Dogecoin Declines Sharply Despite Positive Corporate Announcements

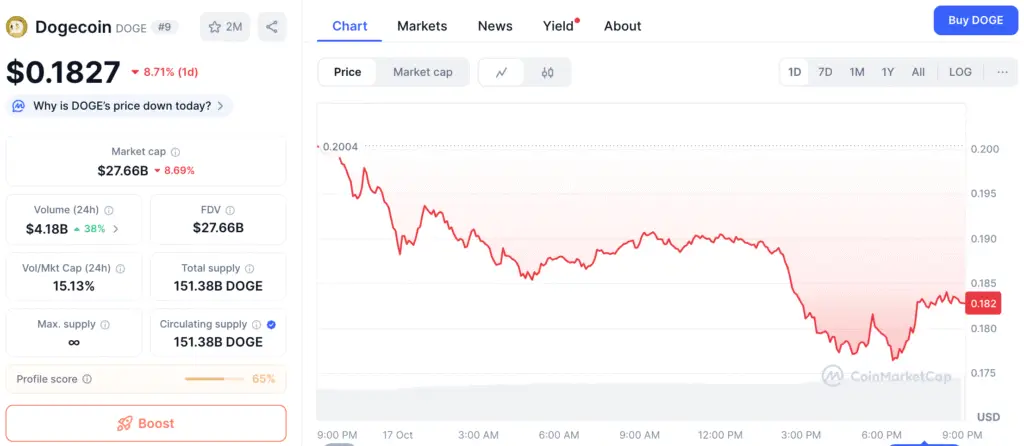

Dogecoin’s price has dropped 21% this week, hovering around $0.20, despite two corporate developments that initially sparked optimism. The token’s inability to maintain its upward trajectory suggests a decline in market sentiment and profit-taking by investors.

The House of Doge announced its intention to merge with a Nasdaq-listed company, while Thumzup Media Corporation plans to integrate Dogecoin for creator payments. However, these updates did not ignite sustained positive momentum, as traders approached the situation cautiously due to market weakness.

Dogecoin Slides 3% After Thumzup’s Early Blockchain Payment Reveal

On October 15, Thumzup indicated that Dogecoin might serve as a means for social media payouts, aiming to lower the costs associated with cross-border transactions. Chief Executive Robert Steele stated that the company intends to boost creator value by removing payment intermediaries via blockchain integration.

Nonetheless, the announcement was preliminary, rather than a definitive product release. Following the initial surge, traders quickly capitalized on their gains, leading to a 3% drop in DOGE for the day and a total monthly decline of 26%. The memecoin is currently trading 73% below its peak of $0.74, indicating persistent selling pressure even with corporate support.

Whale Selling Erodes Trust Among Investors

Dogecoin’s owners sold off 360 million DOGE, amounting to $74 million, shortly after the merger announcement. This trend likely coincided with a wider cryptocurrency flash crash, with Dogecoin being particularly affected.

The liquidation erased profits from speculative surges between $0.25 and $0.30, indicating a decline in investor confidence. Large investors exploited price gains to lock in profits, putting retail traders at risk of significant losses.

Recommended Article: Dogecoin Futures Reset as Nasdaq Listing Points to Possible Low

Dogecoin Decline Mirrors BTC and ETH Downturn Amid Waning Liquidity

The decline in Dogecoin coincided with wider downturns in the BTC and ETH markets. Experts pointed to declining liquidity, increasing risk aversion, and a decrease in meme coin inflows as key factors at play. In these circumstances, investors frequently shift their funds towards established assets, intensifying the downward pressure on speculative cryptocurrencies such as DOGE.

Market analysts noted that the lack of tangible results from recent corporate collaborations has dampened sentiment further. In the absence of consistent institutional investments, meme assets are at risk of experiencing significant downturns during periods of consolidation.

Crucial Technical Levels Shape DOGE’s Upcoming Direction

Recent analysis reveals that Dogecoin is nearing a significant support threshold around $0.19. Analyst Ali Martinez observed that sustaining this price level might set the stage for a rebound toward $0.25 and possibly $0.33 if positive momentum reemerges.

The analysis revealed a parallel ascending channel, indicating that maintaining the lower boundary could lead to a short-term rebound. On the other hand, if $0.19 is not defended, it may result in further declines towards $0.17, a level considered as secondary support by traders observing intraday trends.

Dogecoin Activity Surges as RSI Lingers Below Key Neutral Threshold

As of the latest update, Dogecoin’s Relative Strength Index (RSI) stood at approximately 45, suggesting a lack of robust buying momentum. Values under 50 generally indicate a lack of strong sentiment and restricted potential for upward progress.

In the interim, trading volumes surged to 10% of the circulating supply, indicating heightened activity even amid persistent selloffs. Experts indicated that should DOGE surpass the resistance levels of $0.22 and $0.24, a possible breakout towards elevated targets may occur, bolstered by short-term accumulation.

Connections Between Corporations and Future Perspectives

In the face of immediate fluctuations, Dogecoin remains a focal point for corporate interest. Thumzup has made a significant investment of $2.5 million in DogeHash Technologies, enhancing its involvement in the mining and payment infrastructure related to Dogecoin. The company emphasized that Dogecoin is intended to be an alternative payout method rather than a substitute for fiat currency.

The merger of House of Doge with Nasdaq signifies a pivotal development for DOGE’s entry into regulated financial markets. Despite the token’s current downward trajectory, these corporate actions underscore its potential for a resurgence as the practical applications of blockchain continue to grow beyond mere speculation.

Dogecoin Faces Defining 72 Hours as Buyers Defend Key Support Zone

The next 48 to 72 hours may shape the immediate path of Dogecoin. If buyers maintain the $0.19 support and volume increases, DOGE may rebound towards mid-range resistance levels. Nevertheless, ongoing whale selling or persistent market weakness could drive prices down further, prolonging the bearish trend into late October.

As traders keep a close eye on both technical and fundamental signals, the future of Dogecoin hinges on the progression of institutional partnerships into real-world adoption, rather than becoming just another ephemeral story in the unpredictable world of memecoins.