Hyperliquid Holds Firm Above Support Level as Momentum Slowly Increases

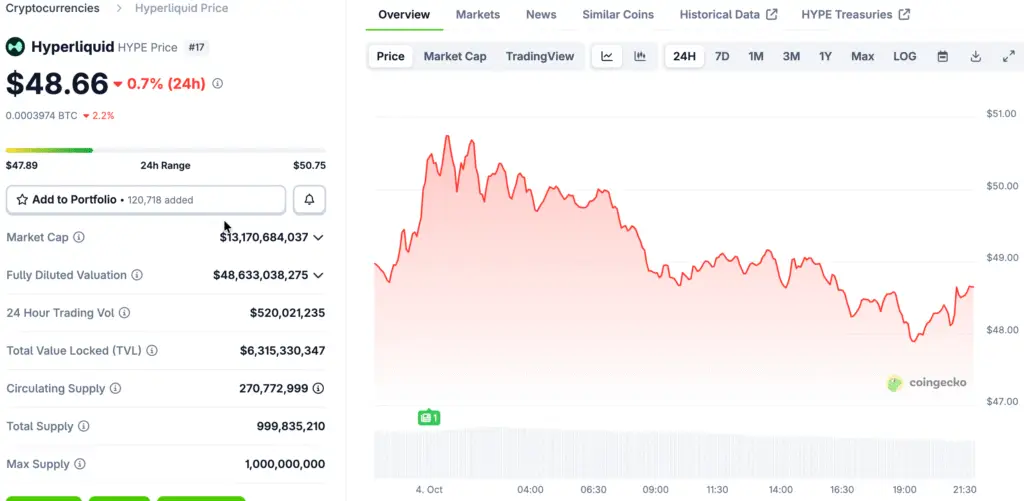

Hyperliquid remains stable around $48.66, showcasing robust buying interest even as competitive market pressures have recently intensified. This consolidation zone has become a key area where traders gather positions, expecting a continuation of bullish momentum.

The token’s capacity to maintain its gains with minimal volatility strengthens the community’s trust in its potential for a medium-term breakout. Increasing liquidity, along with robust trading activity, enhances overall sentiment and consistently aligns technical setups with favorable fundamental trends.

Community Anchors Near $60 Target As Technical Structure Gradually Tightens

The prevailing sentiment within the community is gravitating towards the $60 mark, widely regarded as a reasonable valuation for Hyperliquid’s present course. The price movement has reliably formed higher lows after earlier corrections, creating a solid base for possible recoveries.

The harmony between optimistic community sentiments and enhancing technical patterns frequently boosts momentum when market conditions align clearly. If the resistance around the mid-$50 area is breached with significant volume, the $60 target could swiftly shift from a mere idea to a tangible outcome.

Fee Revenue Demonstrates Resilience Amid Intensifying Competition From Rivals

Hyperliquid is currently generating around $3 million daily in fees, demonstrating its capacity to endure increasing competitive challenges. This steady flow of income creates a dependable financial foundation that bolsters ecosystem stability while enhancing investor confidence at the same time.

Market analysts predict that forthcoming mechanisms could elevate daily fees past $10 million, fundamentally altering the competitive landscape. Such developments would greatly enhance Hyperliquid’s standing in decentralized finance markets while effectively deterring aggressive moves from competitors.

Recommended Article: Hyperliquid Price Eyes $60 Rally Fueled by Market Momentum

Key Technical Levels Provide Crucial Context for Breakout or Breakdown Scenarios

The $42 support continues to be a crucial structural level that consistently supports bullish sentiment in the ongoing trading activity. The upward alignment of moving averages indicates a positive trend, and the RSI readings suggest there is still ample opportunity for further bullish momentum.

Attention is focused on breakout levels between $44 and $49, as sustained closes in this range could reveal substantial upside potential. The inability to maintain the $42 level may lead to heightened volatility; however, the prevailing sentiment remains optimistic as long as the structural support zones remain intact.

Hyperliquid Buybacks and Staking Create Strong Feedback Loop for Price

Currently, more than 660,000 HYPE tokens, valued at around $30 million, are staked, showcasing a robust commitment from the community as a whole. Methodical buybacks strengthen these staking dynamics, decreasing available supply and constricting market float in times of volatility.

The interplay between staking accumulation and buyback initiatives fosters a robust feedback loop that underpins ongoing price stability. The reduced number of tokens in circulation boosts the impact of each rally effort, allowing for more powerful responses when positive catalysts come together.

Consolidation Patterns Strengthen Technical Structure Around Critical Breakout Levels

Recent charts indicate a consolidation phase above $45, with the $46.1 block serving as essential structural support for Hyperliquid at this time. The consistent defenses at this level indicate strong buyer involvement, suggesting a belief in forthcoming breakout efforts aimed at reaching higher ranges.

A breakout above $49 would likely lead to a significantly bullish sentiment, paving the way toward the resistance area of $52–$55. A decline of $46.1 could lead to pullbacks towards the $44 support level, potentially postponing the bullish continuation patterns that are currently developing.

Hyperliquid Staking Strength and Fees Underscore Technical Resilience

The interplay of staking dynamics, technical resilience, and increasing fees highlights Hyperliquid’s robust standing in the face of challenges. Breakouts above $49 are crucial, as they confirm bullish perspectives and significantly open up new opportunities for price discovery.

On the other hand, not maintaining essential supports could lead to temporary challenges, even though the overall framework continues to be positively aligned. Market participants are keeping a keen eye on the $46–$49 range, as the responses observed in this area are expected to influence Hyperliquid’s forthcoming significant market direction.