What the Fed Chair Said Was Very Important

The Fed Chair’s upcoming speech is now a major factor in the short-term movements of the crypto market. This event that everyone has been looking forward to is making investors very nervous as they wait for a new clear direction. A single change in the Federal Reserve’s tone on monetary policy could have a big effect on how people feel about the market.

If Jerome Powell takes a dovish stance, it could quickly cause a big risk-on rally in assets like Bitcoin and Ethereum. This could mean that the economy is getting better, which could be good for investments that are more volatile and focused on growth. This kind of speech could set the stage for a big new bull run in the crypto market.

Ethereum’s Quiet Strength While Bitcoin Struggles

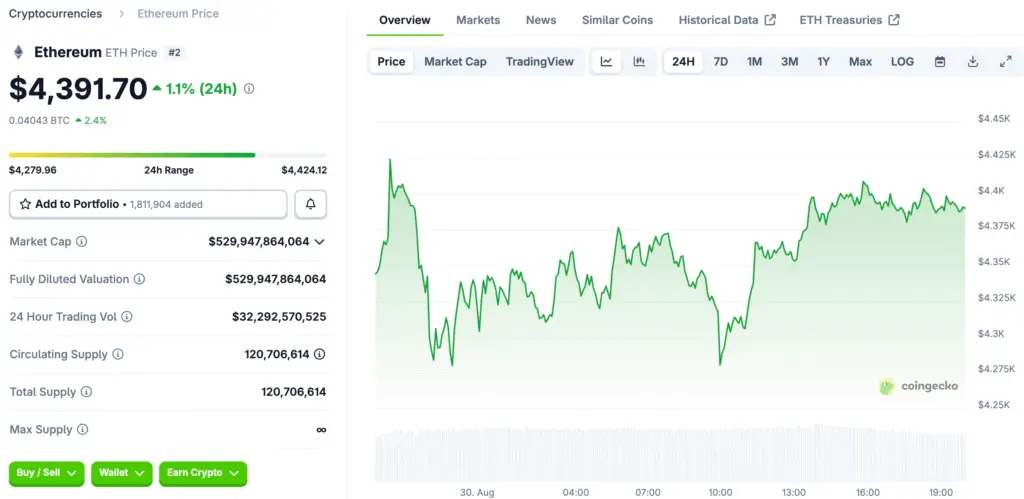

Ethereum has shown amazing strength and an impressive ability to keep its value even when the market is very unstable. This performance is very different from what Bitcoin has been going through lately, when its price fell from an all-time high. Ethereum’s strength right now is a good sign for the whole cryptocurrency ecosystem.

A lot of experienced market players are noticing the difference in performance between the two top digital assets. This new trend shows that Ethereum is starting to become a strong market force on its own, separate from how Bitcoin is doing. It may be more stable because it is a key part of the decentralized finance space.

Important Price Levels That Could Start a Breakout

Investors are now keeping a close eye on a few important price levels for Ethereum that could decide what it does next. Many analysts have pointed to the $4,800 price level as a very important resistance point on the chart that needs to be broken through. If this breakout zone clears, a lot of traders who are sitting on the sidelines could start buying a lot more.

The next big psychological barrier after $4,800 is the impressive $5,000 milestone. Not only would reaching this milestone be a new high, but it would also get a lot of new institutional and retail investors interested. On the other hand, the $4,100 support level is seen as a key point where bulls need to hold their ground.

Recommended Article: Ethereum Accumulation Rises as Institutional Demand Grows

The Psychology of the Market and the Fear of Missing Out

The way investors think is having a huge effect on the current price movement and overall direction of the crypto market. The “fear of missing out” (FOMO) could quickly become a strong force as the price of Ethereum goes up. This can speed up a rally as people rush to buy in, which makes prices go up even more.

Traders are feeling these strong emotions because they are waiting for a big announcement. A good sign could start a buying spree that is much stronger than the recent selling pressure. To make better investment choices, you need to know how these emotional market factors work.

Ethereum’s Basic Role Beyond Speculation

Traders are very interested in short-term price changes, but the real value of Ethereum is its role in the crypto world. The network is the most important part of the infrastructure that runs most decentralized finance protocols and non-fungible token marketplaces. This real-world use gives the whole network a strong value proposition.

Many people see the Ethereum network as a great long-term investment because it is always being improved and built on. Its lively community of developers and new projects is growing very quickly. This is a very strong reason why institutional investors are more and more interested in the digital asset.

The Change in How Investors Feel About BTC and ETH

There is a clear change in how investors feel, as a lot of them are moving their money and attention from Bitcoin to Ethereum. Ethereum’s impressive technological progress and strong network growth are two of the things that have made people change their minds. Ethereum is starting to look like a more creative and forward-thinking digital asset to investors.

Ethereum’s recent performance has made it clear to the wider market that it is a real and interesting alternative to Bitcoin. This shows that the ecosystem is growing up and that investors are looking for more than just the digital gold story. This trend is growing, which means that the cryptocurrency market is entering a new phase of diversification.

From Market Chaos to Calm Investing

Because the market is so uncertain right now, financial experts are strongly advising all investors to trade in a very disciplined and planned way. It’s very important not to make quick decisions based on how you feel about short-term price changes. It’s more important than ever to have a clear investment plan and stick to it.

For people who think long-term, market downturns can be great times to buy high-quality assets at a lower price. They should not panic; instead, they should see these times as strategic opportunities to build up. In the end, the best way to get through market chaos is to stay calm and have a well-thought-out plan.