Dogecoin Experiences 20% Drop, But Buyers Remain Active

Dogecoin’s price fell by more than 20%, reflecting a broader downturn in the memecoin market, as other tokens such as Shiba Inu and Pepe experienced comparable drops. In the face of the downturn, short-term holders seized the opportunity to accumulate instead of succumbing to panic selling, reflecting an increasing confidence in lower valuations.

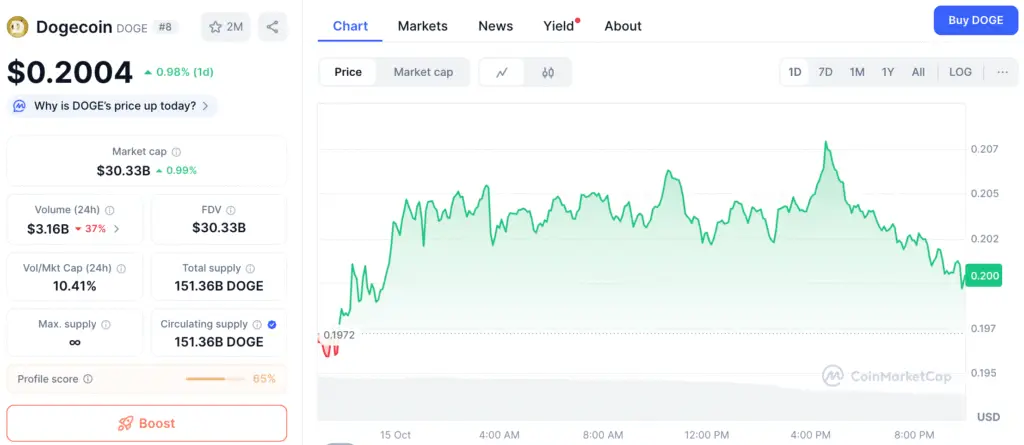

As of the latest update, Dogecoin has found stability at approximately $0.20, bouncing back from recent lows close to $0.16. Experts indicate that this trend demonstrates investors identifying areas of value and gearing up for possible recoveries in the upcoming weeks.

Key Metrics Indicate Dogecoin Is Undervalued

Current on-chain indicators indicate that Dogecoin is currently trading beneath its fair value. The MVRV Z-Score, an indicator of price divergence from its true value, is currently at historic lows reminiscent of the periods preceding significant bull runs in 2017 and 2021.

In a similar vein, the Reserve Risk Indicator is positioned within the accumulation zone, reflecting robust confidence among holders. The positive readings from the Cumulative Value Days Destroyed metric, when combined, suggest that Dogecoin is potentially establishing a solid base for future growth.

Dogecoin Accumulation Phase Resembles Patterns Seen Before Past Bull Runs

In the past, Dogecoin has experienced prolonged accumulation periods prior to significant price surges. Significant MVRV Z-Score troughs and low Reserve Risk readings have frequently foreshadowed powerful uptrends, particularly when long-term holders reduced supply.

The present circumstances reflect those initial phases of accumulation. As the speculative noise diminishes, the data indicates genuine growth from patient investors anticipating the next cyclical upswing.

Recommended Article: Dogecoin Revival Drives Payroll Innovation in European SMEs

Technical Structure Confirms Bullish Breakout

Analyst EtherNasyonaL indicates that Dogecoin’s monthly chart reveals a successful breakout above a multi-year descending resistance line originating from its 2021 peak. This action concluded a prolonged period of compression and signified the beginning of a structural turnaround.

After the breakout, DOGE revisited the $0.15 to $0.16 range, an essential support area and buyers robustly upheld it. The token is currently trading in the range of $0.20 to $0.21, maintaining its position above this important support level.

Key Levels of Support and Resistance to Monitor

The range of $0.15 to $0.16 is crucial for sustaining a bullish trend. A consistent hold above this range may strengthen momentum and avert more significant corrections.

The upper resistance is positioned between $0.28 and $0.30, which has historically limited upward movements in previous cycles. Surpassing this threshold is expected to lead to a more robust bullish trend, pushing towards elevated midterm objectives.

On-Chain Activity and Market Sentiment Improve

The network activity of Dogecoin has shown a consistent upward trend, bolstered by efforts from developers who are delving into tokenization and the integration of NFTs. This development in the ecosystem indicates an expanding range of practical applications that extend far beyond its initial meme-based roots.

Retail excitement is clearly evident on social media, as DOGE continues to thrive from sentiment-fueled spikes during times of market positivity. Traders observe that Bitcoin’s recent strength could contribute to a more stable atmosphere for altcoins overall.

Dogecoin Undervaluation Signals Setup for Major Long-Term Recovery Phase

The combination of technical indicators and on-chain data reveals a unique alignment of undervaluation alongside robust structural integrity. The rounding-bottom formation observed on the monthly chart, along with the historically low MVRV Z-Score readings, suggests a promising bullish potential in the near future.

Should the support zone between $0.15 and $0.16 remain intact, and if momentum pushes above $0.28, experts anticipate that Dogecoin will begin a steady recovery phase. The convergence of investor accumulation, favorable risk indicators, and positive chart patterns strongly supports the potential for long-term growth.