Eric Trump Highlights Bitcoin Growth Potential at Conference

Eric Trump spoke at the Bitcoin Asia conference in Hong Kong, projecting Bitcoin could eventually climb to an incredible $1 million. He emphasized the role of institutional demand alongside Bitcoin’s limited supply as key factors supporting his bold prediction. Despite short-term volatility, Trump sees long-term growth as inevitable for the world’s largest cryptocurrency.

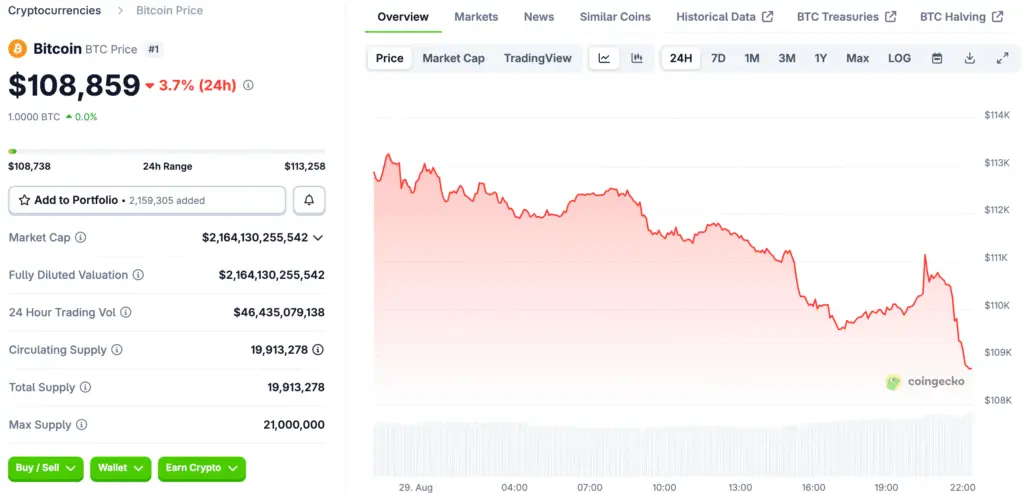

Bitcoin recently traded near $110,000, well below its mid-August record high of $124,480. Still, the digital asset has surged 18% this year, boosted by friendlier U.S. regulations and institutional interest. Trump believes these drivers will continue accelerating Bitcoin adoption and valuation globally.

Bitcoin Price Surge Driven By Institutional Demand

Institutional investors are increasingly entering the cryptocurrency market, providing fresh capital and credibility. Their growing presence has significantly bolstered Bitcoin’s resilience against market corrections and regulatory pressures. Eric Trump sees this trend as central to Bitcoin’s path toward unprecedented valuations.

The influx of large funds, hedge managers, and corporations has transformed Bitcoin from a niche digital asset into mainstream finance. Demand from these institutional players has increased scarcity, particularly as Bitcoin’s capped supply remains unchanged. Analysts agree that this environment creates favorable conditions for long-term price appreciation.

China Plays Important Role in Global Cryptocurrency Development

While mainland China officially bans cryptocurrency trading, it remains heavily involved in blockchain development and related infrastructure. Eric Trump acknowledged China’s influence, calling it a significant force shaping digital currency adoption. He noted potential global impacts if China pursues yuan-backed stablecoins aggressively.

Hong Kong recently passed a stablecoin bill, positioning itself as a competitive global hub for digital assets. This move aligns with regional efforts to compete with the United States in cryptocurrency regulation and innovation. Such developments further emphasize China’s critical role within evolving financial systems.

Recommended Article: Central Bank of Brazil’s Stance on Bitcoin Reserves

Trump Family Expands Into Cryptocurrency Ventures

The Trump family has increasingly embraced cryptocurrencies through new ventures spanning exchanges, stablecoins, and mining. Eric Trump highlighted these initiatives as part of a broader belief in blockchain technology’s future. Their growing portfolio reinforces their long-term confidence in digital assets.

A bitcoin mining venture backed by Eric Trump and Donald Trump Jr. prepares for a Nasdaq listing. This milestone could bring additional visibility to their involvement in cryptocurrency markets. Such moves underscore the family’s commitment beyond simple speculation.

U.S. Regulation Shapes Global Cryptocurrency Momentum

Eric Trump praised the Trump administration’s approach to cryptocurrency regulations, which many believe sparked renewed investor confidence. Supportive policies have helped drive Bitcoin’s rise this year, offering clearer guidelines for institutional participation. This framework has encouraged broader acceptance within traditional financial sectors.

Binance founder Changpeng Zhao echoed these sentiments, suggesting the United States sets a regulatory example for other governments. Zhao argued that forward-looking frameworks prompt competing nations to accelerate their digital asset strategies. This global momentum benefits Bitcoin by fostering competition among regulators.

Bitcoin Community Strongly Supports Trump Presidency

Eric Trump noted that the Bitcoin community provided substantial support for his father before his presidential victory. He expressed gratitude toward this loyal base, highlighting shared values around decentralization and financial freedom. He affirmed the family’s belief in the cryptocurrency sector.

Such political ties highlight how digital assets have entered mainstream discourse. Crypto adoption now extends beyond financial markets into national politics. This dynamic further validates Bitcoin’s influence on broader societal structures.

Outlook for Bitcoin’s Future Remains Strong Despite Volatility

Though Bitcoin faces volatility, long-term believers like Eric Trump see inevitable progress toward record-breaking valuations. Scarcity, institutional adoption, and global competition all drive optimism. Analysts stress patience is key for investors seeking exponential returns.

Bitcoin remains far from Trump’s $1 million target, yet confidence grows among market participants. Technological and regulatory advancements continue to provide supportive frameworks. If these trends persist, Bitcoin could indeed surpass expectations.