Analyst Predicts Short-Term Correction

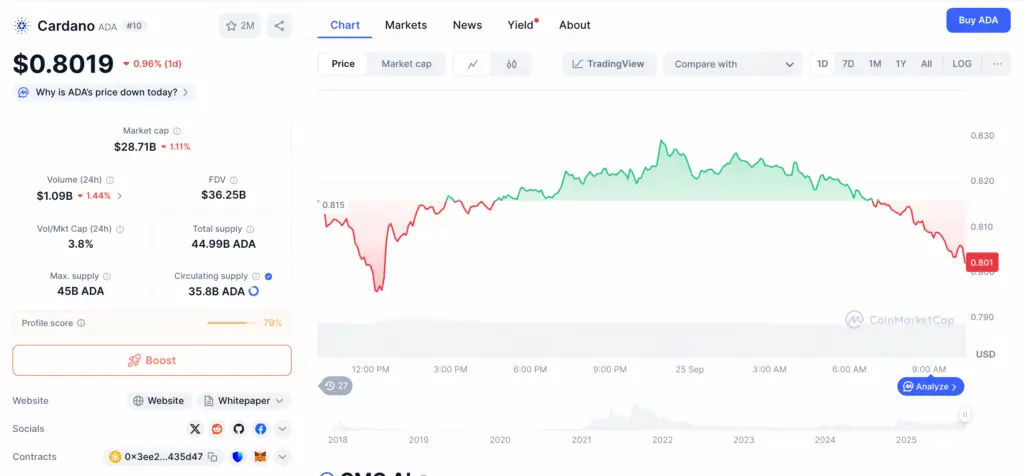

Cardano (ADA) is trading near $0.81 after modest gains, though it has fallen 5% in the past week. Analysts suggest that ADA may see a deeper pullback before resuming its upward trajectory.

Crypto analyst Sssebi forecasts ADA could fall to the $0.70–$0.75 range before staging a recovery. He expects a bounce starting in October, leading to a potential rally into November. This rebound, if confirmed, could set the stage for a new all-time high by Christmas.

Technical Signals Indicate Possible Support

The four-hour ADA chart outlines a potential rebound toward $1.00 after the correction phase. Support around the $0.70 level is seen as crucial for stabilizing the price action.

Volume indicators show steady trading, with no significant accumulation or liquidation events recorded. Meanwhile, the Relative Strength Index (RSI) is approaching oversold conditions. Historically, such readings often precede a recovery phase in price.

Whale Movements Add Pressure

Large ADA holders, or “whales,” have moved significant amounts of tokens in recent days. On-chain analyst Ali Martinez reported transfers totaling about 160 million ADA from addresses holding between 1 million and 10 million coins.

These moves dropped whale balances from 5.6 billion ADA to 5.44 billion ADA in just four days. Earlier in the month, a similar event saw 530 million ADA transferred over two days. Despite this, ADA’s price has remained relatively stable, suggesting demand is absorbing supply.

Recommended Article: Cardano Price Analysis: ADA Faces $0.95 Resistance Before $1.20 Target

Network Transactions Show Continued Growth

Cardano’s mainnet activity has continued to climb, surpassing 114 million transactions. This milestone reflects growing adoption across decentralized applications and financial services on the platform.

Consistent transaction growth strengthens the argument for ADA’s utility beyond speculation. Analysts view this steady activity as a positive signal, even as short-term price volatility persists.

ETF Prospects Boost Investor Confidence

Institutional exposure to ADA could increase following developments in the ETF market. WisdomTree has registered its CoinDesk 20 Fund in Delaware, with ADA included alongside Bitcoin, Ethereum, Solana, and XRP.

The approval odds for a U.S. Cardano ETF have now reached 91%, the highest level yet. Analysts believe such an approval could significantly expand investor access and boost ADA’s liquidity.

December Outlook Remains Bullish

Despite near-term bearish pressures, long-term sentiment for ADA remains optimistic. Analysts highlight December as a potential turning point, with chances of a new ATH on the horizon.

Much will depend on ADA’s ability to maintain support near $0.70 before October. If the rebound follows the expected pattern, momentum could carry ADA well above $1.00 into the year’s end.

Final Thoughts for Investors

Cardano’s trajectory remains one of cautious optimism. Short-term challenges such as whale movements and resistance levels present hurdles to price growth.

However, steady network adoption, rising ETF approval odds, and bullish year-end forecasts provide a strong counterbalance. For investors, the coming months could mark a pivotal chapter in ADA’s performance.