Dogecoin Slips Deeper Into Bearish Territory

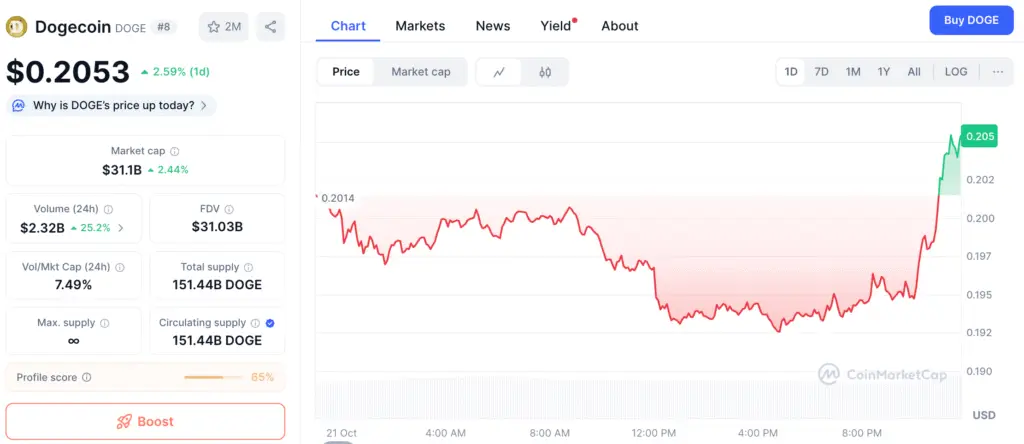

Dogecoin (DOGE) is still going down, making lower highs and lower volume, which is a sign that it is becoming more negative. Once known as the face of meme coin excitement, the token is currently under further selling pressure and traders are losing interest. In the last 24 hours, DOGE’s price has dropped 3.72% and its trading volume has dropped 20.8%. This means that fewer people are trading it and it is losing momentum.

The currency is now trading at $0.19; however, its technical structure is weak as the market becomes more and more gloomy. Analysts say that DOGE may retest the $0.15 support level, which is a psychological zone that has traditionally attracted short-term investors, unless purchasing volume comes back soon.

Bears Tighten Grip as DOGE Loses Key Supports

The short-term structure of Dogecoin exhibits a distinct bearish signal. DOGE is still making lower lows and lower highs on the four-hour chart, which confirms a downtrend that has been going on since mid-October. The coin is presently trading below its twenty-day Exponential Moving Average (EMA), which shows that sellers are in charge.

This feeling is also shown by momentum indicators. The Moving Average Convergence Divergence (MACD) reveals that the green histogram bars are getting shorter and that the EMA 26 (orange) has crossed below the EMA 12 (blue), which means that buying strength is getting weaker. These technical signals, along with falling volume, imply that the bears may stay in charge of the market for a while.

Technical Indicators Show Deteriorating Strength

DOGE’s price is still stuck below both short-term and medium-term moving averages on the daily chart, which shows that it is still weak. The Money Flow Index (MFI) is at 29.58 right now, which means that money coming in is slowing down. If the MFI drops below 20, it might mean that things are oversold, which is frequently a sign that people are about to give up in the near term before the market rises.

DOGE’s latest slide below the 0.236 Fibonacci retracement line has made its technical picture much worse. The price is currently flirting with the $0.18 zone. If it stays below this level for a long time, it might speed up the drop to $0.15, where there is more support at $0.13.

Recommended Article: Dogecoin Price Outlook: Can DOGE Replay Its 36,000% Rally?

Dogecoin Faces Further Downside as Price Falls Below 0.236 Fib Level

Dogecoin’s price has clearly dropped below the 0.236 Fib level at $0.21, based on Fibonacci retracement levels taken from the most recent swing high to the present lows. This makes it more likely that purchasers haven’t been able to take charge.

If DOGE falls below $0.18, the next level of support is $0.15. In the past, rebounds from this range have only lasted a short time unless there was a lot of volume behind them. The next possible landing zone is the 0.786 Fib level at $0.13, which is below $0.15. This level might draw in speculative investors who think the price will go up.

Market Sentiment Remains Weak but Reversal Possible

Even though momentum indicators are still negative, there is yet optimism. Market watchers say that DOGE’s long-term base between $0.15 and $0.16 has been a place where the price has bounced back in the past. If the price breaks above the $0.21 resistance zone, which is also the 0.236 Fib level, it might start a new bullish trend and go to $0.27 or perhaps $0.31, which is the 0.5 Fib retracement level.

But this positive conclusion hinges on more money coming into the market and better feelings in the meme coin industry as a whole. If there isn’t a lot of involvement, DOGE’s price is more likely to go down as more people sell.

Dogecoin Battles to Hold $0.15 Support Amid Prolonged Market Weakness

Dogecoin is still under a lot of technical stress right now. Traders are keeping a careful eye on whether bulls can hold the $0.18–$0.15 level, which might decide which way the market moves next. If DOGE breaks below $0.15, it will prove that the negative trend is still going on, and it might hit new lows for several months.

On the other hand, if the price stays above $0.21 for a long time, it would mean that purchasers are coming back, which would be an early indicator of a trend reversal. The market is still focused on DOGE’s potential to stay stable despite falling demand and a strong negative trend until that happens.