The Catalyst for Grayscale’s Strategic Move

The cryptocurrency market is at an inflection point, with major asset management firms like Grayscale Investments making strategic moves that could have profound long-term effects. Grayscale’s application for an XRP Trust ETF is a calculated maneuver that comes at a highly opportune time. It is not an isolated event but part of a broader trend where heavyweight financial players, including CoinShares and WisdomTree, are seeking to solidify their stake in the digital asset space.

This coordinated effort highlights a significant and accelerating migration toward the mainstream acceptance of cryptocurrencies. Historically, favorable regulatory decisions have often served as powerful catalysts for explosive growth in assets like Bitcoin and Ethereum. With the current fervor surrounding XRP, the stakes are exceptionally high as these financial titans vie to capture burgeoning institutional interest. The filing itself is a testament to the belief that XRP, following a period of legal uncertainty, is now ready for a new level of institutional engagement.

How the Ripple Lawsuit Dismissal Boosted Confidence

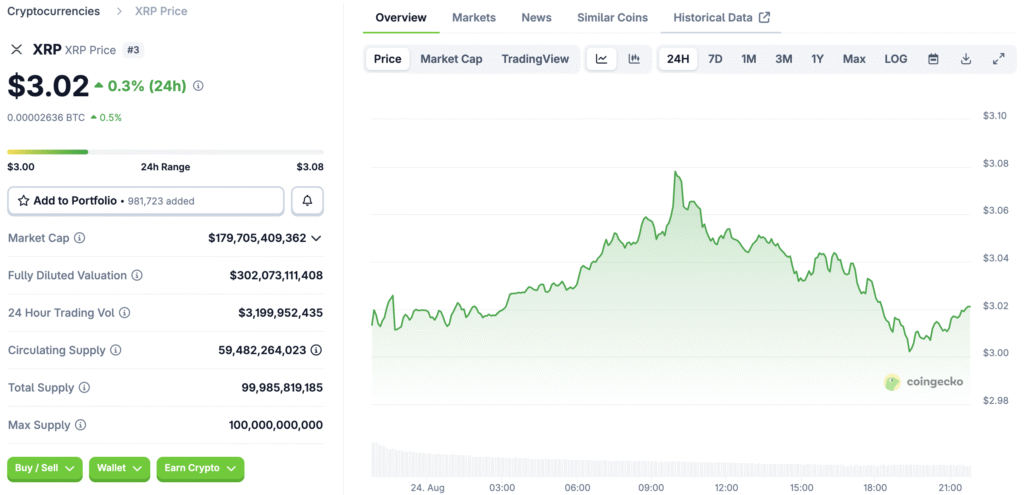

The SEC’s dismissal of Ripple’s lawsuit has sparked increased institutional interest in XRP, paving the way for new ETF proposals. The decision removes a significant regulatory cloud over XRP, making it more attractive for risk-averse investors. XRP’s price surged significantly following the ruling, reflecting investors’ desire for regulatory certainty and expanded investment products.

This increased interest in XRP indicates its potential to shape cryptocurrency liquidity and market engagement. The legal resolution has de-risked the asset for many large-scale financial players.

The Projected Impact on XRP’s Price Valuation

Should the SEC grant its stamp of approval for the XRP Trust ETF, the consequences for XRP could be transformative. The validation of ETFs for other major asset categories has historically led to substantial upward price movements, and analysts anticipate a similar trend for XRP. The approval would open the door for a wave of institutional capital to flow more freely into XRP.

This heightened demand may not only stabilize its market positioning but also promote broader acceptance of digital currencies within diversified investment portfolios. The sheer scale of potential investment inflows is projected to be in the billions of dollars, a volume that could trigger an explosive surge in XRP’s price. This institutional embrace would also lend greater legitimacy to the asset, making it a more appealing choice for both retail and professional investors.

Grayscale’s Response to Market Demand

The institutional investment landscape is evolving rapidly, with firms increasingly looking beyond Bitcoin and Ethereum to explore other digital assets with high potential. The filing for an XRP ETF signals a maturing market where institutions are no longer confined to the top two cryptocurrencies. This broadening of investment horizons is a bullish sign for the entire digital asset ecosystem, as it indicates a growing understanding and acceptance of the unique value propositions of other projects.

The institutional appetite for a regulated, accessible product like an ETF is immense, as it allows them to gain exposure to an asset without the complexities of direct ownership, such as custody and security. Grayscale’s move is a clear response to this demand, positioning them to capture a significant portion of this emerging market.

Navigating Compliance Challenges for Web3 Startups

While the prospect of an XRP ETF is promising for investors and the broader market, it is crucial for Web3 startups to remain vigilant in the face of the compliance challenges that accompany such rapid regulatory evolution. The approval of institutional ETFs could open lucrative new avenues for these young companies, but it also means that the regulatory environment will become more complex and demanding.

Startups must be well-prepared to tackle these complexities by establishing solid compliance frameworks from the outset. This will enable them to scale effectively while integrating seamlessly into an ever-changing financial ecosystem. The new era of institutional involvement will require a higher standard of operational and legal rigor, and only those startups that are prepared to meet these challenges will be able to thrive.

How the SEC Could Redefine XRP’s Future

As the cryptocurrency domain undergoes continuous metamorphosis, Grayscale’s application for the XRP Trust ETF stands as a testament to the rising tidal wave of institutional interest. The potential repercussions of these ETF proposals could signify a maturing market, one that is poised to redefine investment paradigms and bolster institutional legitimacy.

For investors, it is imperative to remain vigilant regarding shifts in regulatory climates and market trends. The road ahead for XRP is likely to be defined by a series of key milestones, including the SEC’s decision on the ETF application and the subsequent reaction of institutional capital. A successful launch would not only increase XRP’s price but also accelerate its broader adoption for payments and other use cases.

Grayscale’s XRP ETF: A Critical Inflection Point

Grayscale’s filing for the XRP ETF marks a critical inflection point in the crypto space. It is fueled by a renewed institutional appetite for XRP, which has been revitalized by the favorable ruling in the Ripple litigation. As the regulatory terrain shifts, the anticipated approval of the ETF could trigger an explosive surge in XRP prices, heralding a new era of institutional involvement in the crypto landscape.

For investors and startups alike, it is crucial to grasp these emerging dynamics and their implications, as the developments surrounding the XRP ETF could very well ignite a renaissance of funding opportunities in the digital asset realm. This signals a new chapter where traditional finance and decentralized technology are becoming increasingly intertwined.

Read More: XRP Price Rally After Historic Court Victory