Chainlink Builds Momentum Through Global Partnerships

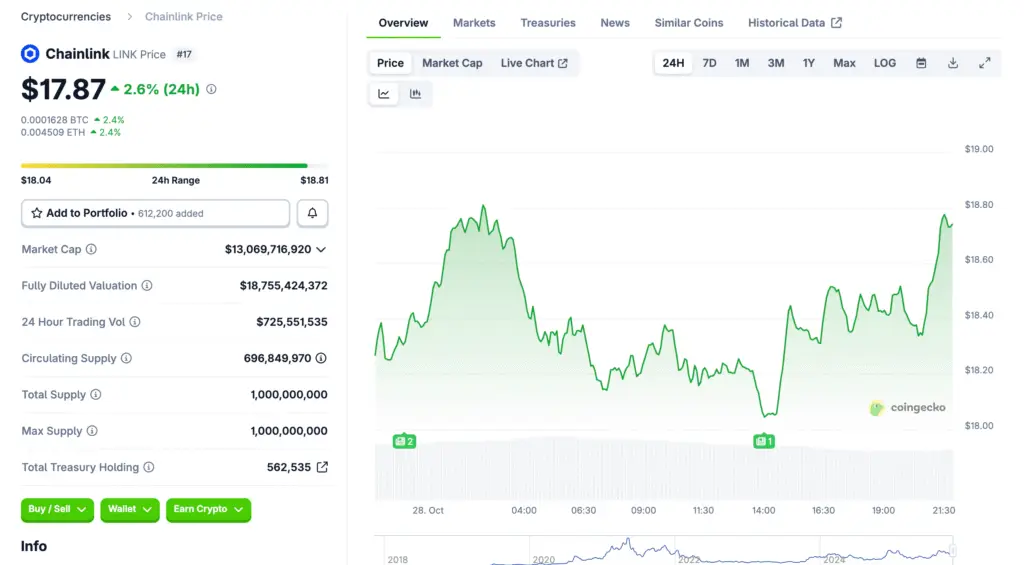

Chainlink (LINK) continues to strengthen its ecosystem through a series of high-profile partnerships with major financial and technology firms. The token currently trades near $17.83 after facing resistance earlier this week. Despite temporary pullbacks, the network’s expanding use cases highlight growing institutional confidence. Analysts expect these collaborations to bolster long-term adoption and price appreciation.

Streamex Integrates Chainlink for Cross-Chain Gold Tokenization

Streamex Corp., a Nasdaq-listed RWA tokenization company, recently partnered with Chainlink as its official oracle provider. The collaboration enables GLDY, Streamex’s gold-backed stablecoin, to operate as a Cross-Chain Token (CCT) powered by Chainlink CCIP. This integration allows secure, transparent transfers across Base and Solana networks while ensuring real-time proof of reserves. The move underscores Chainlink’s critical role in powering tokenized real-world assets.

Arc Partnership Expands Chainlink’s Ecosystem Role

Chainlink also announced its partnership with Arc, a new layer-1 blockchain created by Circle, the company behind USDC. Arc integrates Chainlink CCIP, Data Feeds, and Compliance Engine to ensure secure and compliant cross-chain interoperability. This collaboration represents a major step toward unifying blockchain infrastructure across regulated financial systems. By strengthening data reliability and security, Arc reinforces Chainlink’s position as the industry’s most trusted oracle network.

Recommended Article: Chainlink Whales Accumulate as LINK Targets Bullish Reversal in November

Virtune Embraces Chainlink Standards for Proof of Reserve

Virtune, a Swedish-regulated digital asset manager, has adopted Chainlink’s Proof of Reserve to enhance transparency across its Exchange-Traded Products (ETPs). This integration ensures that assets backing Virtune’s ETPs are verifiable on-chain at all times. It marks one of the largest institutional uses of Chainlink’s verification tools to date. As adoption among traditional financial firms grows, Chainlink’s credibility continues to increase.

Financial Giants Collaborate on Cross-Chain Settlement

The Hong Kong Monetary Authority’s latest e-HKD report highlights a cross-chain settlement pilot powered by Chainlink. The initiative included global institutions such as ANZ, China AMC, and Fidelity International. Using Chainlink’s CCIP and Automated Compliance Engine, these firms achieved secure settlement of tokenized assets across networks. This demonstrates how Chainlink is bridging traditional finance with blockchain innovation on a global scale.

Derivatives Data Confirms Bullish Trader Sentiment

Market data from Coinglass shows Chainlink’s long-to-short ratio climbing to 1.06, its highest in over a month. The increase suggests more traders are positioning for potential upside as bullish confidence builds. CryptoQuant’s futures summary indicates strong whale buy orders and growing open interest. Together, these metrics reinforce the likelihood of continued accumulation ahead of a possible rally.

Technical Outlook: Key Levels Support Upward Continuation

Chainlink faces near-term resistance at $19.67, with a confirmed breakout potentially opening a path to $23.80. Support levels remain firm near $16.50 and $15.80, which could act as consolidation zones before the next move. A sustained close above $19.67 would validate bullish momentum and attract new market participants. Technical indicators continue to favor gradual recovery as long as LINK maintains its current range.

Outlook: Chainlink Positioned for Broader Institutional Expansion

Chainlink’s recent partnerships and integrations reflect growing confidence among major institutions and regulators. Its unique role in enabling tokenized assets, compliance automation, and cross-chain communication remains unmatched. As adoption widens, LINK’s long-term fundamentals appear stronger than ever. These developments suggest a bullish trajectory heading into 2026 as Chainlink cements its leadership in the oracle sector.