Purchasing Solana Strategically for Corporate Treasury

An important and calculated acquisition of $77 million worth of Solana tokens by DeFi Development Corp. made headlines. This audacious action follows the company’s successful completion of a fresh round of equity financing for all parties. The acquisition shows a strong and powerful belief in the Solana token’s long-term growth and usefulness.

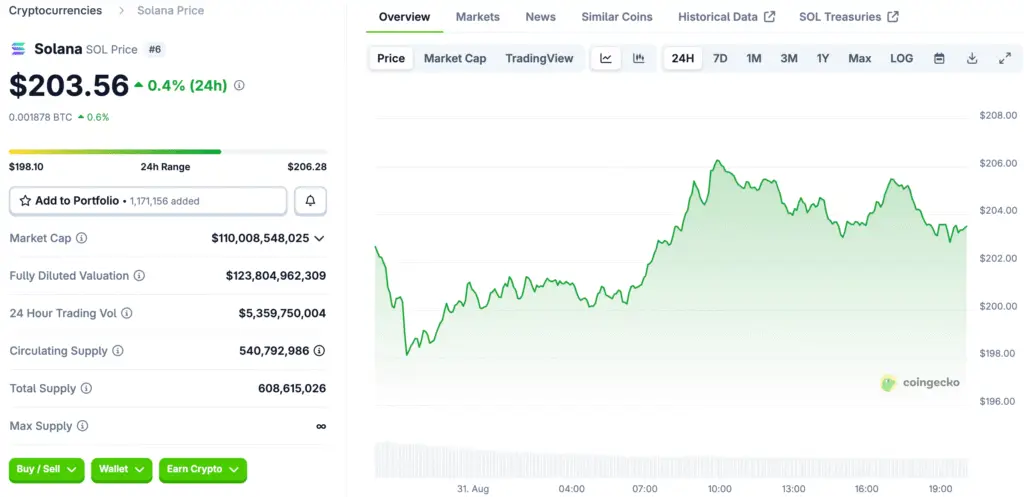

With this new acquisition, the company’s treasury now contains over 407,247 Solana tokens, which is a significant amount. Compared to the token’s prior treasury balance, this acquisition signifies a noteworthy 29% increase. The company’s entire holdings in Solana are now worth a significant sum of money at the current market value.

Plans for Long-Term Staking and Liquidity Management

The recently acquired Solana tokens from DeFi Development Corp. are meant to be held for a long time and used in conjunction with a disciplined investment strategy. The business intends to stake the tokens across a number of validators, including its own brand-new infrastructure. They will be able to produce a substantial yield and return on their investment as a result.

In addition to raising the company’s possible profits, this staking strategy offers crucial support for the performance and security of the Solana network. Everyone in the ecosystem will gain from this very astute and well-thought-out move. Additionally, it demonstrates a dedication to the long-term well-being of the entire Solana network.

A Key Indicator of Exposure to Solana

In order to give all of its shareholders greater transparency about its holdings, the company has now released a new set of important metrics. The Solana-per-share ratio, a potent indicator, is currently at a considerable level. For all of the investors, this metric offers a great deal of clarity and confidence.

The business added that the number of shares would increase when fully diluted, taking into account warrants from the most recent financing round. The Solana-per-share measure is anticipated to stay above a critical level even following the complete dilution. This is a crucial indication of the business’s ongoing and extended exposure to the Solana token.

Recommended Article: Solana’s Impressive 17 Percent Price Surge Explored

A Fintech and Crypto Company Model That Is Hybrid

The company’s shares on the Nasdaq increased by over 9% after the news of the strategic acquisition broke, which is extremely encouraging. The market’s favorable response makes it abundantly evident that it sees the acquisition as a solid and well-thought-out wager on Solana’s potential for long-term growth. DeFi Development Corp. is increasingly seen by investors as a hybrid business.

This business model is currently combining a brand-new, extremely distinctive approach to digital asset management with traditional corporate governance. This is a really novel and exciting new strategy that is currently gaining a lot of popularity. It demonstrates how a combination of new and traditional digital assets will shape the financial industry of the future.

Implications for Growth and the Solana Ecosystem

A significant institutional player’s acquisition of more than 400,000 Solana tokens could have profound and far-reaching effects on the Solana ecosystem as a whole. A more stable and healthy market is frequently the result of this increased institutional holding. Additionally, it attracts a lot of new capital and helps to increase investor confidence.

Additionally, the network is staying decentralized and much more secure thanks to the company’s dedication to staking its tokens across several validators. All of the token holders and the Solana community as a whole stand to gain greatly from this. Both the business and the network as a whole benefit from it.

DeFi Dev Corp’s Treasury Strategy

DeFi Development Corp. has stated that building up superior digital assets will remain a key component of its future treasury strategy. The business still has a sizable amount of money from its most recent round of funding. For upcoming market acquisitions, this offers a great deal of flexibility.

This strategy fits in with the larger trend of corporate cryptocurrency adoption, in which several businesses are using digital assets to diversify their balance sheets. To improve its treasury returns, the business is also utilizing staking and other yield-generating strategies. This method of asset management is incredibly astute and methodical.

The Future of the Solana Market

The market’s favorable response to Solana’s strategic acquisition is unmistakably a vote of confidence in the business and its prospects. All of the investors are now keeping a close eye on the company’s stock performance. With this action, the business establishes itself as a major institutional player in the Solana market.

The secret to the company’s success will be its sustained emphasis on superior digital assets and a methodical approach to yield generation. In the long run, this will help the larger crypto ecosystem as well as the shareholders. The company appears to have a very promising and exciting future.