Chainlink Struggles to Hold Ground After Rejection Near $20

Chainlink’s price has entered a weak area after being clearly turned down at the $20 resistance level. The token is currently worth about $17.70, which is more than 5% less than it was twenty-four hours ago. This is because the crypto market as a whole is losing momentum.

This latest drop has brought attention to the $17–$16.50 support band, which is in line with important Fibonacci retracement zones. Analysts say that if this area doesn’t hold, the asset might lose even more value, potentially down to $15 in the immediate run.

Technical Indicators Reflect Growing Downside Pressure

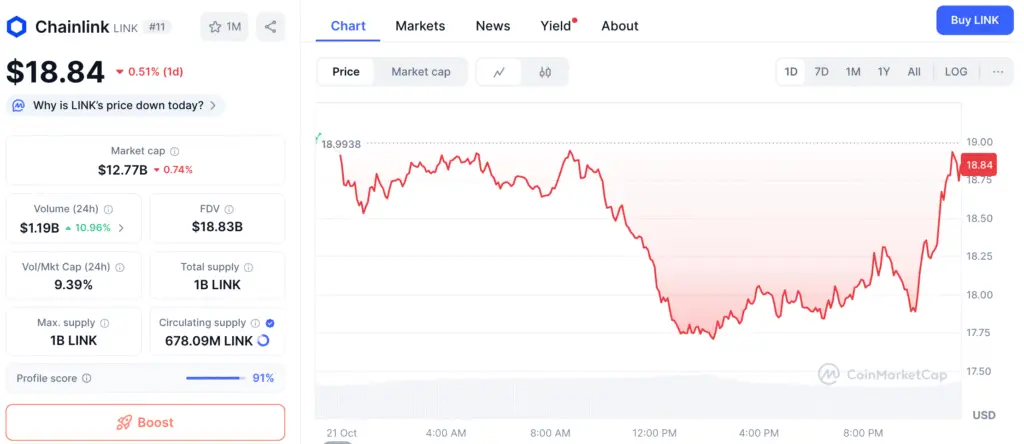

Price movement is still stuck below the 20-, 50-, and 200-day exponential moving averages, which have all turned into resistance between $18.90 and $19.20. The fact that these levels can’t be regained has made negative momentum stronger in the short run.

The Relative Strength Index is now at about forty-one, which means there isn’t much purchasing going on, but the market isn’t yet oversold. This means that there is still a chance of more downward movement before any lasting comeback happens.

Chainlink Outflows Exceed $14M as Buyers Struggle to Absorb Pressure

On October 21, Coinglass’s on-chain analytics showed that Chainlink addresses had net outflows of over $14 million. This was part of a pattern that had been going on for weeks of decreasing inflows. Exchange outflows can sometimes mean that people are buying more, but the price decline shows that purchasers haven’t yet absorbed the selling pressure.

This trend has happened at the same time as more volatility, which has kept LINK’s price around $17 to $18. Analysts say that the asset can only find a stable bottom if exchange flows and trade volume stabilize.

Recommended Article: Chainlink Price Meets $23.11 Wall, Testing Key 2021 Resistance

Federal Reserve Recognition Highlights Long-Term Value

Chainlink got a lot of attention during the Payments Innovation Conference sponsored by the Federal Reserve on October 21. Sergey Nazarov, one of the co-founders, talked with leaders from Paxos, Circle, and Coinbase on how to combine traditional finance with decentralized infrastructure.

Even if this acknowledgment from such an organization makes Chainlink more important for blockchain interoperability, it hasn’t had a big effect on the market right away. Traders are still paying attention to technical signs, which still point to short-term negative momentum.

Chainlink Proves Resilience as Oracles Stay Online During Web Outage

Chainlink showed how strong its oracle architecture is when a large cloud service failure disrupted some portions of the internet. This happened in the middle of a turbulent market. The team said that their decentralized oracle network was still up and running and was still protecting billions of dollars in DeFi transactions.

This podcast shows once again why Chainlink is so important to decentralized finance. It is one of the most trustworthy oracle providers in Web3 since it can supply services without interruption. This might lead to long-term adoption by institutions.

Critical Price Levels Define Chainlink’s Next Move

In terms of technical analysis, $17 is the most important level for bulls to protect. If Chainlink stays below this zone for a long time, it will be at the next support level at $15 and then at $13.50 if bearish pressure gets stronger.

On the other hand, a good bounce over $18.62 might ease selling pressure and make it easier to reach the $20.50 resistance level. A strong closing over $20.50 would certainly change people’s minds, letting LINK go for the $23 area that was witnessed during the September rally.

Chainlink Retains Strong Fundamentals Despite Short-Term Price Weakness

Chainlink’s long-term fundamentals are still robust, even though it is getting worse in the near run. It continues to be the market leader in decentralized data because of its recognition at the federal level, strong oracle dependability, and wide developer integration.

But for now, the asset is still at risk of going down for a long time unless bulls swiftly take control over $19.00. For now, LINK’s immediate path is down, but its institutional legitimacy and utility base provide us reasons to be hopeful about the long term, even though the price is now going down.