Dogecoin Gains Traction as Market Sentiment Improves

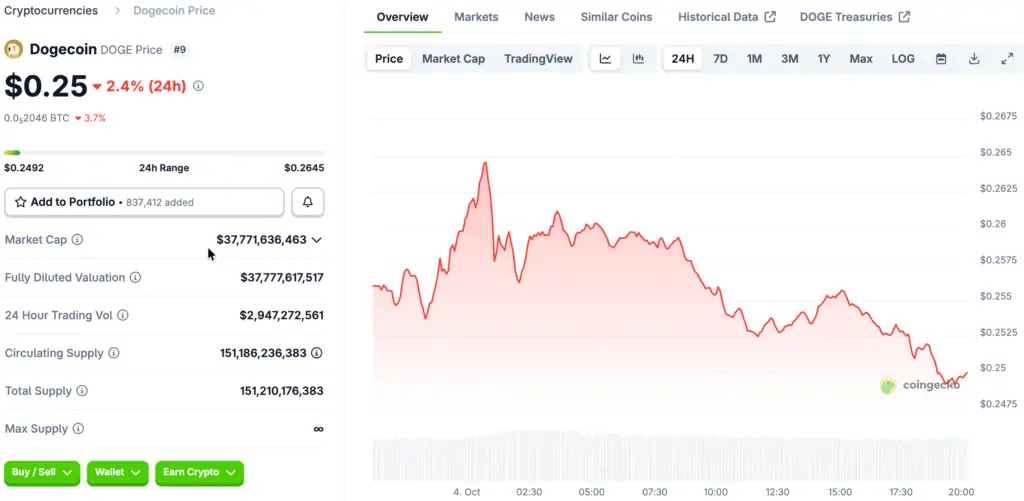

Dogecoin is showing impressive bullish momentum, catching traders off guard with its unexpected resilience above previously recognized demand zones. Previous predictions expected a liquidity sweep around $0.25, but the price quickly reversed upward without activating the anticipated downside wicks.

This resilience indicates an increase in trader confidence and underscores the tendency of meme coins to unexpectedly break away from conventional technical patterns. Market participants are currently reassessing their short-term targets, particularly with a significant liquidity pocket situated near the $0.27 level.

Key Liquidity Levels Create Attractive Breakout Opportunities

The $0.27 zone signifies a crucial supply area where there is a concentration of resting liquidity positioned above the current price action. Seasoned traders understand that prices often move towards areas of high liquidity to effectively activate pending orders.

If the bullish momentum persists, this area may serve as a magnet, drawing Dogecoin upward as demand grows stronger. On the other hand, a lack of sustained buying pressure could postpone or nullify breakout scenarios, leading to consolidation below resistance levels.

Dogecoin Surprises with Dramatic Reversal Trends

The recent surge in Dogecoin took many traders by surprise as the price bypassed expected liquidity sweeps before climbing further. This surprising behavior highlights the challenges of trading meme coins effectively with rigid textbook strategies on a consistent basis.

Experienced analysts highlight the importance of adjusting to fluctuations and staying adaptable when price movements deviate from anticipated market patterns. The recent sharp reversal of Dogecoin has sparked renewed bullish sentiment, particularly among traders looking for significant short-term profits during the Q4 rallies.

Recommended Article: Dogecoin Surge Sparks Interest in Global Crypto Payrolls

Market Uncertainty Remains Despite Bullish Price Structure

While the present structure seems optimistic, uncertainty is ever-present in crypto markets, where reversals can occur unexpectedly. The historical price movements of Dogecoin reveal several instances where significant rallies were swiftly followed by reversals, ensnaring overly ambitious bulls.

Traders must exercise caution, recognizing that short-term forecasts are based on probabilities rather than certainties. Keeping a disciplined approach to risk management allows traders to stay ready in case market dynamics suddenly turn against the current momentum.

Technical Setups Point Toward Magnetic $0.27 Liquidity Zone

Daily charts indicate that Dogecoin is nearing a crucial liquidity zone, which frequently serves as a catalyst for bullish continuation trends. When the price exceeds $0.27, the presence of resting stop orders and limit orders sets the stage for a swift upward price surge during breakouts.

Market participants are meticulously monitoring volume and momentum indicators for confirmation signals that suggest ongoing buying activity across various exchanges. A clear breakout past resistance may spark fresh excitement among retail investors, solidifying Dogecoin’s position as a prominent meme token.

The Wider Market Landscape Enhances Dogecoin’s Standing

The surge of Dogecoin takes place against a backdrop of heightened volatility and a resurgence of investor interest in the cryptocurrency market this quarter. Bitcoin has once again surpassed the $120,000 mark, with Ethereum aiming for $10,000, boosting overall market sentiment and drawing in new capital investments.

Meme coins such as Dogecoin tend to experience significant advantages during periods of market optimism, attracting speculative interest in pursuit of substantial returns. The current macroeconomic factors create a supportive environment that may enhance Dogecoin’s potential rise towards key liquidity milestones in the near future.

Dogecoin’s Path Toward $0.27 Faces Key Resistance Tests

Dogecoin is hovering close to the $0.27 liquidity target, but it still faces multiple resistance levels that need to be overcome for a clear breakout. Market participants anticipate significant fluctuations as opposing bullish and bearish pressures converge around these key technical turning points.

A successful breakout may lead to a series of buy orders, driving Dogecoin to reach new short-term highs and significantly boosting momentum. Nonetheless, a rejection at resistance can result in periods of consolidation or corrective pullbacks, thoroughly testing the conviction and patience of traders.