Ethereum Faces Mounting Downside Pressure

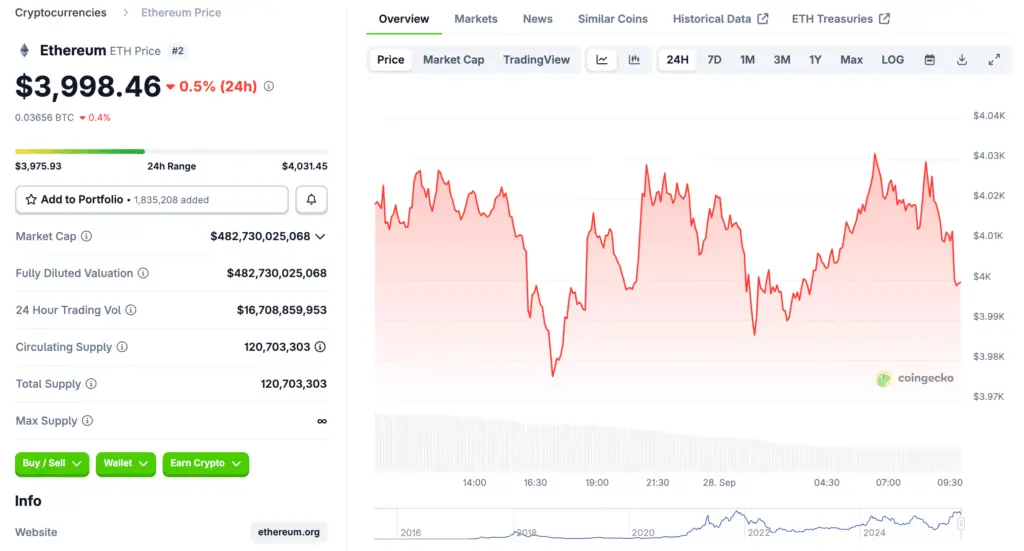

Ethereum’s price is facing its most critical moment in months after a steep decline below $4,000. Over the past 24 hours, ETH has shed another 4%, rattling investor confidence and setting the stage for potential deeper losses. Traders are closely monitoring support levels as the market debates whether this marks a temporary pullback or the start of a significant downtrend.

Market experts warn that if Ethereum fails to stabilize soon, it could face a 30% correction from current levels. This would push the price toward $2,750, a zone that previously served as strong support during past market cycles. The stakes are high, and sentiment is turning cautious as leveraged positions unwind rapidly.

Key Resistance Level Defines Bullish Reversal Prospects

Crypto analyst Ali Martinez has identified $4,841 as a critical resistance level for Ethereum’s reversal. He notes that ETH must break and sustain above this threshold to shift momentum back in favor of bulls. Without such a move, downward pressure is likely to persist and deepen.

Martinez bases his analysis on MVRV price bands, which indicate when Ethereum is historically overvalued or undervalued. Currently, ETH remains below key bands, signaling weakness rather than strength. A failure to reclaim this zone could leave the market vulnerable to further downside volatility.

Support at $4,100 Becomes a Battleground

Another respected analyst, Daan Crypto Trades, points to the $4,100 zone as the immediate battleground for bulls and bears. He observes that ETH’s recent red candle cut deep below this level, reflecting increasing selling pressure. Bulls must defend this area aggressively to avoid a weekly close that would invite more sellers.

If Ethereum fails to hold $4,100, traders anticipate a cascading effect that could accelerate the decline. Conversely, a slow and steady recove ry from here might set the stage for a future breakout attempt. The next few sessions will be crucial for determining which scenario plays out.

Recommended Article: Best DeFi Coins To Buy As Ethereum Price Is Expected To Pump To $10,000 Soon

Co-Founder’s 1,500 ETH Transfer Raises Eyebrows

Adding to the bearish sentiment, Ethereum co-founder Jeffrey Wilcke has moved approximately 1,500 ETH to Kraken. The transfer, valued around $6 million, coincided with ETH’s recent slip from $4,000 to $3,900. On-chain analysts quickly flagged the movement, speculating about possible intentions to sell.

While sending tokens to an exchange doesn’t guarantee a sale, Wilcke has a history of large transfers preceding market activity. In August, he deposited $9.22 million worth of ETH, and previously moved $262 million into new wallets. These actions often stir speculation and can influence market sentiment during sensitive price periods.

Heavy Outflows Add More Selling Pressure

Recent data from Farside Investors shows that spot Ethereum funds experienced over $250 million in outflows on September 25. Fidelity’s FETH ETF saw the heaviest withdrawals at $158 million, highlighting a sharp shift in investor behavior. These large outflows are compounding the downward momentum already triggered by technical breakdowns.

Outflows often indicate reduced investor confidence and can exacerbate existing price declines. If this trend continues, Ethereum may face additional liquidity challenges that make recovery more difficult. Analysts are watching ETF flows closely for early signs of sentiment stabilization or further deterioration.

Liquidations Amplify Market Stress

Ethereum’s nearly 20% drop over just 12 days has triggered widespread liquidations across leveraged positions. These forced sell-offs are intensifying downward pressure, wiping out both retail traders and institutional participants. Even treasury-backed firms like BitMine are struggling to keep up with the pace of liquidations.

Liquidation cascades can create feedback loops that accelerate price declines well beyond fundamental value levels. Once leverage is flushed from the system, markets typically stabilize—but the process can be brutal for participants caught on the wrong side of the trade.

Bulls Hope for Gradual Recovery Scenario

Despite the bearish narrative, some analysts believe Ethereum could stage a measured recovery if key supports hold. Daan Crypto Trades notes that a slow, controlled climb from current levels would flush out weak hands and build a stronger base for future rallies. However, this requires discipline from buyers and patience across the broader market.

Bulls are watching for signs of decreasing outflows and stabilization near $4,100. If these conditions align, Ethereum might consolidate before mounting another breakout attempt later in the year. But for now, caution dominates the landscape as ETH teeters on a critical edge.

Critical Weeks Ahead for Ethereum’s Trajectory

Ethereum’s next moves will likely define its trajectory for the remainder of 2025. A failure to recover soon could validate the bearish case targeting $2,750. Conversely, reclaiming key resistance levels could restore confidence and reignite bullish momentum.

With large transfers, heavy ETF outflows, and key technical levels in play, Ethereum finds itself at a pivotal crossroads. Traders and investors alike are preparing for heightened volatility and decisive market moves in the weeks ahead.