Bitcoin Falls Below $100,000 Amid Market Turbulence

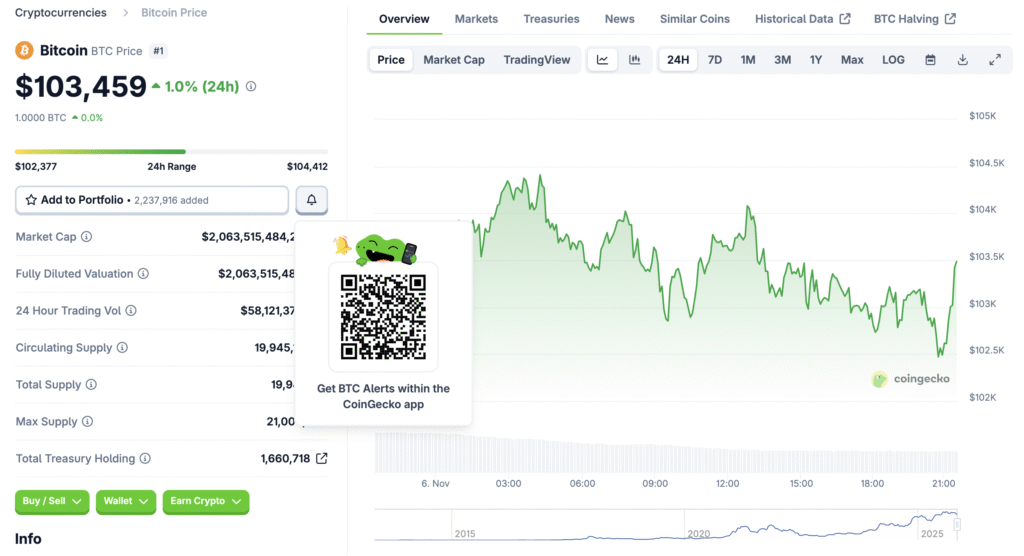

Bitcoin slumped to its lowest point in five months, briefly dipping below the $100,000 mark during Asian trading hours. The decline reflects growing caution among investors following October’s $19 billion liquidation wave. As global stocks tumbled, risk assets across the board saw renewed volatility.

Widespread Liquidations Deepen Market Anxiety

Data from CoinGlass revealed that approximately $2.09 billion in crypto positions were liquidated within 24 hours. Most losses stemmed from long positions, signaling an unwinding of bullish bets. Although far below October’s record washout, traders remain wary amid lingering uncertainty surrounding U.S. monetary policy.

Investor Confidence Wanes After Fed’s Hawkish Signal

Federal Reserve Chair Jerome Powell’s remarks suggesting that a December rate cut is not guaranteed dented market optimism. Analysts believe this shift removed a key support pillar for crypto sentiment. As macro risks mount, investors are increasingly reluctant to take aggressive long positions.

Recommended Article: Bitcoin Falls Below $100,000 for the First Time in Months

Bitcoin Dominance Climbs as Altcoins Lag

Bitcoin’s dominance surged above 60% as altcoins bore the brunt of the sell-off. Ethereum tumbled more than 12%, dropping to $3,179, while XRP fell 5.3% to $2.22. Analysts project that altcoins could fall another 30% against Bitcoin if current trends persist.

Global Stocks Join the Decline

Asian equities mirrored Wall Street’s slump following warnings from major U.S. banks about overvalued tech stocks. The S&P 500 and Nasdaq posted their sharpest single-day declines since early October. In Asia, South Korea’s Kospi fell 4.1%, dragging regional markets lower amid risk aversion.

U.S. Shutdown and Data Freeze Amplify Uncertainty

The ongoing U.S. government shutdown, now stretching to 36 days, has stalled official economic reporting. Investors are relying on private surveys like ADP’s employment data for policy clues. The lack of visibility has increased reliance on Federal Reserve commentary, adding to short-term volatility.

Traders Brace for Further Macro Pressure

Traders attribute the recent downturn to geopolitical tensions, including renewed trade rhetoric from President Trump targeting China. Combined with slowing global growth and liquidity strains, these factors continue to weigh on investor confidence. Analysts expect volatility to persist until clear policy signals emerge.

Outlook: Possible Rebound if Macro Climate Improves

Despite the pessimism, analysts see potential for recovery if macro indicators strengthen. Ryan Lee of Bitget predicts Bitcoin could rebound toward $115,000–$120,000 if conditions stabilize. Ether may test $4,200 with support from DeFi activity. However, geopolitical and inflation risks could still limit near-term upside potential.