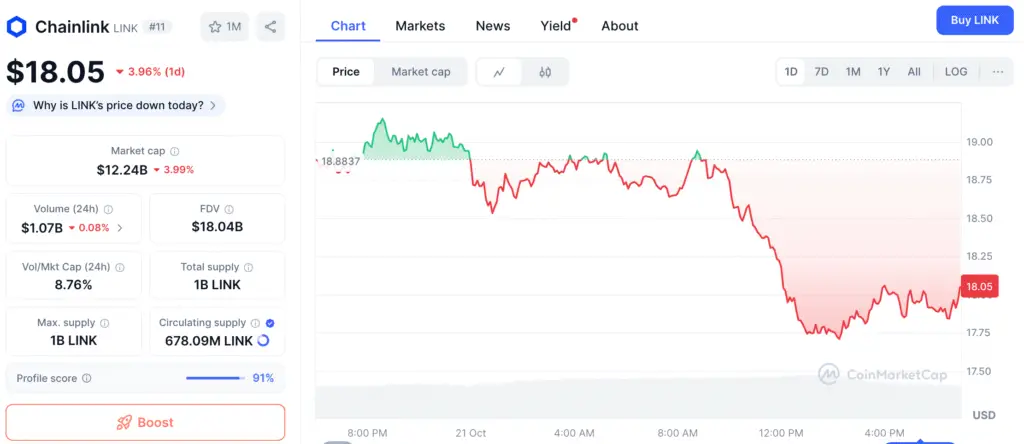

Chainlink’s Price Surge Sparks Renewed Market Enthusiasm

Chainlink has captured investor attention once again, posting a 12% surge to $18.75 within a 24-hour period. This strong price performance marks a turning point after weeks of subdued trading across the broader cryptocurrency market. Investors now view Chainlink as a leading candidate for midterm momentum following an extended consolidation phase beneath critical resistance zones.

The rally has been driven by increasing buying volume and strong on-chain indicators, signaling growing confidence among holders. Analysts attribute this renewed strength to improved sentiment, wider adoption, and Chainlink’s continued importance in decentralized oracle solutions.

Positive Momentum Intensifies According to Technical Signals

On the 4-hour chart, Chainlink’s structure has shifted decisively in favor of buyers, showing a clear bullish breakout pattern. The Relative Strength Index currently sits near 65, reflecting increasing demand and active market participation over recent trading sessions.

Although the RSI approaches overbought territory, it shows no signs of exhaustion, suggesting potential for additional gains. This ongoing momentum aligns with the broader recovery trend across the crypto market, supported by rising institutional participation.

Chainlink Bull Bear Power Signals Strong Buyer Momentum Toward $30

The Bull Bear Power indicator supports the bullish outlook, displaying strong green histogram bars near the 2.33 level. This reading highlights that buyer strength continues to outweigh selling pressure among major trading pairs.

If this trend persists, Chainlink could retest resistance near $23.44, a level closely monitored by technical analysts. A breakout above this zone, reinforced by strong volume, could trigger the next move toward the $30 psychological milestone.

Recommended Article: Chainlink Price Meets $23.11 Wall, Testing Key 2021 Resistance

Significant Investors Persist in Acquiring Chainlink

Data from Glassnode shows a steady rise in addresses holding at least 10,000 LINK tokens. The number of these large holders increased from 2,988 in early October to 3,049 this week, signaling renewed confidence among key participants.

Historically, such accumulation phases have preceded extended bullish runs, as major investors position themselves ahead of broader market rallies. This accumulation trend reinforces the idea that Chainlink’s current surge is driven by long-term confidence rather than short-term speculation.

Chainlink Approaches Key Breakout Zone With CMF Showing Fresh Inflows

On the daily chart, Chainlink trades just below the upper boundary of a symmetrical triangle pattern. A breakout from this formation would confirm the beginning of a midterm bullish wave. The Chaikin Money Flow reading of 0.02 reflects ongoing capital inflows, confirming that investors remain eager to acquire LINK.

At its current pace, the token could soon face resistance around $21.05, coinciding with the 0.618 Fibonacci level. Holding above this point may inspire renewed enthusiasm among both spot and derivatives traders.

Fibonacci Levels Uncover Essential Price Objectives

Chainlink’s technical roadmap suggests further upside potential based on key Fibonacci retracement zones. The 0.618 Fib level presents the current challenge, while the 0.786 level near $24.03 represents the next major target for bullish traders.

If LINK achieves a sustained daily close above that threshold, experts project a swift advance toward $30. Such a move would mirror earlier recovery trends that characterized previous market growth cycles.

Factors That May Influence Chainlink’s Upcoming Direction

To maintain its bullish outlook, Chainlink must hold support above $18 and avoid slipping below the 0.382 Fib region. Failure to stay above that range could trigger a retracement to $14.28, where historical support overlaps with prior consolidation levels.

Nevertheless, increasing investor participation, expanded oracle integrations, and continued DeFi adoption strengthen Chainlink’s long-term fundamentals. With these factors aligned, the probability of LINK reaching $30 in Q4 2025 appears increasingly likely.