Ethereum Strengthens as BlackRock and Vanguard Increase Accumulation

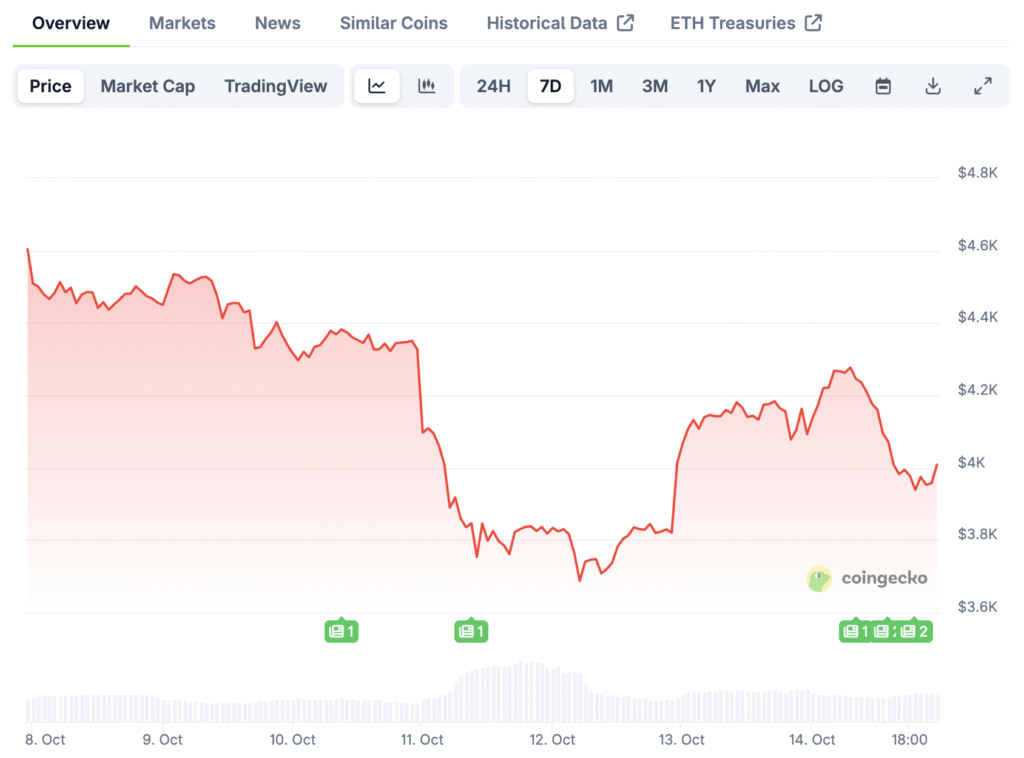

Ethereum is picking up bullish momentum after a short dip below $4,000, igniting fresh optimism among investors worldwide. Experts now suggest that this pullback could signify the last correction before a sustained upward rally commences.

Notable crypto analyst Mike Investing reported that major institutions such as BitMine, BlackRock, and Vanguard have recently amassed billions in Ethereum. He forecasted that ETH might hit $7,000 by May 2026, provided that accumulation persists along with ongoing investor confidence.

Massive Short Exposure Could Trigger Billions in Liquidations if Rally Hits

Market data indicates that approximately $9.5 billion in short positions could be liquidated if Ethereum experiences a sudden 20% rally. In contrast, merely $2.6 billion in long positions would be vulnerable if prices were to decline by the same amount.

This imbalance establishes an uneven scenario where upward movement causes greater distress, heightening the chances of a series of liquidations. Experts suggest that if ETH surpasses $4,800, automated liquidations may drive it swiftly past $5,000 and into higher resistance levels.

Ethereum Faces Resistance at $4,000 Before Potential Bullish Continuation

Although macro indicators suggest a prolonged rally, traders are exercising caution regarding potential short-term pullbacks influenced by intraday patterns. Technical specialists have observed a “three drive” pattern emerging, with bearish divergence evident on the 30-minute chart timeframe.

According to analyst SailorManCrypto, a rejection within the $3,900–$4,000 range may lead to short-term selling before a potential continuation. Market participants are closely monitoring these areas, as they signify essential demand points that may dictate the forthcoming significant upward movement.

Recommended Article: Ethereum Price Surge Renews Optimism Among Crypto Investors

Ethereum Staking Growth Tightens Exchange Supply and Boosts Scarcity

The staking ratio of Ethereum is on a consistent upward trajectory, significantly reducing the supply available on exchanges and tightening the liquidity in circulation. This structural reduction in available tokens boosts scarcity dynamics, which usually supports sustainable long-term valuation appreciation.

Furthermore, the rise in ETH ETF inflows indicates a strengthening confidence among institutional investors who are looking for regulated blockchain exposure. The interplay of increasing on-chain activity and these elements fosters a positive atmosphere for sustained growth towards elevated long-term targets.

Ethereum Momentum Builds as Price Nears Key $5,700 Technical Barrier

According to the latest technical models, experts identify $5,700 as the upcoming resistance level for Ethereum before the market moves towards $7,000. Momentum indicators indicate that consistent closes above $4,800 may lead to a notable acceleration toward this important psychological level.

If ETH continues to see increasing volume along with enhanced liquidity metrics, the potential for a breakout significantly improves as we approach early 2026. Experts highlight that the $7,000 mark is still achievable, considering the backing from institutions and the persistent accumulation trends observed worldwide.

Stable Price Action Suggests Foundation for Sustained Long-Term Growth

Ethereum’s price has recently found stability at approximately $4,107, showcasing a daily increase of 7.8% supported by a robust trading volume of $59.2 billion. Short-term fluctuations continue, yet the general sentiment in the market stays optimistic, as institutional investors bolster wider accumulation patterns.

Experts anticipate a short period of consolidation within the range of $3,900 to $4,300 before momentum picks up and leads into the next rally phase shortly. If buying pressure remains strong through Q4 2025, Ethereum may steadily progress toward $7,000 by mid-2026 with assurance.

Ethereum Strengthens Global Presence as Smart Contract Adoption Expands

The prominence of Ethereum in decentralized finance and the adoption of smart contracts are consistently drawing significant enterprise integration on a global scale. The efficiency of its network, enhancements in scalability, and lower supply inflation all bolster forecasts of long-term appreciation that is fundamentally in sync with demand.

The involvement of institutions has shifted Ethereum from being merely a speculative asset to an essential element of diversified cryptocurrency portfolios around the world. Experts assert that $7,000 is a reachable benchmark highlighting Ethereum’s ongoing development as a standard for digital financial infrastructure.