Unpacking Ethereum’s Recent Price Drop

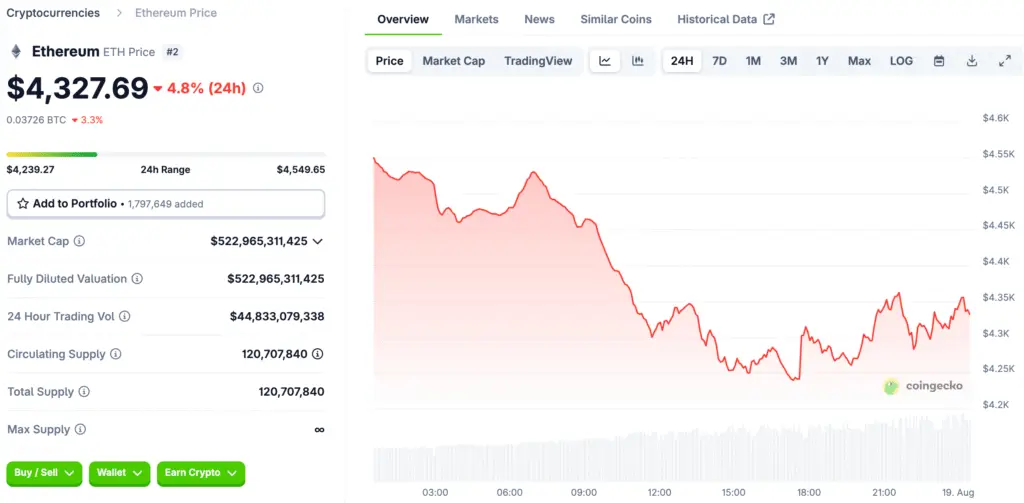

The cryptocurrency market has started the week with noticeable declines, continuing a trend of profit-taking across various assets. Ethereum, in particular, was hit hard, experiencing a significant retreat of nearly 10% from its multi-year highs reached just last week. The price of Ether dropped to approximately $4,250, while Bitcoin hovered around the $115,000 level. This synchronised downward movement indicates a broader market sentiment shift, where investors are becoming more cautious.

Beyond the two largest cryptocurrencies, the price volatility also extended to other assets, with Algorand and Avalanche each seeing declines of 5-7%. While the market is experiencing a significant pullback, the sell-off has not yet triggered a broad panic, suggesting a more calculated, rather than a fear-driven, reaction from investors.

The Impact of Profit-Taking and Liquidations

A key factor driving the recent price declines is widespread profit-taking by investors. This behaviour is particularly evident among large holders, often referred to as “whales.” On-chain data from CryptoQuant points to a sharp rise in exchange inflows, which is a strong indicator that these major players are moving their assets onto exchanges to sell. This profit-taking has triggered a cascading effect, leading to a substantial number of liquidations.

Over the past 24 hours, nearly $240 million in long positions were liquidated out of a total of roughly $340 million. This process occurs when leveraged traders, who have bet on a price increase, are forced to sell their holdings to cover their losses as the market moves against them. The immense scale of these liquidations adds significant downward pressure and can accelerate a market correction.

On-Chain Data and Shifting Investor Behaviour

The on-chain data provides crucial insights into the market’s current dynamics. The sharp increase in exchange inflows is a clear signal that large addresses are actively selling. This selling pressure from whales can influence the market sentiment and encourage other investors to follow suit. Furthermore, as Bitcoin prices fell, open interest in options markets climbed, which may indicate a growing interest in “trend tracking” strategies.

This buildup of significant short positions suggests that a portion of the market is betting on further price declines. These actions in the derivatives market can amplify volatility and contribute to downward pressure, as traders position themselves to profit from a bearish trend. The combination of on-chain selling and increasing short interest in options paints a picture of a market in transition.

Macroeconomic and Geopolitical Factors at Play

The crypto market’s recent performance is not just a result of internal dynamics but is also heavily influenced by external macroeconomic and geopolitical concerns. Markets are closely watching the outcome of the Jackson Hole symposium, a gathering of central bankers and economists, for clues about future monetary policy. Any hints of a more hawkish stance from the Federal Reserve, perhaps in response to hotter-than-expected inflation numbers, could signal a major risk for the ‘crypto bull market.’

A more aggressive Fed could increase the cost of capital and reduce liquidity, making risk assets like cryptocurrencies less appealing. Additionally, geopolitical events, such as the ongoing talks between President Trump and President Zelenskyy, could have an impact. A lack of a deal between Ukraine and Russia, for instance, might be seen as “inflationary” due to continued sanctions on Russian energy resources, further complicating the global economic outlook.

Analysing Technical Price Levels for Ethereum

From a technical analysis standpoint, the recent drop has put key price levels into focus for both Ethereum and Bitcoin. The Bitcoin price has fallen below its 50-day Exponential Moving Average (EMA), a level that has historically served as a critical support line in bull markets. The inability to reclaim this level quickly could signal a weakening of momentum.

For Ethereum, momentum indicators appear to be more overheated. In the event of a deeper correction, the $4,000 level is considered the first key support zone. This psychological and technical level could act as a floor for prices, potentially attracting new buyers. On the upside, resistance for Ether remains around the $4,800 mark, the peak from the 2021 bull run, a level that has been reinforced by recent selling pressure as the price approached it.

The Diverging Trends in Crypto ETF Flows

An interesting and potentially telling divergence has appeared in the world of crypto exchange-traded funds (ETFs). While Bitcoin funds saw nearly $500 million in inflows last Friday, which indicates strong institutional interest, Ethereum ETFs experienced a contrasting trend with outflows of over $50 million. This difference suggests that institutional sentiment is not uniform across all digital assets.

The selling in Ethereum ETFs was concentrated almost exclusively in the Fidelity Ethereum Fund, which may indicate profit-taking from a single large entity rather than a broad institutional retreat. This concentrated selling pressure highlights the influence that a few large players can have on the market, especially when their movements are not offset by widespread buying.

Future Outlook for the Crypto Bull Market

The immediate future for the cryptocurrency market will likely be shaped by the interplay of macroeconomic news, technical chart patterns, and on-chain data. While the recent sell-off has been significant, it is viewed by many as a necessary consolidation period. The resilience of institutional inflows into Bitcoin ETFs suggests a continuing long-term confidence in the digital asset space.

The key risk remains a shift in central bank policy driven by inflation, which could impact the broader market. Investors will be watching for signs of stability around key support levels, particularly for Ethereum at $4,000. The market’s ability to absorb this sell-off without widespread panic will be a critical test, potentially setting the stage for the next phase of the bull run.

Read More: Ethereum Whale Sparks Buzz with Massive ETH Withdrawal