SharpLink Gaming’s Ambitious $200 Million Raise

SharpLink Gaming (SBET), a prominent online gambling marketing firm, is making a major move to expand its Ethereum treasury. The company announced its plan to raise approximately $200 million through an agreement to sell common stock to four institutional investors at a price of $19.50 per share. This significant capital raise is expected to close on August 8, pending the fulfilment of closing conditions.

The deal brings SharpLink closer to its ambitious goal of holding 1% of all Ethereum in circulation, a strategy that is part of a broader trend of public companies pivoting to corporate strategies focused on accumulating massive amounts of cryptocurrencies. This aggressive approach, inspired by firms like Strategy, positions SharpLink as a key player in the evolving landscape of corporate crypto treasuries and a strong bullish force for the Ethereum ecosystem.

A Growing Trend in Corporate Crypto Strategies

SharpLink’s latest move is part of a significant and growing trend where public companies are adopting corporate strategies focused on accumulating massive amounts of cryptocurrencies. This shift, which has gained momentum over the past year, has seen the emergence of several Ethereum treasury firms. These companies are recognising the value of holding digital assets on their balance sheets, not just as speculative investments but as strategic reserves.

This trend has been a major factor in catapulting Ethereum to its highest price in roughly two years. The rise of these corporate treasuries as a new class of investors provides a consistent source of demand for cryptocurrencies, contributing to market stability and long-term price appreciation. SharpLink’s decision to actively pursue this strategy, backed by institutional investors, further validates this trend and signals a maturing market where digital assets are becoming an integral part of corporate finance.

SharpLink’s Treasury and Market Performance

As of August 3, SharpLink Gaming’s treasury held an impressive 521,939 ETH, with a total value of $1.9 billion. The company initiated its Ethereum-accumulation strategy in June of this year, and its rapid accumulation has quickly placed it among the world’s largest corporate Ethereum treasuries. This aggressive accumulation, led by co-CEO Joseph Chalom, reflects a strong conviction in Ethereum’s long-term potential.

This financial commitment and strategy have been met with a positive market reaction, with SBET shares rising 5.51% following the news. The stock’s performance highlights how investors are responding favourably to companies that are actively building a crypto treasury and aligning their growth with the digital asset economy.

Betting on the Future of Ethereum

The crypto community is watching closely to see if SharpLink Gaming will meet or exceed its benchmark of accumulating one million ETH tokens by mid-September. This goal has become a point of interest, with betting platforms like Myriad Markets showing that 55% of bettors have wagered that SharpLink will not achieve this target. Regardless of the outcome of this specific benchmark, the company already boasts one of the world’s largest Ethereum treasuries.

For context, the largest ETH treasury firm is the Peter Thiel-backed BitMine Immersion, which holds roughly $2.9 billion in ETH. SharpLink’s determined pursuit of its treasury goal demonstrates its long-term vision for the asset and its commitment to becoming a dominant player in the Ethereum ecosystem.

The Broader Context of Crypto Market Catalysts

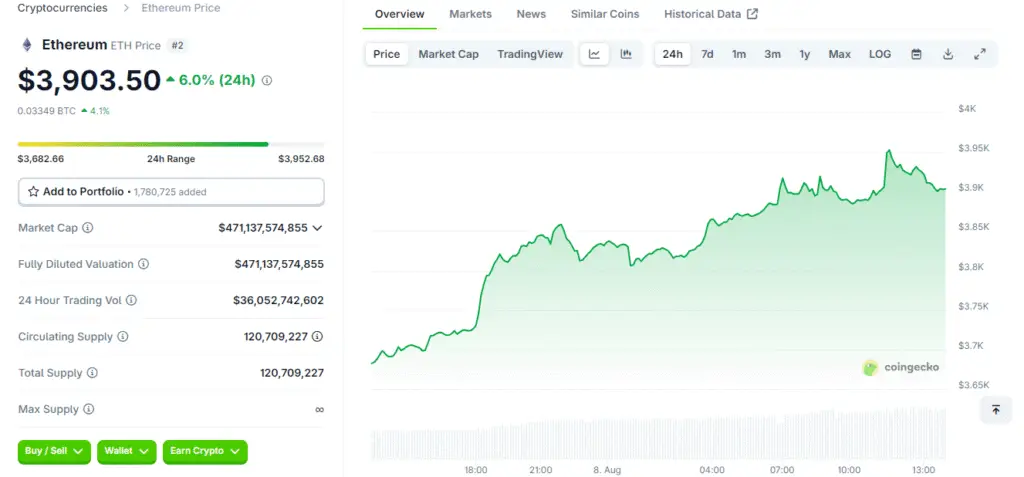

SharpLink’s strategic raise comes at a time of renewed bullish sentiment in the broader crypto market. The news of its raise coincided with Bitcoin ETFs snapping a four-day outflow streak, pulling in $91.6 million in new capital. This broader market strength provides a favourable backdrop for SharpLink’s treasury accumulation and its overall growth strategy. Furthermore, Ethereum was recently trading at $3,812, just 22% below its record price of $4,878 from the 2021 bull run, according to data provider CoinGecko.

This strong price performance and renewed institutional interest, as seen with ETF inflows, create a powerful upward momentum for Ethereum. SharpLink is perfectly positioned to capitalise on this trend, using its newly raised capital to acquire ETH at a time when the market is showing significant strength and potential for further growth. The confluence of these factors a new wave of institutional capital, a bullish market, and a dedicated treasury firm paints a compelling picture for the future of Ethereum.

Why SharpLink Is a Standout Investment

For investors, SharpLink offers a unique opportunity to gain exposure to the growth of the Ethereum ecosystem through a publicly traded company. By investing in SBET, investors are not just betting on the price of ETH but also on the company’s ability to successfully execute its treasury strategy, which includes potential opportunities for staking and DeFi integration. The company’s commitment to holding 1% of all ETH in circulation, backed by a strategic $200 million raise from institutional investors, makes it a compelling investment opportunity.

This blend of traditional equity investment with direct exposure to a rapidly growing digital asset positions SharpLink as a leader in the evolving financial landscape. The company’s mission to be the “world’s leading ETH treasury” is not just a statement of intent but a strategic plan backed by capital, partnerships, and a clear vision for growth, making it a standout choice for forward-thinking investors.

Read More: Ethereum Price Warning Signs: Sell-Pressure Hits Historic Highs