Hyperliquid Demand Must Offset New Supply to Maintain Price Stability

Hyperliquid is set to encounter $500M in token unlocks each month starting in November, which could greatly impact short-term price stability. Buybacks are anticipated to address only a portion of this new supply, leading to worries about the ability of demand to keep pace with issuance adequately.

Arthur Hayes observed that this imbalance could lead to a temporary sense of caution, particularly if the inflows fail to counterbalance the selling pressure from newly released tokens. Nonetheless, seasoned traders highlight that significant unlocks do not necessarily disrupt fundamentally bullish markets as long as liquidity remains consistently robust.

Deep Liquidity Could Absorb Incoming Selling Pressure

Hyperliquid enjoys strong market depth, having effectively handled similar sell-side events in the past without causing major breakdowns. If trading activity increases in tandem with new issuance, the system may accommodate more tokens without completely disrupting the overall upward trend.

The result hinges on the volume of inflows aligning with unlock schedules, enabling effective distribution of supply into robust bid zones across the board. Market participants are intently observing November’s performance to determine if structural demand continues to be strong enough to offset the increased circulation of tokens.

Hyperliquid Could Regain Trader Flows If Aster Momentum Cools Down

Analyst Dai noted that Aster recently achieved $90B in 24-hour perpetual volume, while Hyperliquid recorded $10B, highlighting a swift change in trader preferences. Competitive surges like these can shift market dynamics, putting Hyperliquid’s dominance to the test and challenging its capacity to effectively maintain institutional capital.

Nonetheless, Hyperliquid’s impressive $270B in 30-day volume demonstrates its continued significance as a vital secondary venue in the current perpetual futures ecosystem. If Aster’s momentum slows down, traders might shift their investments back to Hyperliquid, bolstering both liquidity and market activity during key moments.

Recommended Article: Hyperliquid Price Eyes $60 Rally Fueled by Market Momentum

Channel Structure Supports Gradual Recovery Narrative

The price remains within an ascending parallel channel, with recent pullbacks consistently bouncing off mid-range supports, clearly maintaining its structure. Carrix’s charting indicates that bulls are consistently protecting lower boundaries, suggesting significant interest from trend-following participants during periods of retracement.

If this pattern continues, targets around $55 may become attainable as the price gradually moves back toward the upper boundary of the channel. This pattern showcases resilience in the face of unlock concerns, indicating that traders continue to perceive HYPE’s structure as solid within medium-term bullish scenarios.

Hyperliquid Neutral Momentum Leaves Room for Bullish Moves on Demand

Hyperliquid is nearing a critical resistance zone between $51 and $52, having previously turned away several breakout efforts during earlier rallies. A clear breakout above this zone may lead to bullish targets around $55 and eventually $60, aligning closely with the upper channel projection.

On the other hand, ongoing rejections could pull the price down to its $46 base, solidifying range-bound conditions and considerably postponing any bullish continuation patterns. The current momentum indicators are showing a neutral stance, which allows for potential upward movements if demand increases significantly near resistance levels in the sessions ahead.

Price Levels Offer Clear Short-Term Trading Compass

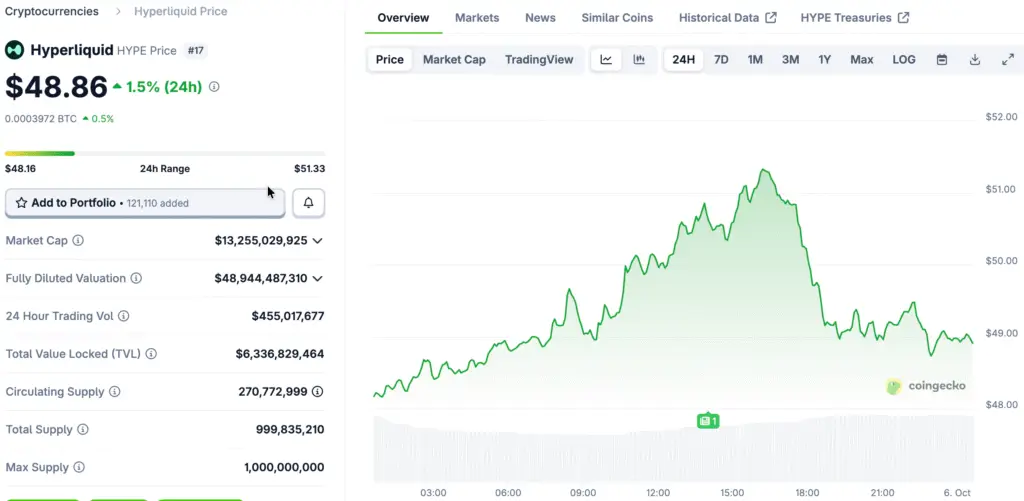

HYPE is currently trading at approximately $49.03, with a daily trading volume of about $393 million. It is maintaining a position between strong support levels of $46 to $47 and facing a significant resistance level at $52. Bulls have consistently defended lower boundaries, sustaining a positive outlook as long as price action remains above the $50 pivot levels.

A consistent hold above $52 would validate bullish breakout conditions, likely leading to swift movements toward the $55–$60 target ranges shortly thereafter. A decline of $50 might reveal lower support levels, which could hinder momentum and raise the chances of prolonged consolidation instead of a swift continuation.

Hyperliquid Structure Favors Bulls If Support Holds Through November

Hyperliquid finds itself at a crucial crossroads, navigating impending token unlocks while maintaining robust technical frameworks and strong liquidity foundations across the board. The $50–$52 resistance zone stands as a crucial decision point for the market, likely influencing whether buyers can successfully push rallies toward $60.

Should volume increase and resistance be overcome, Hyperliquid’s optimistic channel configuration may lead to an additional upward movement prior to the supply event in November. If resistance isn’t cleared, the price may remain confined within a range; however, the overall structure still leans towards buyers, provided that support remains strong.