Memecoin Market Shows Explosive Growth and Institutional Confidence

The memecoin sector is drawing remarkable institutional interest, skyrocketing from $63 million to $300 million in just a few months. This surge highlights the evolution of meme-inspired initiatives, shifting from grassroots experiments to valuable assets attracting significant investment capital.

Even with this remarkable expansion, issues surrounding sustainability continue to be significant, as the majority of meme assets still depend largely on market momentum fueled by hype. In the absence of strong infrastructure, even the biggest institutional investments find it challenging to sustain momentum during times of increased volatility or when the network experiences congestion.

Shiba Inu and Pepe Showcase Limited Structural Scalability

Shiba Inu has seen trading activity exceeding 1 trillion tokens, yet it continues to face challenges in surpassing its 200-day simple moving average. In a similar vein, PEPE boasts $560 million in derivatives volume and multiple exchange listings, yet it is still limited by the scalability issues of Ethereum.

The gathering of whales in both tokens indicates an acknowledgment of immediate worth, yet it also reveals underlying structural vulnerabilities for the long haul. These structural inefficiencies frequently reveal themselves in the form of elevated transaction costs and prolonged confirmation times, which diminish user experience and undermine market confidence.

Bonk Rides Solana Ecosystem Momentum but Faces Volatility

Bonk capitalizes on Solana’s efficiency, utilizing affordable transactions and strategic ecosystem partnerships to draw in both retail and corporate investments. The $25 million financing round highlights increasing investor confidence in Solana-based memecoins, even amid the broader market turbulence.

Nonetheless, Bonk continues to reflect the speculative trends that have traditionally characterized fleeting meme token phases. The lack of independent infrastructure makes Bonk susceptible to changes in the ecosystem, putting its price movements at the mercy of external market risks that are beyond its internal management.

Recommended Article: Layer Brett Gains Momentum as XRP Forecast Fuels Buzz

The Quick Cash Mindset Restricts Sustainable Value Development

Recent launches of record-breaking memecoins showcase a tremendous demand in the market while simultaneously revealing a persistent fast-money mentality that characterizes speculative actions. Although immediate gains capture interest, the majority of projects struggle to establish concrete use cases that support growth beyond the initial surge.

The CoinDesk Memecoin Index’s 11% outperformance over Bitcoin highlights market excitement, but these figures mask the inherent instability of valuations driven by memes. Rapid gains often eclipse the essential need for innovation that is vital for true long-term growth.

Layer Brett Addresses Scalability Challenges with Layer 2 Innovations

Layer Brett distinguishes itself by evolving from a base token into a specialized Ethereum Layer 2 blockchain solution. This development tackles the inefficiencies in gas fees and the transaction bottlenecks that hinder traditional memecoins from attaining lasting adoption.

The network design facilitates rapid processing, significantly lowering expenses for users engaged in decentralized finance or staking initiatives. This foundation creates genuine utility that transcends mere speculation, providing a robust infrastructure designed to facilitate widespread engagement throughout diverse market cycles.

Utility and Staking Strengthen Layer Brett’s Growth Potential

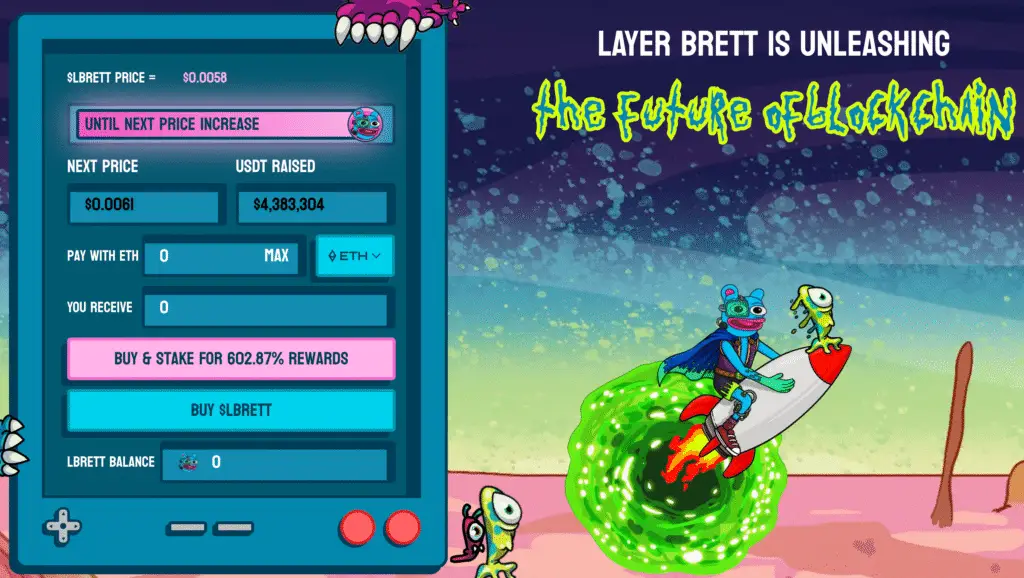

Layer Brett’s staking mechanism offers more than 615% annual percentage returns, highlighting the importance of utility-backed incentives rather than just speculative allure. This strategic framework connects community engagement with network development, focusing on sustainable growth instead of promoting rapid inflows followed by profit-driven exits.

In contrast to Shiba Inu, Bonk, and Pepe, which depend on the performance of external blockchains, Layer Brett maintains complete control over its ecosystem. This autonomy fosters ongoing enhancement, scalable growth, and steady reinforcement of its PayFi-focused narrative within the wider memecoin landscape.

Layer Brett Established As A Leading Contender In The Top 150x

The blend of meme culture allure and strong infrastructure makes Layer Brett the obvious leader for 150x potential. The project seamlessly combines engaging technology with appealing staking options, effectively merging entertainment with practical blockchain advancements.

Currently priced around $0.0058 per token, Layer Brett offers a compelling entry point for investors looking for significant potential gains. With the expansion of institutional capital and the increasing prominence of infrastructure-focused tokens, Layer Brett seems poised to notably surpass its competitors by 2028.