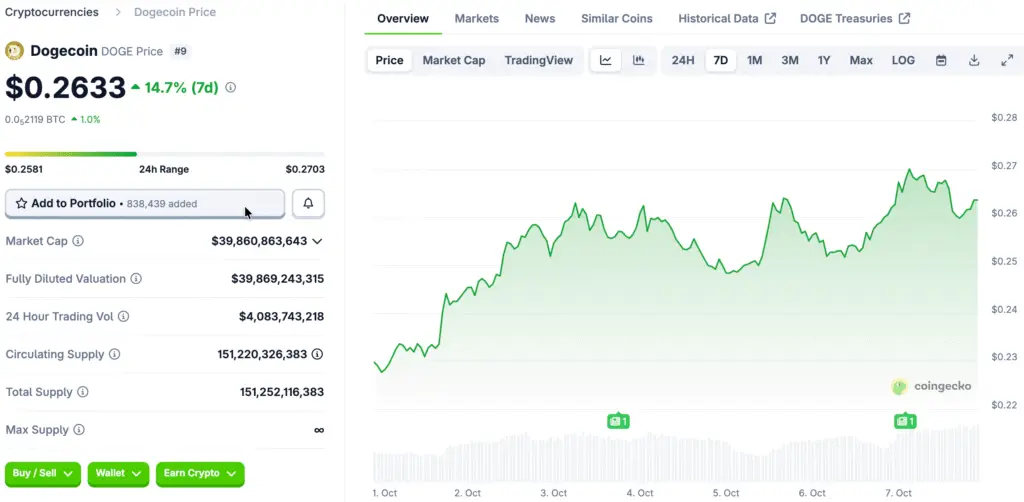

Dogecoin Surges 4% in a Remarkable Daily Performance Against the Market

Dogecoin has achieved a remarkable 4.2% price rise in the last 24 hours, notably surpassing the overall performance of the crypto market. During this period, the market-cap weighted index saw a modest increase of just 1.6%, yet Dogecoin stood out as a significant factor in fostering overall bullish sentiment.

This development brought DOGE nearer to the crucial $0.27 resistance level, sparking renewed conversations among traders aiming for the psychologically important $0.30 threshold in the upcoming sessions.

Risk-On Market Conditions Provide a Bullish Backdrop for DOGE

The recent surge in Dogecoin aligns with a wider wave of positivity permeating the cryptocurrency markets. The recent rise of Bitcoin to new all-time highs has fostered a positive risk-on atmosphere, encouraging investors to shift their focus towards altcoins.

In the past, Dogecoin has shown a robust reaction to times of renewed market excitement, frequently resulting in significant short-term increases as momentum gathers. The present macroeconomic and cryptocurrency-specific trends are creating a perfect environment for yet another speculative surge.

TVL Expansion Underscores Strengthening Network Activity

DefiLlama reports that Dogecoin’s total value locked (TVL) has increased by 3.6% in the last 24 hours, reflecting a surge in on-chain activity. This growth indicates a rise in capital investment within Dogecoin’s ecosystem, pointing to greater user involvement and trust.

TVL metrics frequently serve as an indicator of network vitality and liquidity. The recent increase closely corresponds with the current price trends, strengthening the optimistic outlook with clear fundamental indicators.

Recommended Article: Dogecoin Price Analysis, Cardano Latest News, and New Viral Crypto Tokens Trigger Market Buzz

Whale Accumulation Adds Fuel to Dogecoin’s Rally

Major investors, often called whales, have ramped up their Dogecoin purchases in the last 24 hours. Recent reports reveal that whales acquired around 30 million DOGE tokens during this timeframe, marking a notable rise in activity compared to previous trends.

Whale movements frequently signal upcoming retail trends, serving as preliminary indicators of possible price changes. Their revived enthusiasm for DOGE has intensified buying activity and attracted the focus of traders observing market movements.

Dogecoin Futures and Liquidations Stay Stable, Signaling Organic Accumulation Phase

Market data indicates that liquidation and futures flows for Dogecoin remain relatively stable, implying that the rally is not simply driven by short squeezes or speculative spikes. This stability suggests a more natural accumulation phase, driven by authentic buying interest instead of compelled liquidations.

These conditions frequently create a more stable environment for ongoing price growth, as they diminish the chances of abrupt reversals caused by excessive leverage.

Key Resistance Levels Define Dogecoin’s Near-Term Outlook

Technical analysts are paying close attention to the $0.27–$0.30 range, identifying it as Dogecoin’s immediate resistance zone. A significant move above $0.30 may ignite increased momentum, possibly resulting in a rapid short-term surge.

On the other hand, if this zone is not breached, we may see consolidation, with support around $0.25 expected to serve as the initial defensive line for bullish traders. These levels are anticipated to influence short-term price movements as investor interest increases.

Dogecoin’s Momentum Could Signal Broader Meme Coin Revival

The surge in Dogecoin, fueled by significant whale accumulation and an expanding network, may serve as a spark for a resurgence of interest in meme coins throughout the market. Historically, price surges in DOGE have frequently been followed by similar movements in related tokens such as Shiba Inu.

If the overall sentiment in the crypto market stays positive and Bitcoin maintains its peak levels, Dogecoin’s existing momentum might develop into a more significant rally driven by narratives, drawing in retail traders looking to seize quick profits.