The Dominant Platform for Stablecoins

According to a new analysis from JPMorgan, Ethereum is uniquely positioned to benefit from the explosive growth of the stablecoin market. The network currently hosts a staggering $138 billion worth of stablecoins, giving it a commanding 51% share of the entire $270 billion sector. This dominance is a powerful indicator of the network’s reliability and institutional trust.

Stablecoins, which are digital tokens pegged to the value of a fiat currency like the U.S. dollar, have seen their market cap grow for eight consecutive months, outpacing the broader crypto market. This trend is a clear signal that stablecoins are no longer a niche product but a cornerstone of the digital financial system, and Ethereum is the dominant platform on which they are being built.

Bullish Predictions for Stablecoin Growth

The growth of the stablecoin market is expected to accelerate in the coming years, with bullish predictions from both traditional finance and crypto-native analysts. JPMorgan estimates that the sector could reach $500 billion by 2028, a significant jump from its current size. A more optimistic prediction from Standard Chartered suggests an even faster growth trajectory, with the market cap potentially hitting $750 billion by late 2026.

This rapid growth is being fuelled by a combination of factors, including increased institutional adoption, a more favourable regulatory environment, and a growing demand for stable, low-volatility assets in the crypto ecosystem. Ethereum’s position as the leading platform for stablecoins ensures that it will be a primary beneficiary of this growth, as new capital and new projects continue to flow into the ecosystem.

The Impact of New Regulations on Ethereum

The recent passage of the GENIUS Act, which creates clear guardrails for the stablecoin industry, has been a major catalyst for heightened activity across the Ethereum ecosystem. This new regulation provides a sense of certainty and security for developers and investors, which is crucial for the long-term health of the market. The new regulatory environment is not just benefiting stablecoins; it is also driving increased activity in decentralised finance (DeFi), NFTs, and spot markets.

The growth of stablecoin issuance on Layer-2 solutions, which are built on top of Ethereum, is also a positive development for the network. This is because every transaction on a Layer-2 solution eventually benefits Ethereum through increased network activity and a fee burn mechanism. This synergy ensures that as the stablecoin market grows, Ethereum’s utility and value will grow along with it.

The Path to New All-Time Highs

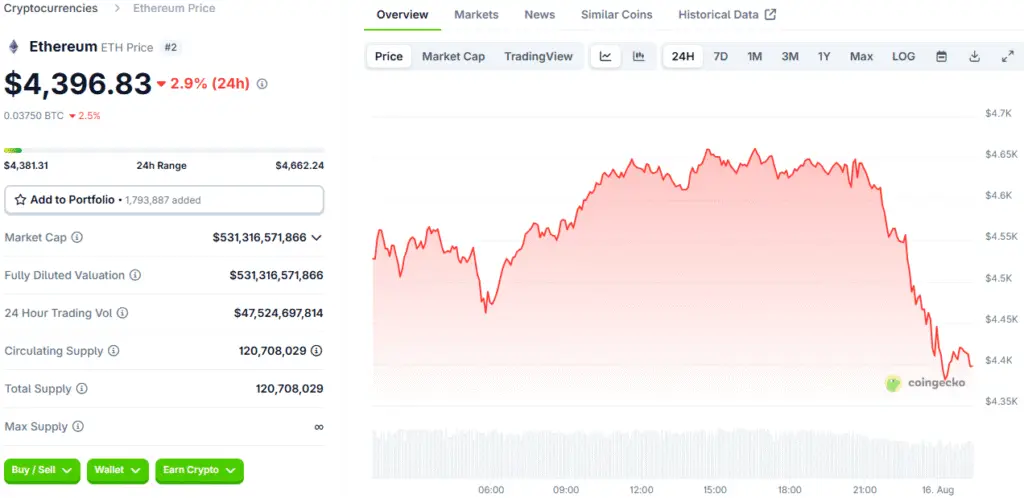

Ethereum’s recent performance reflects the growing confidence in its future. The cryptocurrency is currently trading around $4,540, up an impressive 50% over the past month. While it is still trading just below its 2021 high of $4,900, the current rally is being driven by more fundamental factors than the speculative mania of past cycles. The embrace of stablecoins by Wall Street and the clear regulatory path provided by new legislation are creating a new source of structural demand that is providing a strong foundation for future growth.

With bullish price predictions and a clear narrative of institutional adoption, it appears that the current rally is not just a short-term blip but a sustained move that could take Ethereum to new all-time highs. The market is now looking for a definitive breakout above its previous peak, which would be a powerful signal that the next phase of the bull market has officially begun.

Ethereum at the Centre of TradFi and Decentralised Technology Convergence

The stablecoin boom is not happening in a vacuum; it is part of a broader ecosystem of growth that is making Ethereum an increasingly attractive investment. The network’s robust developer community, its ongoing technical upgrades, and its dominant position in the DeFi space are all contributing to its success. The passage of the GENIUS Act and the resulting regulatory clarity are providing a green light for traditional finance to enter the space, and Ethereum is the platform of choice for these new players.

This convergence of traditional finance and decentralised technology is creating a powerful flywheel effect, where every new stablecoin, every new DeFi project, and every new institutional investor is contributing to the network’s growth and value. This is a new chapter in the story of crypto, where utility and institutional adoption are now the primary drivers of value, and Ethereum is leading the way.

Read More: Ethereum Surges as Investors Call It the Biggest Macro Trade