Explosive Presale Growth Positions Mutuum Finance as Standout

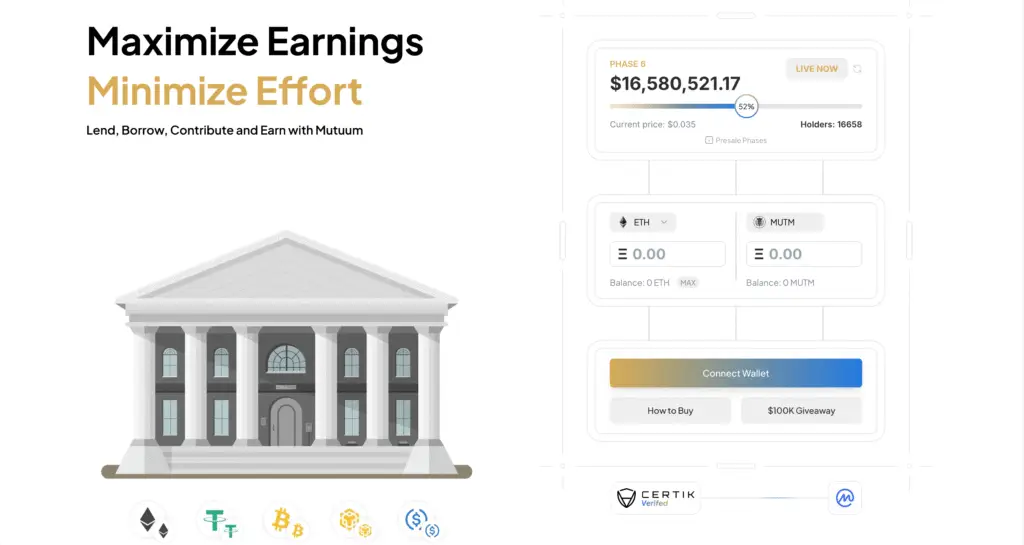

Mutuum Finance (MUTM) has rapidly become one of the most talked-about tokens of 2025, surpassing $16.45 million in presale funding. The project has successfully combined structured growth, transparency, and community engagement, setting it apart from typical hype-driven launches.

Launched at $0.01 in Phase 1, the token is now in Phase 6 at $0.035, marking a 250% gain for early buyers. With each presale phase increasing prices by 20%, the final launch price of $0.06 locks in a 600% appreciation for initial participants.

Strategic Presale Model Encourages Early Participation

The Mutuum Finance presale is designed to reward early supporters through structured pricing and gamified incentives. Phase 6 is already more than halfway complete, and Phase 7 will soon raise the price to $0.04, adding urgency for new investors.

So far, 730 million tokens have been sold to more than 16,600 holders, building a diverse liquidity base and reducing whale concentration. A real-time dashboard and Top 50 leaderboard enhance transparency and foster active community involvement.

Dual-Lending Architecture Drives Utility and Innovation

Mutuum Finance’s standout feature is its dual lending model, which combines Peer-to-Contract (P2C) pooled lending for mainstream assets with Peer-to-Peer (P2P) markets for niche or higher-risk tokens. This flexible structure allows the protocol to serve both retail and institutional users.

Borrowing rates adjust dynamically based on liquidity pool utilization, ensuring efficient capital allocation. Stable borrowing options will also be available, offering predictable conditions for long-term participants and institutional lenders.

Recommended Article: Cardano Price Struggles as Mutuum Finance Gains “ADA 2.0” Hype

Tokenomics Designed for Sustainable Demand

Lenders receive mtTokens representing their supplied assets, which can be staked to earn MUTM rewards through a buy-and-distribute mechanism. A portion of protocol fees is used to purchase MUTM on the open market, creating sustained buying pressure beyond the presale.

This design aligns token incentives with protocol usage, fostering organic demand growth over time. Analysts highlight this mechanism as a key factor supporting Mutuum’s long-term valuation stability.

Security Measures Build Investor Trust Ahead of Launch

Mutuum Finance recently completed a CertiK audit, earning a strong 90/100 Token Scan score. Additionally, the project launched a tiered bug bounty program offering up to $50,000 for identified vulnerabilities, ensuring thorough code testing before mainnet deployment.

Security and transparency initiatives, including live dashboards and reward programs, signal the project’s commitment to building lasting investor confidence—an essential trait in the competitive DeFi landscape.

Immediate Platform Utility Sets Mutuum Apart

Unlike many projects that release tokens months before utility arrives, Mutuum Finance will launch a functional beta platform simultaneously with its token debut. This approach enhances investor confidence and improves its chances for early exchange listings.

The beta version will offer lending and borrowing functionalities, giving participants immediate opportunities to engage with the ecosystem and generate returns from day one.

Roadmap Outlines Ambitious Expansion Plans

Mutuum Finance’s roadmap features major growth catalysts, including an over-collateralized stablecoin, Layer-2 integrations, and cross-chain expansion. These initiatives aim to improve scalability, reduce transaction costs, and connect the protocol to multiple ecosystems.

Additionally, Chainlink oracle integration with fallback systems will ensure accurate pricing and risk management. These planned developments position Mutuum Finance as a serious long-term player in decentralized finance.

Mutuum Finance Poised to Lead Next DeFi Wave

Analysts increasingly view Mutuum Finance as a top DeFi contender for 2025. Its combination of presale momentum, innovative architecture, robust security, and immediate utility sets a strong foundation for sustainable growth.

As the presale nears completion and platform launch approaches, investor expectations continue to build. Mutuum Finance’s strategic execution suggests it could emerge as one of the standout DeFi protocols in the coming year.