Arthur Hayes’ Bullish Ethereum Forecast

Arthur Hayes, the co-founder of BitMEX and a highly influential figure in the cryptocurrency space, has made a striking and bullish prediction for Ethereum’s future price. In a recent interview, Hayes suggested that the world’s second-largest cryptocurrency, ETH, has the potential to climb to a range of $10,000 to $20,000 before the current market cycle comes to an end.

This forecast marks a significant shift from his earlier, more cautious stance. In early August, Hayes had sold a portion of his ETH holdings, anticipating a market correction. However, after ETH surged past $4,000, he quickly repurchased the asset, admitting that he “can’t fight the market.” This change in conviction, from bearish to profoundly bullish, provides a compelling perspective on the market’s current momentum and future potential.

Ethereum’s Potential for a Rapid Rally

Hayes’s bullish forecast is not simply based on gut feeling; it is rooted in his analysis of market dynamics and technical chart patterns. He believes that once Ethereum decisively clears its current all-time high of $4,878, a major momentum shift will occur. Hayes described this breakout as creating a “gap of air to the upside,” suggesting that with a significant resistance level out of the way, the price could experience a rapid and dramatic increase with little friction.

He also points to a key factor that could fuel this momentum: crypto-native companies are actively raising funds specifically to accumulate ETH. As the asset breaks through its all-time high, it becomes an even more attractive investment for these firms, creating a positive feedback loop of buying pressure that could send the price “sending upwards” to new and unprecedented levels.

Macroeconomic Tailwinds and Political Influence

Beyond the technical and on-chain factors, Hayes also links his optimistic outlook for Ethereum to broader macroeconomic and political trends. He argues that the political and economic environment in the United States could create a favorable climate for risk assets, including cryptocurrencies. Specifically, he believes that any financial asset that a public figure like Donald Trump backs and deems important could experience a significant bull run during his time in office.

This perspective ties the crypto market’s potential for growth to a more traditional and often unpredictable macro landscape. The interplay between these large-scale economic forces and the unique dynamics of the digital asset market forms a central part of Hayes’s investment thesis, highlighting a more holistic view of what drives market movements.

Ethereum’s Advantage Over Solana

The interview also addressed the ongoing rivalry between Ethereum and its competitor, Solana. When asked which he would back in the current market cycle, Hayes acknowledged that “They’re both gonna go up,” but then went on to confirm that he would be “more overweight on ETH than SOL.” This strategic preference for Ethereum over Solana comes at a time when both cryptocurrencies have shown a mix of volatility and growth.

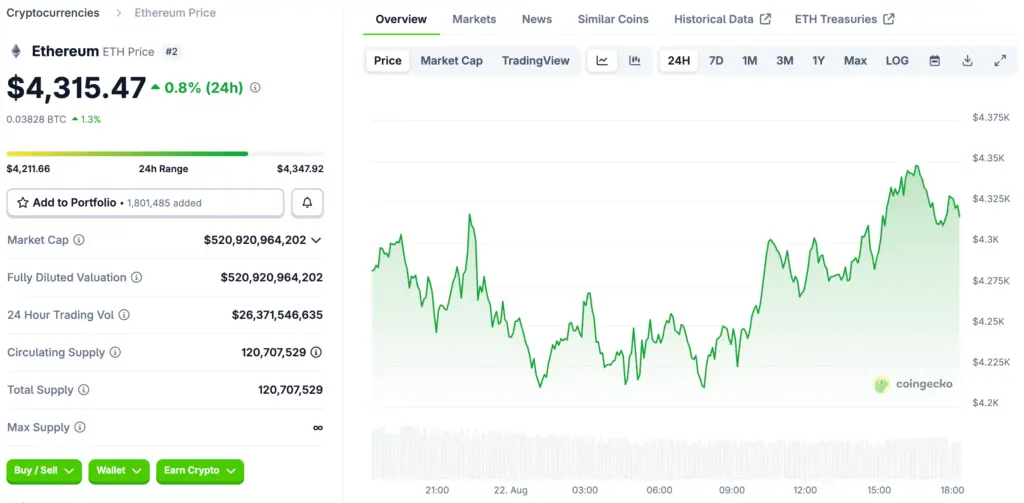

As of the report, Ethereum was trading at $4,288, a slight dip over the last 24 hours but still up almost 15% over the past month. In contrast, Solana, trading at $183, has struggled to maintain its recent momentum, slipping in both the 24-hour and seven-day periods. Hayes’s preference for ETH, despite its price remaining below its all-time high, suggests a belief in its long-term fundamental strength and its foundational role in the decentralized finance ecosystem.

Market Performance and Recent Volatility

The recent price action of both Ethereum and Solana illustrates the volatile and dynamic nature of the crypto market. While Hayes’s forecast for a future rally is optimistic, the present reality shows a market that is not without its challenges. Ethereum is currently trading at $4,288, reflecting a slight decline in the past 24 hours and a more notable drop of 7.4% over the past week. However, the asset’s impressive 14.8% gain over the last month demonstrates its underlying strength and resilience.

Meanwhile, Solana has experienced a similar period of volatility, slipping 2.4% in the past day and 6% over the last seven days. These price movements highlight the speculative nature of the market and the importance of a long-term perspective. While short-term volatility is to be expected, the broader trends and foundational developments of a cryptocurrency are often what determine its long-term success.

Understanding the Investment Thesis

Hayes’s investment thesis for Ethereum is multi-faceted, combining technical analysis, an understanding of market psychology, and a view of broader macroeconomic factors. His decision to re-enter the market after an initial sell-off is a testament to his belief in the power of following the chart’s narrative. He is not just looking at a price target but is also considering the behavioral dynamics of the market, specifically the momentum that a clear breakout could generate.

His focus on crypto-native companies and their fundraising efforts to acquire ETH adds a layer of institutional-level analysis to his prediction. This approach suggests that the next phase of Ethereum’s growth will be driven not just by retail enthusiasm but by the strategic accumulation of capital from established players in the space, signaling a maturing market.

Arthur Hayes’ Bullish Ethereum Prediction

The future price of Ethereum, as predicted by Arthur Hayes, will hinge on several key factors. The most immediate is the asset’s ability to convincingly break and hold above its all-time high. This technical breakout could serve as the catalyst for a significant rally, attracting new capital and reinforcing investor confidence. Beyond the charts, the performance of the broader crypto market and the influence of macroeconomic factors will also play a crucial role.

Hayes’s forecast, while ambitious, provides a compelling glimpse into the potential for Ethereum to not only recover its previous highs but to surpass them by a significant margin. It serves as a powerful reminder that in the world of crypto, where technology, finance, and human psychology converge, the possibilities for future growth can be truly extraordinary.

Read More: Ethereum’s Short-Term Pain Could Spark Its Biggest Rally Yet