Kaspa’s Price Enters a Pivotal Decision Zone

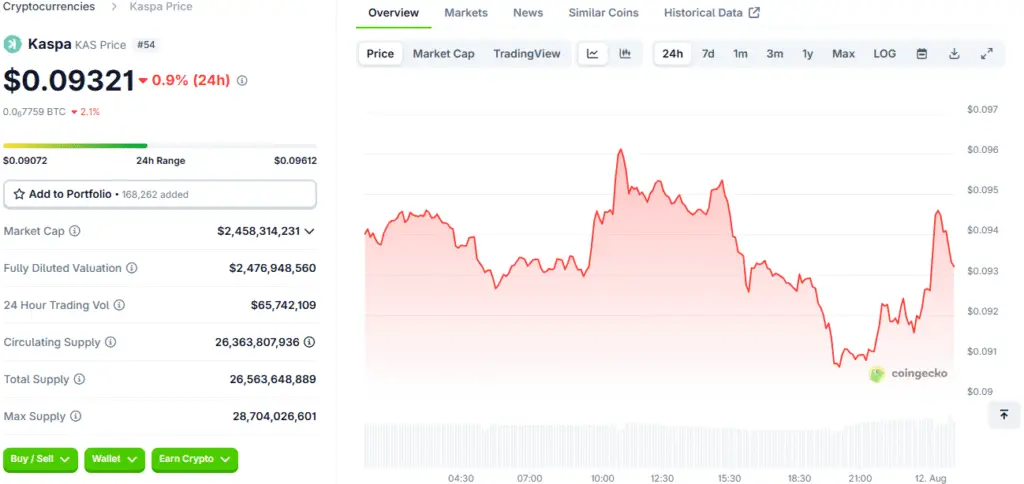

The price of Kaspa (KAS) is currently at a critical juncture, having entered a pivotal decision zone that could dictate its trajectory for the coming weeks. The token is compressing near the psychologically significant $0.10 level, a price point where the next major move often begins. After a strong upward trend since late June that saw the price top in the mid-$0.12s, Kaspa entered a consolidation phase, forming a resilient base around the $0.095–$0.10 range.

This period of price compression, as described by Kaspa Daily, is a classic pattern that often precedes a major breakout. While the market waits for a decisive shift, the underlying technical and on-chain signals for Kaspa are flashing green, with a mix of light selling pressure and persistent buying interest. This makes the current price zone a key area for traders and investors to watch, as the outcome of this standoff will likely determine the direction of the next short-term action.

Funding Rates and Derivatives Signal Bullish Tilt

The Kaspa futures market is showing signs of a bullish trend, with funding rates above zero since late June. This indicates that traders holding long positions are consistently paying those holding short positions, indicating persistent buyer confidence and a bullish market bias.

The current positive funding dynamic, which is leaning positive again while the KAS price coils at $0.10, often precedes a significant breakout. The willingness of traders to pay a premium for long positions suggests a strong belief in the continued rise of prices. This suggests that the current quiet period is not a sign of weakness but rather accumulation before the next leg up.

Shrinking Supply Fuels Price Potential

Kaspa’s on-chain signal is the decreasing supply of tokens on exchanges, with known exchange holdings trending down from 3.3 billion KAS six months ago to a six-month low of 2.19 billion KAS today. This decrease has significant implications for the token’s price potential, as fewer coins on exchanges mean lighter near-term sell pressure as tokens are moved to self-custody wallets for long-term holding.

This tighter supply can act as a catalyst, accelerating price moves when demand returns. The trend of supply moving off exchanges is generally seen as a bullish indicator, suggesting a growing conviction among holders who are less inclined to sell their assets.

Key Levels to Watch on the KAS Chart

For traders and investors, identifying key support and resistance levels is crucial for navigating Kaspa’s current price action. The immediate near-term resistance is located between $0.098 and $0.10. A clean 4-hour close above $0.10 would be a significant bullish signal, putting the $0.105–$0.11 range into view and setting up a test of $0.12 if volume increases. On the support side, a strong base is established at $0.094–$0.095, with a steeper support level at $0.090.

The most critical long-term ceiling remains the descending trendline near $0.112–$0.12. A daily close above this zone would confirm a larger trend change and make extension targets of $0.13–$0.15 a more plausible scenario. The coming days will be a test of these levels, with a breakout in either direction likely to set the tone for the coming weeks.

Read More: Kaspa Steady Growth Profile: A Smart Long-Term Investment

The Case for a Breakout and Sustained Momentum

The case for a significant Kaspa breakout is built on a confluence of positive factors. A sustained upward move requires more than just a single catalyst; it needs rising spot volume, steady positive funding rates, and open interest that grows alongside the price. This combination of indicators often signals a healthy and sustainable rally, where institutional and retail interests are aligned.

The current setup, with shrinking exchange supply and positive funding rates, suggests that the market is in a prime position for this to happen. If Kaspa can decisively break above the $0.10 resistance, it could trigger a dash to the $0.105–$0.11 area, and a move above $0.112–$0.12 would confirm a larger breakout, unlocking a new phase of growth. This potential for a sustained, momentum-driven rally is what makes Kaspa a compelling opportunity.

Bullish Sentiment and Community Optimism

The bullish sentiment surrounding Kaspa is not just a statistical anomaly; it is a core characteristic of its community. According to Kaspa Daily, KAS ranks an impressive third for bullish sentiment, a position it has held in the top ten for months, showing a steady optimism within the community. This collective belief and enthusiasm are powerful drivers in the crypto market, as a strong community can provide a crucial layer of support and resistance against volatility.

The community’s optimism is fuelled by the project’s technological strengths, its fair launch, and its clear roadmap. This strong sentiment, however, also highlights a potential “failure case” if the KAS price were to lose the $0.094 support level while funding stays positive, which could trigger a short squeeze towards $0.090. This underscores the importance of a strong, unified community to defend key price levels and prevent a more significant downturn.

Kaspa Consolidation Phase Before a Rally

Kaspa’s price is in a quiet spot right now, but it is a pivotal moment. The token is stuck between a key support zone and a major resistance level, and the market is waiting for a decisive shift. The combination of shrinking exchange supply, positive funding rates, and strong community optimism creates a compelling case for a bullish breakout. Traders are watching closely the $0.094–$0.095 range because whichever way the price breaks next will likely set the direction of the next short-term action.

The project’s unique technology and its committed community provide a solid foundation for long-term growth, and the current consolidation phase may be the final stage before a significant rally begins. For investors, this is a moment to watch closely, as the outcome of this consolidation could determine whether Kaspa can break out and fulfil its potential.