Hayes Sparks Selloff With Big HYPE Sale

This week, Arthur Hayes made headlines by selling more than 96,000 HYPE tokens for $4.8 million. Reports confirmed that the sale took place on Sunday, just after he publicly promoted the project. This sudden change made investors uneasy and made them wonder what his real plans were for Hyperliquid.

Lookonchain said that Hayes made more than $823,000 in profit on this trade alone. Hayes joked that the sale was to pay for a Ferrari deposit. His mention of a luxury sports car made people more worried about putting their own interests ahead of long-term project support.

Ferrari Purchase Draws Community Attention

Hayes talked about a Ferrari that was shown off in Milan earlier this month. The plug-in hybrid, which has more than 1,000 horsepower, will cost about $540,000 to start. Hayes said that the money he made from HYPE would help him buy a Testarossa model.

People in the community were very upset and said that the sale was poorly timed because Hyperliquid had just gone up. A lot of people thought that cashing out during a lot of hype hurt trust in the project’s credibility. The show made people think that crypto markets are full of opportunistic people.

HYPE Price Drops by More Than 10%

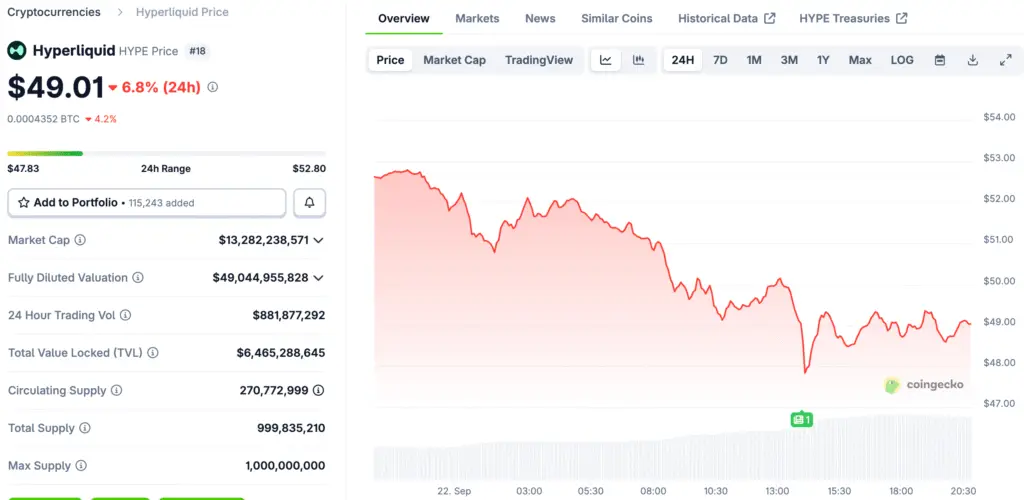

During Monday’s Asian trading session, Hyperliquid’s native token lost almost 12% of its value. Prices dropped from over $54 to about $47 before leveling off. The drop came soon after Hayes’s big sell-off, which scared off speculative traders.

HYPE is still much higher than it was in early 2025, even though this setback happened. This year, the token’s value has doubled, reaching an all-time high of almost $59 in mid-September. Investors are now trying to figure out if this drop is just a short-term thing or a sign of bigger problems.

Recommended Article: Circle Deepens Hyperliquid Partnership With HYPE Investment and Native USDC Launch

Hayes Used to Talk Up Hyperliquid’s Potential

Hayes had just talked about Hyperliquid at a big industry event in Tokyo a few weeks before. He said that based on projected fees, the exchange could go up by 126 times. These bold claims got investors excited at the time.

Some of his supporters, though, are upset that he left so quickly after making these comments. Some people say that talking up a project and then cashing out hurts trust. This kind of behavior makes people doubt that hype may be more important than substance in some parts of the crypto industry.

Hyperliquid’s Core Value Proposition

Hyperliquid is a decentralized derivatives exchange that focuses on perpetual contracts. Traders can use a lot of leverage to bet on a lot of different crypto assets. Its unique structure and growing user base have led to strong adoption in 2025.

Along with the price of HYPE, the total value locked on the platform has gone up a lot. A lot of people think of it as a better option than centralized derivatives platforms. It’s not clear yet if Hayes’ departure will have a long-term effect on usage.

Hayes Talks About Broader Liquidity

In addition to selling, Hayes also talked about macro liquidity trends. He said that the General Account of the US Treasury recently went over $850 billion. He said that this milestone would bring liquidity back to most financial markets.

Hayes says that the end of this liquidity drain means that risk assets will do better. His point of view is in line with what people think will happen: monetary flows could soon help crypto prices. Still, a lot of investors are still skeptical because of his recent sell-off.

Crypto Market Sheds $80B as HYPE, ASTER, and Pump Lead Declines

HYPE wasn’t the only token that lost value on Monday. The ASTER token on Aster, a rival decentralized exchange, fell 17% from its all-time high. The Solana memecoin Pump also fell sharply, by 15%.

Other important currencies, such as Cronos, Ether, XRP, and Solana, all went down every day. Even well-known coins like Dogecoin and Cardano lost value. The total value of all cryptocurrencies fell by $80 billion, which shows that the market is weak in general, not just HYPE.