Cardano at a Crucial Price Level

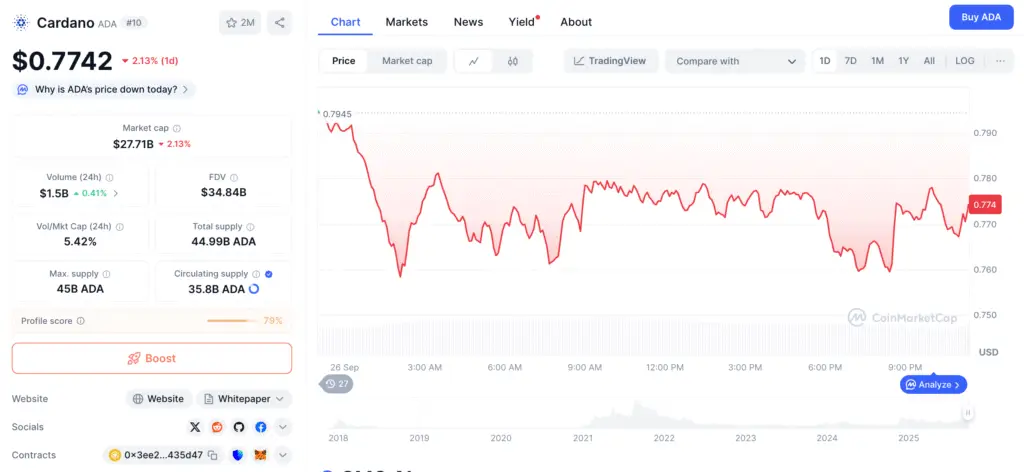

Cardano (ADA) is currently testing its $0.80 support level, a threshold analysts say is key for recovery. At the time of writing, ADA trades near $0.7742, reflecting a 2.13% daily drop and a 16.5% weekly decline. These losses come despite significant regulatory progress that could open new doors for institutional participation.

The inclusion of Cardano in Grayscale’s Digital Large Cap Fund ETF — with a 1% allocation — marks a milestone. As the first regulated multi-asset crypto product to feature ADA, it enhances legitimacy and signals growing recognition among institutional investors.

How ETF Inclusion Could Impact Cardano’s Market

ETF inclusion is expected to influence Cardano’s demand and long-term stability. Just as Bitcoin ETFs spurred institutional inflows, ADA’s presence could attract a wider investor base. Increased liquidity from ETF trading may also help reduce sharp price swings, improving appeal for long-term holders.

Still, ETF exposure introduces risks. Short-term speculative activity could heighten volatility, while ongoing regulatory scrutiny and potential cyber vulnerabilities remain concerns. For now, ETF inclusion provides Cardano with visibility but does not eliminate underlying market challenges.

Recommended Article: Cardano (ADA) Faces Pullback but Analysts Eye December All-Time High

Startups Leveraging Cardano’s Volatility

Fintech startups, particularly in Asia, can view Cardano’s volatility as an innovation opportunity. By integrating ADA’s blockchain into payment platforms and DeFi solutions, startups can design tools that balance high-yield potential with risk management.

Stablecoin-based payment services built on Cardano could offset volatility, enabling reliable transactions for users. Meanwhile, ADA’s growing DeFi ecosystem creates pathways for startups to pioneer crypto payroll systems, remittance solutions, and lending platforms.

Managing Crypto Payroll Amid ADA’s Price Swings

For decentralized organizations, ADA’s volatility poses unique payroll challenges. Solutions include:

- Flexible payment choices between fiat, stablecoins, or ADA.

- Hybrid models with base salaries in fiat and bonuses in crypto.

- Use of stablecoins built on Cardano to hedge risks.

- Maintaining liquidity reserves in both crypto and fiat.

- Smart contract payroll platforms that automate payments.

- Clear communication on timing, exchange rates, and tax implications.

Adopting these strategies can help organizations maintain financial stability while embracing crypto-based compensation.

Risks and Rewards of Cardano’s Volatility

Cardano’s volatility carries both opportunities and dangers. On the reward side, ETF inclusion and broader recognition may increase institutional demand, raising credibility and potentially stabilizing price. On the risk side, speculative surges, liquidity concerns, and regulatory uncertainty could challenge investor confidence.

Ultimately, ADA’s price swings may fuel innovation in fintech and payroll systems but require careful risk management. If startups and organizations harness these dynamics effectively, Cardano could serve as both a catalyst for adoption and a test case for crypto’s integration into mainstream finance.