ETH/USD Consolidates Near Critical Price Support

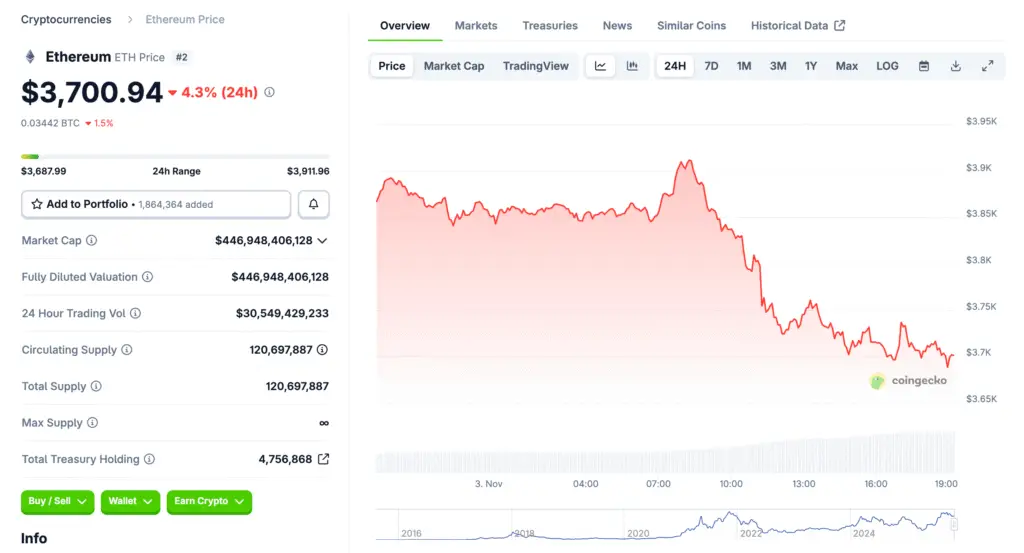

Ethereum (ETH/USD) is navigating a delicate balance between bearish momentum and potential recovery. The asset has been testing the $3,715 level, a price that has acted as a reliable support zone throughout October. With the pair bouncing multiple times in recent weeks, traders are closely watching whether Ethereum can sustain this level or risk deeper declines.

Short-Term Momentum Signals Caution for Bulls

Technical indicators, including RSI and MACD, have both signaled growing bearish momentum. The recent break below the long-term uptrend that began in April has heightened fears of a continued downward phase. However, short-term trading around $3,715 remains a crucial test of market sentiment. Any decisive move below could confirm a bearish breakout, prompting traders to seek lower support levels.

Possible Downside Targets Below $3,715

If ETH/USD closes beneath the $3,715 mark, analysts expect further selling pressure targeting $3,600 and possibly $3,500. Such levels coincide with earlier support areas from August, where the market experienced brief consolidation before the September rally. A confirmed breakdown could strengthen bearish confidence, especially as leveraged traders adjust risk exposure amid falling momentum.

Countertrend Opportunities for Optimistic Traders

Despite the prevailing bearish tone, Ethereum’s ability to repeatedly hold $3,715 offers hope for bullish traders seeking countertrend entries. If the asset maintains this zone and rebounds, potential targets lie at $3,900 and $4,100—levels that have served as previous resistance zones. A strong bounce would indicate renewed buyer interest, potentially reversing short-term weakness.

Recommended Article: Ethereum Price Optimism Signals Broader Shift Toward Decentralized Payroll Infrastructure

Falling Wedge Pattern Suggests Long-Term Upside Potential

Zooming out to the daily chart reveals a broader technical structure forming a falling wedge. Historically, this pattern often precedes bullish breakouts, signaling the end of extended corrections. If Ethereum manages to break above the upper boundary of this wedge, analysts predict a gradual climb that could eventually retest the $4,867 all-time high set in August.

Market Sentiment Split Between Fear and Opportunity

Investor sentiment remains divided. Bears highlight the sustained loss of upward momentum and the rejection from $3,900 as signs of exhaustion. Bulls, on the other hand, focus on the consolidation pattern as an accumulation phase before the next rally. The next few trading sessions are expected to provide critical insight into whether Ethereum’s sideways movement will evolve into a reversal or a continuation of the downtrend.

Risk Management and Strategic Positioning

Professional traders are emphasizing risk management as volatility picks up. Short positions may be favored below $3,715 with stops placed above resistance at $3,800. Conversely, bullish traders may seek to enter above $3,800 with stops just under $3,700 to minimize downside exposure. Such dual strategies reflect the uncertainty of the current market structure.

Broader Market and Long-Term Implications

Beyond immediate price movements, Ethereum’s performance continues to be shaped by macroeconomic and regulatory developments. Institutional demand, Layer 2 network activity, and ETF inflows could determine whether ETH can recover momentum before the year ends. As the market oscillates between fear and anticipation, Ethereum remains a cornerstone of the broader crypto narrative—teetering between short-term weakness and long-term potential.