possible breakout ahead.

Market analyst CW highlights two significant sell walls positioned before the next psychological level at $1,200. Resistance bands between $1,120 to $1,150 and $1,180 to $1,190 represent areas where profit-taking has repeatedly halted upward movement. Overcoming these barriers could trigger new bullish momentum and confirm a breakout toward higher price targets.

Purchasers Uphold Robust Support Thresholds Around $1,000

On the downside, accumulation zones remain strong between $1,000 and $1,040, where buyers have consistently absorbed selling pressure. This creates a stable foundation that allows BNB to maintain its upward trajectory.

Technical charts indicate that a daily close above $1,150 would flip resistance into support, reinforcing the bullish trend. If BNB fails to break through, minor corrections toward the $1,050 to $1,000 range could occur. Experts emphasize that holding above $1,000 keeps the market outlook positive and demonstrates long-term investor confidence despite short-term fluctuations.

Solana Reflects BNB’s Surge Pattern Ahead of 2024

Analyst Alex Clay notes striking similarities between Solana’s ongoing accumulation and BNB’s consolidation phase before its major 2024 rally. For roughly 658 days, Solana has traded within a tight range between $140 and $210, forming what analysts call a “re-accumulation zone.”

This extended stability, combined with growing institutional participation, often signals the potential for a powerful breakout. Clay projects that a successful move above $210 could send Solana toward the $600 to $800 range, echoing BNB’s explosive 2024 price trajectory. These patterns underscore how market cycles often repeat among leading altcoins.

Recommended Article: Solana Faces Breakdown Risk as Analysts Warn of 75% Price Drop

Institutional Support Strengthens Both Ecosystems

Both Binance Coin and Solana are attracting significant institutional interest due to their robust ecosystems. Binance’s deflationary tokenomics and dominance in exchange activity sustain steady demand, while Solana’s high-throughput blockchain and expanding DeFi network draw developers and liquidity providers.

Rising on-chain activity across both networks suggests broader adoption. Analysts observe that institutional desks have continued accumulating positions, supporting the view that major altcoins are entering a renewed growth phase.

BNB Strengthens as Traders Strategically Build Positions Near Resistance

BNB’s current market capitalization stands at $155.48 billion, supported by a 24-hour trading volume of $2.49 billion. Its circulating supply of 139.18 million tokens plays a key role in its deflationary model, reducing inflation risk and appealing to retail and institutional investors alike.

Intraday data shows BNB fluctuating between $1,070 and $1,120, with notable buying spikes during upward moves. This pattern of accumulation indicates that traders are building positions in anticipation of a breakout. As liquidity clusters near resistance, increased trading volume could serve as the catalyst needed to push BNB beyond the $1,150 mark.

Analytical Perspective: A Breakthrough on the Horizon

The current technical setup of BNB displays a symmetrical tightening pattern, often preceding significant volatility. A confirmed breakout above $1,150 could lead to $1,200 and possibly $1,250, while continued consolidation below this level may extend the accumulation phase.

Meanwhile, Solana’s strong structure adds optimism to the overall altcoin landscape. If Solana breaks above $210 as predicted, it could spark renewed investor confidence and revitalize the market’s upward momentum following a long stabilization period.

BNB and Solana Lead Early Signs of Market Stabilization in Q4 2025

The broader crypto market is showing initial signs of recovery after a volatile third quarter. Altcoins with solid fundamentals such as BNB and Solana are reclaiming leadership as traders shift away from short-term speculative bets.

Both coins stand out as frontrunners for the next bullish cycle, backed by strong ecosystems, institutional interest, and consistent momentum. If BNB confirms a breakout above $1,150 and Solana replicates its 2024 surge, their rallies could spark a broader altcoin recovery as the market transitions into 2026.