Cardano Price Momentum Strengthens After Prolonged Consolidation

Cardano has captured market interest once again following a period of stagnant performance, displaying initial indications of a potentially lasting upward movement. The token has recently surpassed its 50-day moving average, indicating a notable enhancement in technical strength within the mid-term trend.

The recent breakout has notably improved investor sentiment, leading buyers to focus on the $0.94 resistance level ahead of the significant psychological threshold at $1.00. Market participants anticipate ongoing accumulation as trading volumes rebound in tandem with the broader altcoin momentum.

Coinbase Holdings Surge Signaling Institutional Confidence

Coinbase has announced a significant increase of 462% in its Cardano holdings, which now amount to around 9.56 million ADA in institutional accounts. This notable buildup represents one of the most substantial quarterly on-chain increases ever documented by the exchange.

The total cbADA supply on the Base network has surged significantly from 1.7 million at launch to 9.53 million. This increase underscores the growing interest in wrapped ADA assets and validates the expanding on-chain activity among long-term holders.

Liquidity Rotation Strengthens Wrapped Cardano Adoption

In the meantime, Coinbase has seen a significant decrease in its Ripple reserves, plummeting by 98% from 970 million XRP to just 16.39 million tokens. This significant change highlights a movement of liquidity that is increasingly favoring Cardano’s wrapped assets in comparison to rival networks.

The shift highlights an increasing trust among investors in ADA’s capabilities as a scalable smart contract platform. The inclination towards wrapped ADA products reinforces the confidence institutions have in the enduring utility of Cardano’s blockchain.

Recommended Article: Cardano Eyes Breakout as $0.90 Resistance Nears Key Apex

Technical Structure Points Toward Bullish Continuation

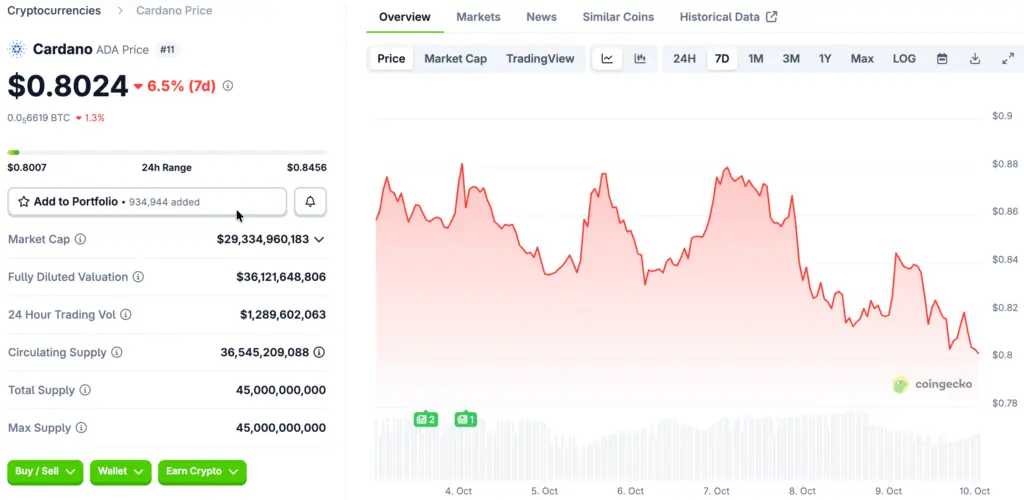

Cardano is holding steady above its crucial support zone of $0.83 to $0.85, consistently drawing in buyers during market pullbacks. Keeping this support structure in place fosters a positive outlook for continued upward movement throughout the current quarter.

Should the price stay above $0.83, there is potential for bulls to drive it up to $0.94, with targets set at $1.00 or possibly reaching $1.06 to $1.12. Momentum indicators, especially enhancements in RSI, indicate a resurgence of strength that may bolster a sustained bullish trend.

Key Resistance Levels Define the Near-Term Path

The $0.94 resistance level continues to serve as the key multi-touch barrier for validating a short-term upward breakout. A significant daily or weekly close above that level could pave the way for Cardano’s next psychological target at $1.00.

A clear breakout accompanied by robust trading volume could lead to momentum extensions towards the resistance levels at $1.06 and $1.12. These levels serve as possible medium-term targets before the consolidation phases continue within the larger upward trend.

Macro Tailwinds Boost Cardano Bullish Narrative

Macro factors further strengthen ADA’s advantageous position as Bitcoin hovers around record highs in anticipation of the year-end cycle. Traditionally, the end-of-year rotations channel funds into large-cap altcoins after phases of Bitcoin dominance.

The continuous fundamental growth of Cardano, bolstered by the adoption of smart contracts and the expansion of the Base network asset, aligns well with the current macro environment. A confirmed close above $0.94 may trigger increased institutional inflows and support a more extensive multi-month rally.

Cardano Anticipates a Promising Quarter Ahead

Experts anticipate that Cardano may hit the $1.00 mark shortly, provided that the current technical momentum and on-chain accumulation patterns continue to hold steady. The range between $0.83 and $0.94 seems promising, setting the stage for further growth as we move into early 2026.

Investors see the current zone of ADA as a promising opportunity for entry ahead of possible growth towards higher resistance levels. As Coinbase holdings increase and technical indicators strengthen, Cardano is set to emerge as a top performer among altcoins in Q4.