Floki Breaks Consolidation With 23% Surge and Strong Accumulation Momentum

Floki has experienced a remarkable increase of over 23% recently, breaking through a prolonged consolidation phase and sparking fresh excitement among active traders worldwide. The token surged past the $0.00010 resistance level with impressive volume, indicating a significant change in sentiment following weeks of stagnant movement.

Analyst Erick Crypto notes that the breakout was driven by ongoing accumulation and heightened confidence from both retail and whale investors. The current momentum is directing attention to the $0.00015 target, a historically important level that has played a crucial role in defining trend continuation during past upward rallies.

Significant Resistance Zone Near $0.000123 Feeling the Heat

Analyst CW points out a significant sell wall emerging between $0.000102 and $0.000123, consistently thwarting previous bullish efforts in the past. This area serves as a critical barrier for FLOKI, where sellers have repeatedly asserted control during previous surges, stifling upward movement.

CW noted that the recent rally has been supported by robust buying volume, indicating heightened market activity at the current resistance levels. If renewed buying pressure can decisively break through this sell wall, FLOKI may quickly push its gains toward upper target areas around $0.00015.

FLOKI’s Breakout Gains Momentum with Surging $440M Trading Volume

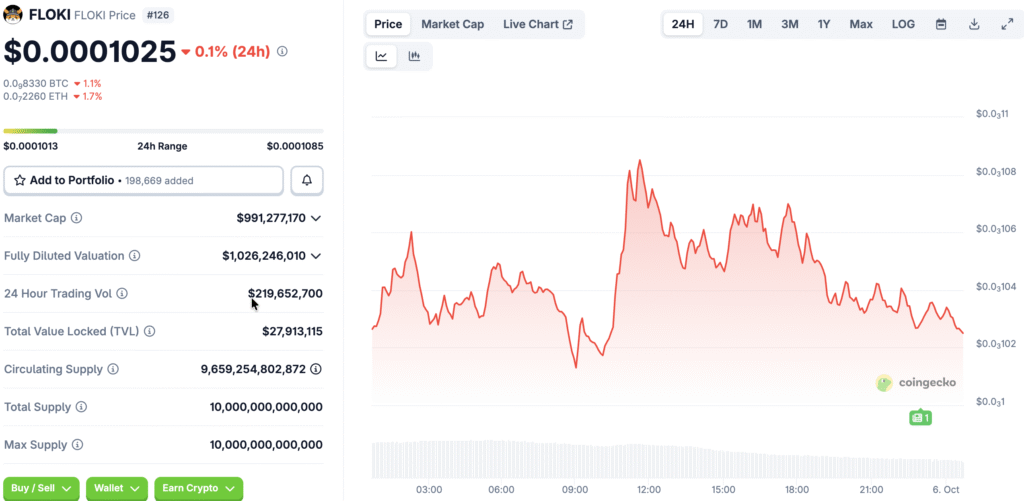

FLOKI’s trading volume exceeded $440 million within a 24-hour period, strengthening bullish momentum and confirming the breakout as demand keeps rising. The price surged from $0.000085 to more than $0.000107 within just one day, bolstered by steady morning accumulation and vigorous follow-through.

Intraday charts reveal that traders are ramping up their exposure during the breakout phase, suggesting a growing confidence in the durability of the recent strength. Minor pullbacks later in the session did not diminish the gains, indicating a robust presence of buyers and a solid defense around the breakout levels.

Recommended Article: FLOKI Price Analysis: Bearish Momentum vs. Strong Long-Term Trend

Consolidation Patterns Suggest a Potential Upward Movement Ahead

The historical behavior of FLOKI prices indicates patterns of consolidation near mid-range resistance, often preceding significant rallies, which suggests a strong potential for bullish continuation. The current chart patterns reflect these accumulation setups, with $0.00012 appearing to be a probable staging point for an imminent upward movement.

If the price holds steady around this midline prior to overcoming resistance, bulls could build momentum for a prolonged rally towards the $0.00015 resistance level. Inadequate consolidation may lead to a retreat to $0.00009, providing bulls with an opportunity to gather momentum prior to challenging previous peaks.

FLOKI Builds Strong Support at $0.00010 for Next Rally

The $0.00010 level, once a significant barrier, has now transformed into a dependable support, providing bulls with an essential base for future advancements. Experts highlight that preserving this support is crucial for keeping FLOKI’s bullish framework intact during the forthcoming consolidation periods.

Market participants are paying close attention to price movements in this region, as any declines into this zone could entice fresh buying interest from short-term traders. Maintaining this level keeps FLOKI ready for a rapid upward movement as soon as the existing resistance cluster is overcome.

Market Participants Monitor Sell Wall Response as Upcoming Trigger

The sell wall at $0.000102 acts as the immediate market catalyst, with volume and order book dynamics playing a crucial role in determining whether a breakout or rejection occurs. Should the bulls break through decisively with increased volume, the rally may gain momentum rapidly, targeting the $0.00015 and possibly the $0.00020 levels.

Nonetheless, ongoing rejection at this level could prompt profit-taking and a short-term pullback, resulting in a brief consolidation around $0.00010. In either case, this resistance cluster is central to FLOKI’s short-term path, as market sentiment continues to be very optimistic.

FLOKI Rejections Could Offer Fresh Entries While Structure Stays Bullish

The recent 23% surge in FLOKI, coupled with increasing volume and a breakout above significant resistance levels, underscores a resurgence of investor confidence and robust technical momentum at this time. The bulls are now confronted with the significant $0.000102 barrier, a pivotal point that could dictate whether FLOKI continues its upward momentum or takes a brief pause.

If the bullish forces continue to exert pressure and successfully breach resistance, targets around $0.00015 become achievable within the ongoing momentum cycle. On the other hand, any rejection may present fresh entry points near support, maintaining FLOKI’s overall structure for potential future rallies.