Ethereum’s Price Swings Complicate Payroll for Asian Businesses

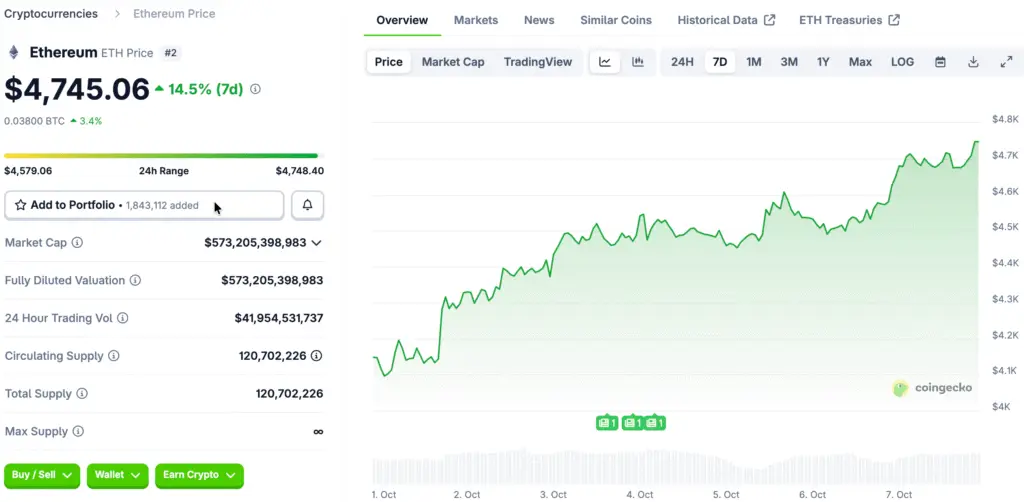

The price of Ethereum has experienced significant volatility in recent weeks, posing considerable challenges for businesses investigating crypto payroll solutions. Daily fluctuations surpassing 10% can disrupt salary computations, tax documentation, and currency exchanges.

In Asia, where payroll systems are already navigating intricate regulations, these abrupt changes introduce an additional layer of operational risk. Companies disbursing salaries in Ethereum need to strategically handle the timing of conversions to prevent unforeseen losses on payday.

Regulatory Complexity Adds Further Payroll Challenges

Throughout Asia, the landscape of crypto payroll regulations is marked by fragmentation and complexity, making it challenging to navigate. Countries implement rigorous anti-money laundering (AML) and know-your-customer (KYC) frameworks that vary significantly across different jurisdictions.

The absence of harmonization compels companies to constantly adjust their policies to steer clear of penalties. Regulatory uncertainty discourages larger organizations from embracing crypto payroll solutions, particularly during times of volatility in Ethereum’s price.

Stablecoins Offer Predictable Payroll Alternatives

In response to market fluctuations, numerous companies are increasingly adopting stablecoins such as USDT and USDC, which are linked to traditional fiat currencies. A hybrid payment model that integrates fiat, stablecoins, and Ethereum contributes to consistent payroll stability.

More and more employees are opting for consistent segments of their paychecks in stablecoins, while also appreciating the chance to receive a portion of their earnings in ETH for potential gains. This method harmonizes creativity with economic stability.

Recommended Article: Ethereum Eyes $6K as Institutional Demand Grows

Innovations in Crypto Payroll Led by Fintech Startups

Innovative startups in the fintech sector are at the forefront of implementing cryptocurrency payroll solutions tailored for Asian markets. Smart contracts are utilized to automate payments, minimizing errors and delays in cross-border transactions.

Implementing extra measures like circuit breakers, diversification strategies, banking partnerships, and meticulous record-keeping strengthens resilience. Programs focused on educating employees about wallet security and payment structures enhance confidence in these systems.

Younger Workforces Accelerate the Shift Toward Crypto Salaries

Across Asia, younger generations are showing a growing preference for receiving their salaries in digital assets, especially stablecoins. Startups and decentralized autonomous organizations (DAOs) are rapidly responding to this demand by providing cryptocurrency payroll solutions.

The rise of stablecoins, now representing more than 90% of digital salaries worldwide, indicates a significant change in payroll systems. This shift is propelled by changing workforce expectations and the advancement of blockchain technology.

Ethereum Ecosystem Evolves Alongside Payroll Innovation

Ethereum continues to play a crucial role in the crypto payroll sector, even amidst the challenges of volatility. The capabilities of its smart contracts drive numerous automated payment systems and decentralized payroll solutions.

With advancements in network upgrades enhancing scalability and lowering fees, companies might discover Ethereum to be a more viable option for their compensation frameworks. Nonetheless, stablecoins offer the crucial stability needed for payroll operations.

Asia Payroll Systems Evolve With Ethereum Integration and Stablecoin Standardization

The integration of Ethereum’s technological framework, the reliability of stablecoins, and advancements in fintech are transforming payroll systems throughout Asia. Organizations are discovering how to harmonize adherence to regulations with adaptable payment solutions.

With the evolution of regulatory frameworks and the growing adoption of stablecoins, it is anticipated that strategies for crypto payroll will increasingly become standardized. This development has the potential to position Asia as a frontrunner in the transformation of digital payroll systems.