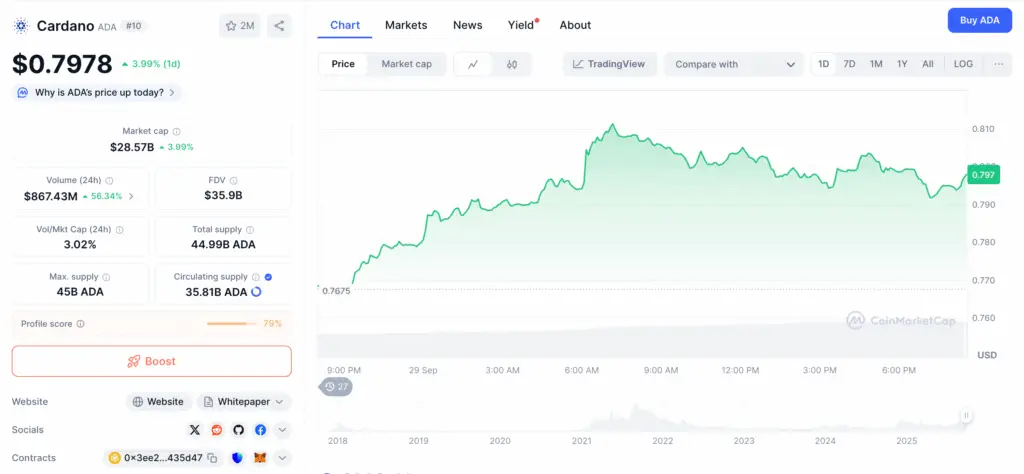

Cardano Faces Resistance at Critical Price Levels

Cardano (ADA) continues to trade cautiously, with its price consolidating near the $0.89 level. A key resistance zone at $0.93 remains the crucial barrier that must be overcome to trigger a stronger bullish rally.

Traders are closely monitoring ADA’s momentum. A sustained push above resistance could set up the next upward surge, while failure might lead to a short-term pullback into the $0.80–$0.85 demand range before another breakout attempt.

Slow Momentum Pushes Investors Toward Alternatives

The sluggish price movement has led many ADA investors to diversify into newer projects offering higher potential returns. Market participants are hedging their positions to balance long-term Cardano exposure with short-term growth opportunities.

This shift reflects growing caution among traders, who are watching ADA’s price structure carefully. Until a clear bullish signal emerges, attention is increasingly drifting toward innovative early-stage altcoins.

Mutuum Finance Presale Surpasses $16.4 Million

Mutuum Finance (MUTM) has quickly become a major contender in the current crypto presale landscape. At $0.035 per token in Phase 6, the project is already 50% sold out, raising over $16.4 million from more than 16,600 investors.

The rapid uptake underscores strong community confidence in its hybrid lending model and growth potential. Many investors see early entry as a strategic hedge while ADA consolidates below key breakout levels.

Recommended Article: Cardano’s Price Faces Pressure but ETF Momentum Could Shift Outlook

Innovative Dual-Lending Architecture Attracts Interest

Mutuum Finance’s appeal lies in its hybrid dual-lending architecture, combining Peer-to-Peer (P2P) and Peer-to-Contract (P2C) systems. This structure enhances capital efficiency by offering flexible borrowing and lending mechanisms.

P2C allows contracts to set fixed interest rates automatically, while P2P enables direct interaction between lenders and borrowers in real time. This flexibility positions Mutuum as a versatile lending platform for both traditional assets and riskier crypto tokens.

Security and Accuracy Reinforce Investor Confidence

Mutuum Finance has launched a CertiK Bug Bounty Program with rewards up to $50,000 USDT, encouraging developers to identify vulnerabilities. This proactive security approach enhances investor trust during its critical presale phase.

Additionally, the protocol integrates Chainlink oracles and fallback price feeds from major tokens like USD, ETH, MATIC, and AVAX. These measures ensure accurate collateral management and stability under volatile market conditions.

Analysts Dub Mutuum Finance the “ADA 2.0”

Several market analysts have nicknamed Mutuum Finance “ADA 2.0” due to its early-stage potential and innovative architecture. While Cardano maintains a loyal base, Mutuum’s presale momentum and novel features are capturing wider attention.

This branding reflects both strategic positioning and community excitement. Many investors view MUTM as a way to complement ADA exposure with a high-upside, early-phase opportunity that blends DeFi innovation and practical utility.

Strategic Hedge Emerges Among ADA Holders

Cardano’s prolonged consolidation has prompted investors to seek complementary assets like Mutuum Finance to diversify their portfolios. Presale entry allows participants to secure discounted tokens before potential exchange listings.

This dual-investment strategy highlights a broader trend: established assets offer stability, while emerging DeFi projects provide growth. ADA’s resistance struggle and MUTM’s presale success embody this evolving investment dynamic in the altcoin market.