Hyperliquid Displays Initial Indicators of Recovery Momentum

Hyperliquid (HYPE) is making a comeback after facing a significant 46% decline, successfully regaining the important $44 support level. The project’s core elements are increasingly solid, bolstered by heightened user participation and an influx of liquidity on the rise. This recovery signifies a shift from a phase of consolidation to the possibility of expansion, as traders prepare for a resurgence in upward movement.

The ongoing recovery phase comes after several weeks of market volatility. HYPE is currently trading around $45, showing signs of stability as investor sentiment begins to recover. Experts suggest that this rebound may pave the way for a prolonged recovery towards elevated resistance levels, provided the momentum is maintained.

Fundamentals Strengthen With $305M Strategic Buybacks

Arete Capital’s 2025 valuation report indicates that HYPE’s annualized revenue may hit $1.87B by FY26, showcasing a projected growth rate of 65%. The anticipated growth is projected to arise from the Builder Codes, HyperCore, and HIP-3 markets, each playing a role in the development of the network’s financial ecosystem.

The team has earmarked $305M for buybacks and ecosystem initiatives, which has effectively lowered the liquid supply to approximately 220M tokens. This intentional decrease establishes a constricted supply situation that could intensify future price fluctuations should demand persist in its upward trajectory.

User Growth Accelerates Alongside Rising On-Chain Activity

Recent on-chain metrics indicate unprecedented levels of user engagement. Since mid-September, there has been a notable increase in daily active users and new accounts, while transaction throughput has maintained a steady pace across various markets. The recent uptick corresponds with enhanced liquidity and greater involvement in exchanges.

Experts observe that this rapid growth reflects genuine network development instead of mere speculative spikes. This data lays a solid groundwork for optimism in the long run, despite the short-term fluctuations anticipated from token unlock events scheduled for November.

Recommended Article: Hyperliquid Calls Out Binance Amid $19B Liquidation Debate

Technical Structure Supports Continuation Setup

Following the recovery of the $44 mark, Hyperliquid has set a new foundation on a higher timeframe. The recent price movement indicates initial strength after a liquidity sweep beneath prior lows, which is frequently viewed as a bullish reversal signal, especially when supported by heightened spot buying activity.

Experts in technical analysis point to the range of $48 to $52 as the upcoming key confirmation zone. A consistent close above this area could potentially ignite additional momentum, aiming for the $60 to $65 range, which corresponds with resistance levels observed in late Q2 trading patterns.

Hyperliquid Strengthens Recovery Outlook While Staying Above Key Averages

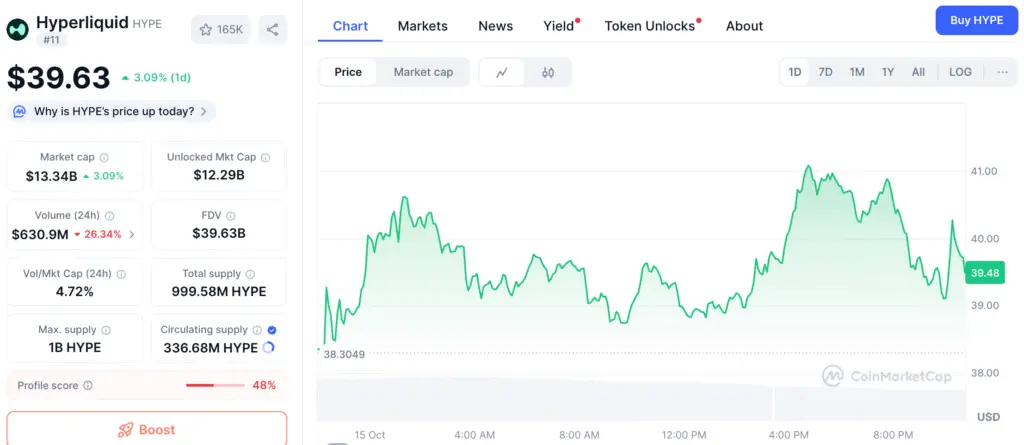

Momentum is steadily increasing as HYPE’s price remains above its 200-day moving average and exponential moving average, currently situated between $38 and $40. The averages serve as fluid support zones, fostering a positive outlook as the wider market finds its footing.

Provided that Hyperliquid stays above these moving averages, the technical perspective supports the continuation of recovery. A rise beyond the $48 to $50 range would indicate a shift in the trend and could mark the beginning of a new upward movement.

Sentiment and Liquidity Flows Bolster Market Confidence

Recent liquidity metrics indicate a steady accumulation of spot positions on major exchanges, as larger investors bolster their holdings in response to the resurgence of retail traders. This enhanced involvement bolsters overall stability and supports enduring optimism.

Rushi, an analyst, has forecasted a possible year-end price target of $200, highlighting Hyperliquid’s robust revenue prospects, diminished float, and extensive ecosystem integration. These forecasts, though ambitious, capture the excitement fueling the growth of the project’s investor base.

Hyperliquid Recovery Strengthens With User Growth and Tightening Supply

The current recovery phase for Hyperliquid is dependent on maintaining support in the $44 to $45 range while also striving to break through the upper resistance around $50. A confirmed breakout may pave the way to $60 and $65, indicating a resurgence of market confidence.

Amid increasing user metrics, constricting supply, and evident accumulation patterns, HYPE seems ready for a significant upward shift. If the current momentum continues into Q4, Hyperliquid may position itself as a notable recovery option within the wider cryptocurrency landscape.