The HYPE and SUI Selloff Explained

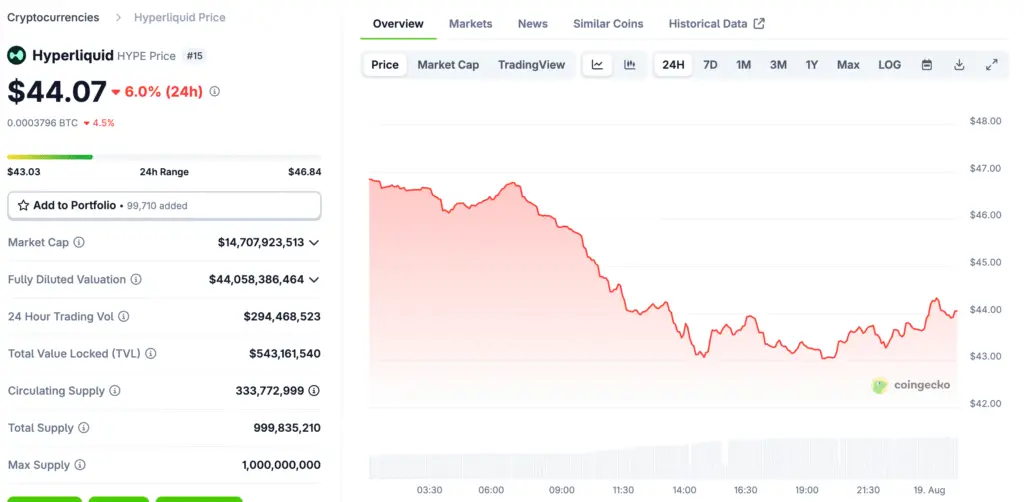

The cryptocurrency market, known for its rapid and often brutal volatility, has once again demonstrated its unpredictable nature with a sharp sell-off that saw major altcoins lose significant value. At the forefront of this decline were Hyperliquid (HYPE) and Sui (SUI), which plummeted by 8.7% and 7.3%, respectively. This was a direct result of Bitcoin’s correction from its recent highs of over $118,000 down to $115,000. While a Bitcoin price dip might seem minor on the surface, it often acts as a domino, triggering a chain reaction across the broader altcoin market.

Analysts at Nansen noted that this looks like a “natural pullback” amplified by liquidations, which are especially impactful on altcoins due to their smaller market capitalisation and higher volatility compared to Bitcoin and Ethereum. When the market’s leading asset corrects, traders on more speculative altcoins are often the first to feel the pain, leading to cascading sell-offs as positions are closed to meet margin calls.

Bitcoin’s Domino Effect on Altcoins

The recent Bitcoin correction from its record highs served as the primary catalyst for the widespread altcoin losses. Bitcoin’s market dominance and its role as a leading indicator mean that its movements have a disproportionate impact on other digital assets. When Bitcoin experiences a strong rally, altcoins often follow, sometimes with even greater percentage gains. Conversely, when Bitcoin corrects, altcoins typically suffer from more severe losses.

This phenomenon is vividly demonstrated by the latest market action, where Bitcoin’s 2.68% dip set off a chain reaction that resulted in far steeper declines for tokens like HYPE, SUI, Solana, and Cardano. The correlation between Bitcoin and altcoin performance is a critical factor for traders to monitor, as it highlights the inherent risk in holding more speculative assets during periods of market uncertainty.

Ethereum’s Critical Price Level at Risk

While HYPE and SUI led the altcoin losses, Ethereum’s performance was equally telling. The second-largest cryptocurrency by market cap dipped under the crucial $4,300 support level, shedding 5.4% of its value. According to analysts, Ethereum’s ability to hold support near $4,150 is vital. A breakdown below this level could trigger further cascading liquidations, with downside targets in the $3.9k to $3.6k range.

The market’s reaction to this key support level will be a significant indicator of its short-term direction. If Ethereum can consolidate and hold above this zone, it may signal that the market is ready to resume its advance. However, a failure to do so could lead to a deeper and more prolonged correction for the entire market, with altcoins especially HYPE and SUI, likely to remain relatively weaker.

Unpacking the Broader Economic Context

The timing of this sell-off is not a coincidence, as it occurred ahead of the highly anticipated Jackson Hole Economic Symposium. This annual meeting of global central bankers and policymakers, including Federal Reserve Chair Jerome Powell, is known for setting the tone for future monetary policy. Analysts from QCP Capital suggested that the “washout” in the crypto market could reflect traders de-risking their portfolios in anticipation of Powell’s speech.

The market is particularly sensitive to any hints about interest rate cuts or changes in monetary policy, as these can directly impact liquidity and risk appetite. Higher-than-expected Producer Price Index (PPI) data also played a role, forcing markets to scale back expectations for a September rate cut and adding to the cautious sentiment.

The Role of Funding Rates and On-Chain Data

On-chain data provided early warning signs of the impending market volatility. Analysts noted that Bitcoin funding rates, which reflect the cost of holding a long position, had been “warning of trouble.” Negative funding rates can indicate that traders are becoming less bullish and are paying to short the asset, which often precedes a price drop. The selloff was also amplified by a massive wave of liquidations.

Data from CoinGlass showed that over $487 million in long positions were wiped out in the recent downturn, with a significant portion coming from Ethereum alone. This kind of liquidation cascade is a common feature of crypto market corrections and can exacerbate price movements, leading to a much steeper decline than would be expected from the initial price action alone.

Analyst Sentiment and the Corrective Pullback

Despite the significant price drops, many analysts are not yet panicking. They are referring to the market move as a “corrective pullback within an uptrend.” This view suggests that the recent decline is a healthy and natural part of a bull market cycle, where overextended assets shed some of their gains before resuming their upward trajectory. Historical data supports this perspective, with Bitcoin and other major cryptocurrencies experiencing multiple significant corrections during previous bull runs.

These pullbacks often present strategic buying opportunities for long-term investors. However, there is a clear warning that if key support levels are not held, this “corrective pullback” could transition into a more severe and prolonged market downturn, especially for the more volatile altcoin sector.

The Fed’s Impact on HYPE and SUI’s Price

The coming days will be critical for HYPE and the entire crypto market. All eyes are on the Jackson Hole symposium, with traders waiting to see how Federal Reserve Chair Jerome Powell’s remarks will influence sentiment. A dovish tone could signal renewed confidence and a potential rally, while a hawkish stance could push prices lower. For tokens like HYPE and SUI, their performance will heavily depend on whether Bitcoin and Ethereum can find stable footing.

If the market’s leading assets manage to rebound, HYPE and other altcoins could follow suit. However, if the bearish momentum continues, these tokens are likely to remain particularly vulnerable. Investors should remain vigilant, monitor key macroeconomic events, and be prepared for continued volatility as the market seeks a new direction.

Read More: Hyperliquid’s Native USDC Support: Boosting DeFi Efficiency and Security