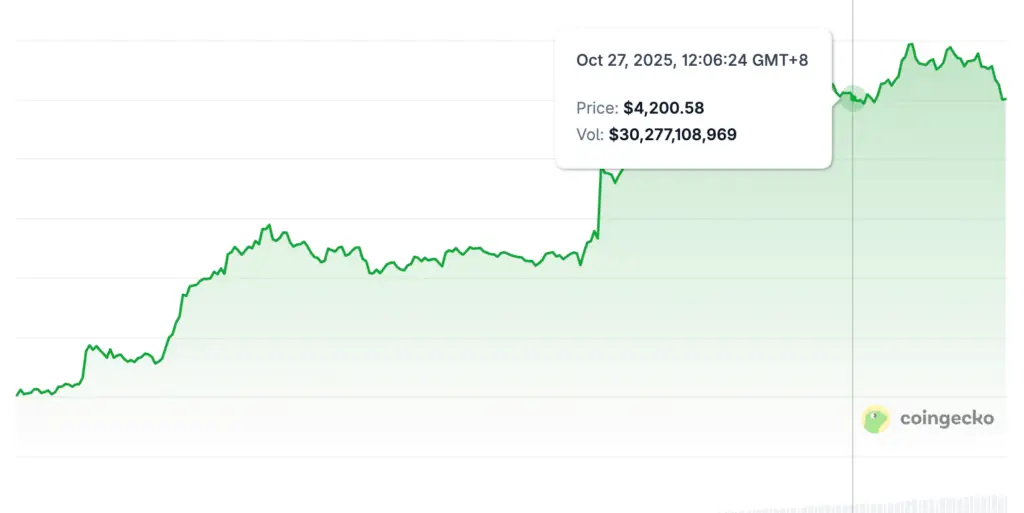

Ethereum Rebounds Amid Geopolitical Optimism

Ethereum (ETH) surged past $4,000 on October 26 as markets reacted to optimism surrounding Trump’s upcoming meeting with Chinese President Xi Jinping. The cryptocurrency gained 10% from its weekly low, mirroring a broader market rally across Bitcoin, Solana, and XRP. The visit follows a positive start to Trump’s Asia tour, which included a peace treaty signing between Cambodia and Thailand. Investors anticipate that easing geopolitical tensions could boost risk assets like Ethereum in the short term.

Treasury Firms Accelerate Ethereum Accumulation

Corporate interest in Ethereum remains robust, even amid fluctuating prices. Data from Artemis revealed that public treasury holdings of ETH now surpass Bitcoin in supply dominance for the first time. These firms collectively hold 3.2 million ETH compared to 640,040 BTC owned by corporate investors. This reflects Ethereum’s increasing appeal as a yield-generating asset following its transition to Proof-of-Stake (PoS).

Yield Advantage Drives Institutional Adoption

Ethereum’s 3–4% annual staking yield continues to attract global treasuries seeking productive reserves. Art Malkov, CEO of Electroneum, emphasized that “corporate treasuries are fiduciaries first, seeking yield over speculation.” The token’s yield-bearing nature provides an alternative to idle cash holdings while maintaining ESG compliance. Ethereum’s 99% energy efficiency improvement since PoS transition further enhances its sustainability profile for institutional investors.

Recommended Article: Ethereum Consolidates as Analysts Track $3,500 and $4,100 Breakout Levels

Short Traders Deploy $650M in Leverage Positions

Despite bullish fundamentals, short traders have ramped up bearish leverage near the $4,100 resistance level. Data from Coinglass indicates that roughly $650 million in short contracts were opened within 24 hours, accounting for 76% of total short leverage. The long-to-short ratio dropped to 0.82, signaling a market leaning toward correction expectations. Historically, such setups often precede volatile price swings as opposing forces battle for momentum.

Market Awaits Trump–Xi Trade Outcomes

The upcoming Trump–Xi meeting in Korea on October 30 could influence crypto sentiment significantly. Analysts say discussions over tariffs and economic cooperation might shape institutional risk appetite. A successful meeting may push Ethereum above $4,150 resistance toward $4,240, where another liquidity cluster sits. However, a negative outcome or renewed trade tension could trigger liquidations, dragging ETH toward $3,900 support.

Ethereum’s Technical Outlook Remains Mixed

Technically, Ethereum trades within a narrow band between $3,700 and $4,100. The Relative Strength Index (RSI) stands near 46, indicating balanced sentiment. Short-term moving averages hover around $3,900, suggesting stability but no clear bullish breakout yet. Analysts caution that a sustained close above $4,150 is needed to confirm the next upward trend toward $4,800.

Smart Money Activity Points to Accumulation

On-chain analytics reveal continued wallet outflows from exchanges, suggesting accumulation by long-term holders. Whale addresses such as “0x86Ed” recently withdrew 8,491 ETH (valued at $32.5 million) from OKX, reinforcing investor confidence. Bitmine-linked wallets also acquired 45,814 ETH worth $184 million, signaling sustained institutional demand. These actions imply that while short-term traders hedge, strategic investors continue to build positions.

Ethereum’s Path Ahead: Volatility With Opportunity

As the market braces for macroeconomic news, Ethereum faces a tug-of-war between short-term speculation and long-term conviction. If ETH breaks $4,150 resistance with strong volume, analysts forecast a climb toward $4,500–$4,800 levels. Conversely, a failure could lead to a retest of $3,700–$3,900 supports. Either way, Ethereum remains a central player in the 2025 crypto narrative, balancing institutional accumulation with global macro risks.