Federal Reserve Signal Drives Ethereum to All-Time Highs

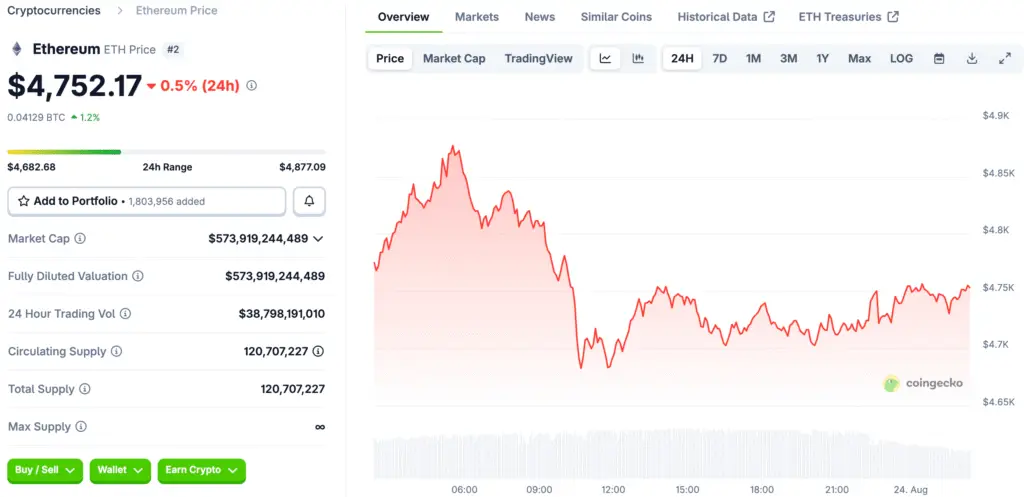

Ethereum ($ETH), the leading altcoin, has recently achieved a new all-time high (ATH) of $4,885. This significant price movement follows a signal from U.S. Federal Reserve Chairman Jerome Powell regarding potential rate cuts. The market reacted with a wave of optimism, leading to a 15% upsurge in Ethereum’s price over the last twenty-four hours. This sharp move upward is a direct result of a shift in investor expectations. Historically, when central banks signal a loosening of monetary policy through measures like rate cuts, it is often seen as a bullish indicator for risk-on assets, including cryptocurrencies.

Investors anticipate that lower interest rates will make traditional investments like bonds less attractive, pushing capital into higher-risk, higher-reward assets like Ethereum. This newfound liquidity and optimism have collectively fueled the rapid price appreciation, leading to the creation of a new ATH and a powerful signal to the rest of the market that a significant shift in macroeconomic conditions may be underway.

Bitcoin’s Market Dominance Slips Amid Ethereum’s Rise

The massive price rally in Ethereum has had a notable impact on the broader crypto market, particularly on Bitcoin’s dominance. Bitcoin ($BTC) has seen a dip in its market dominance, which has now fallen to 56.5%. This shift highlights Ethereum’s increasing role as a primary momentum driver in the market and suggests a rotation of funds. The concept of the “flippening,” where Ethereum’s market capitalization surpasses Bitcoin’s, has been a long-standing point of discussion in the crypto community.

While this has not occurred yet, the recent performance of Ethereum relative to Bitcoin reignites this conversation. As Bitcoin’s dominance shrinks, it suggests that a growing portion of market capital is being allocated to other cryptocurrencies, with Ethereum being the primary beneficiary. This is often an indicator that the market is moving into an “altcoin season,” where assets outside of Bitcoin experience stronger growth and a wider range of investment opportunities.

Institutional Investors Fuel the Sustained Rally

The renewed interest from institutional investors is playing a significant role in fueling this rally. As capital flows from traditional assets and even from Bitcoin into Ethereum, many investors see Ethereum as having more room for growth due to its foundational role in decentralized finance (DeFi) and other applications. This influx is driven by the maturation of regulated investment vehicles, such as spot Ethereum ETFs, which provide a safe and compliant way for institutions to gain exposure.

Unlike in previous market cycles, where retail investors were the primary catalysts, this current rally is supported by large, sophisticated players who are integrating Ethereum into their portfolios as a strategic, long-term asset. This institutional adoption provides a robust foundation for the rally, making it more sustainable than a short-term, hype-driven move. The ability for these institutions to invest in a regulated way has added a new layer of credibility and stability to the market.

How Ethereum’s Rally Liquidated Shorts

The rapid price increase in Ethereum has had a profound effect on leveraged traders. In the last 24 hours alone, nearly $300 million in crypto short positions were liquidated, with Ethereum accounting for a significant portion of that total. By comparison, Bitcoin’s short positions saw liquidations of only $67 million during the same period. This indicates that a large number of traders were betting against Ethereum’s price, and the sudden rally triggered a liquidation cascade.

A liquidation cascade occurs when a sharp price move forces leveraged positions to be closed, which in turn creates more selling (or buying) pressure, pushing the price even further in the direction of the move. This event serves as a stark reminder of the risks associated with high-leverage trading in a volatile market and can act as a powerful accelerator for a price trend. This short squeeze further propelled Ethereum’s price higher as bears were forced to buy back their positions to close them.

The $5,000 Milestone Is Now in Sight

Following its new ATH, market data indicates a 74% chance that Ethereum could reach the $5,000 mark by the end of the month. The sustained momentum and positive market sentiment are key factors supporting this forecast. The current focus of investors remains on Ethereum’s upward trajectory, as it prepares for a major jump that could cement its position as a key player in the global financial landscape.

A move above $5,000 would be a significant psychological milestone for the asset, attracting media attention and new retail investors. From a technical analysis perspective, it would confirm a new price discovery phase, where the asset’s value is no longer defined by previous resistance levels. Breaking this barrier would be a monumental achievement, signaling strong bullish conviction and setting the stage for further gains in the long term.

Ethereum’s Potential for a Major Jump

While the immediate target is $5,000, some bullish analysts are even anticipating a further spike, with a 29% possibility of Bitcoin rising to $5,400. The strong performance of the flagship altcoin suggests a growing confidence that it is preparing for a major jump that could cement its position as a key player in the global financial landscape. This bullish sentiment is not limited to Ethereum but is spilling over into the rest of the market.

The renewed interest in altcoins and the potential for a new bull run are being closely monitored by traders and investors, who are positioning themselves to capitalize on the potential for significant gains across the board. This trend indicates a maturing market where investors are looking beyond just Bitcoin for a diversified portfolio.

How the Fed’s Policy Validates Crypto

This entire rally is underpinned by the anticipation of a more accommodating monetary policy from the U.S. Federal Reserve. The signal from Chairman Powell has created growing optimism among investors, as the potential for rate cuts could lead to increased liquidity flowing into the crypto market. When the Federal Reserve engages in policies that increase the money supply, like quantitative easing or rate cuts, it can lead to a devaluation of the dollar.

In such a scenario, investors often seek alternative stores of value, and digital assets like Ethereum are seen as an attractive option. This macroeconomic backdrop is a crucial driver for the current market rally, as it changes the risk-reward calculation for a wide range of investors and further validates the role of cryptocurrencies in the global financial system.

Recommended Article: Solana and Ethereum Explored for Digital Euro