Pepe’s Price Action: A Descending Wedge

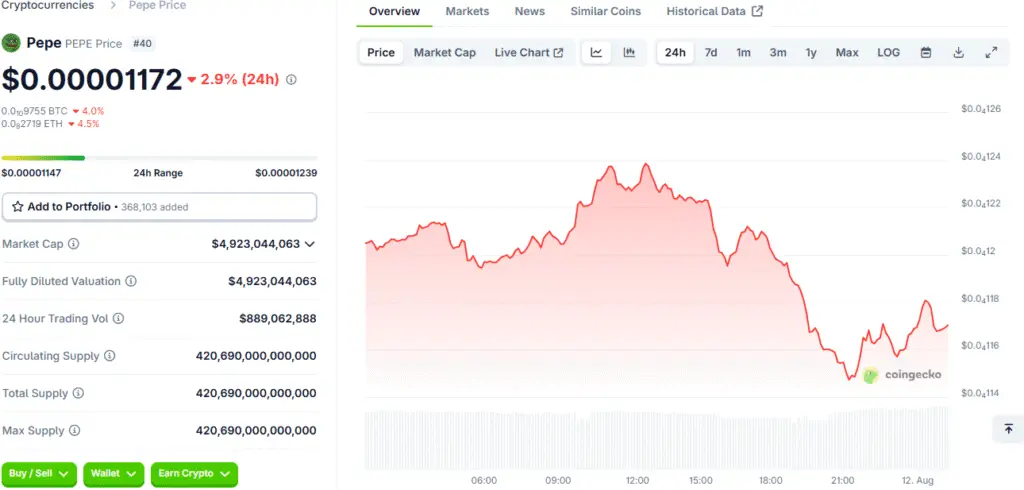

The price of Pepe (PEPE) is currently showing a classic technical pattern: a descending wedge. This pattern is often seen as a bullish reversal signal, indicating that the selling pressure is gradually weakening. Looking at the daily chart, PEPE is moving within this wedge, with liquidity building up both above and below the current price.

This creates a situation where the market is essentially “teasing” traders, as a break in either direction could lead to a significant move. While a dip below the wedge is possible to grab some of the liquidity, the fact that a strong demand zone is sitting just below the current range is a key bullish sign. This pattern, and its potential resolution, is a key focus for traders looking to predict the token’s next move.

The Demand Zone: A Potential for Reversal

A crucial factor to watch for is a potential bounce from a beautiful demand zone that sits just under the current price range. A demand zone is a technical analysis term for an area on a chart where a large number of buy orders are concentrated, and a successful test of this level could see a sharp reversal in price. If Pepe tags this level and buyers step in, it could trigger a significant upward movement, potentially a “run toward clearing all that juicy liquidity above.”

This would confirm the bullish reversal and set the stage for a new rally. However, the market is not guaranteed to follow this path, as the unpredictable nature of meme coins means that the price could move in ways that defy technical analysis. This demand zone is a key level of interest, and its strength will be tested in the coming days.

The Fun and Frustration of Meme Coin Trading

The article highlights the unique fun and frustration of trading meme coins like Pepe. While they are born as jokes, they are often backed by a dedicated community and significant liquidity, which gives them a life of their own. The technical charts can provide a possible path, but they are not a guaranteed prophecy. The market, as the author states, “doesn’t owe us anything,” and Pepe could surprise everyone by moving in ways that make no technical sense at all.

This is the essence of meme coin trading, where community sentiment and viral trends can often override traditional market fundamentals. This high-risk, high-reward environment is what makes meme coins both a thrill and a challenge for traders. It requires a different mindset than traditional asset trading, one that is more attuned to community dynamics and social media trends.

Read More: PEPE Price Finds Local Bottom at $0.00001 as Arthur Hayes Sells $13M in Crypto

Liquidity and Market Dynamics

The presence of liquidity both above and below the current price is a key factor in Pepe’s price action. Liquidity represents the total volume of buy and sell orders at various price levels. When there is significant liquidity above the current price, it can act as a magnet, drawing the price upward to “clear” those orders.

Conversely, liquidity below the current price can act as a support level, but if it is broken, it can accelerate a downward move. The descending wedge pattern, with liquidity building up on both sides, creates a dynamic where the market is primed for a significant move once a catalyst emerges. This standoff between buyers and sellers is what makes the current moment so pivotal for Pepe’s future trajectory.

On-Chain Data and Community Sentiment

While the article focuses on technical analysis, on-chain data and community sentiment are also crucial for understanding Pepe’s market. On-chain metrics, such as the number of active wallets, transaction volume, and the flow of tokens to and from exchanges, can provide a deeper insight into the behaviour of the community. A high number of active wallets and a consistent transaction volume can indicate a healthy and engaged community, which is a powerful engine for a meme coin’s growth.

Similarly, social media sentiment, often referred to as “buzz”, can be a leading indicator of a potential rally. The fact that Pepe is backed by a “surprisingly dedicated community” suggests that it has a strong base of support that could fuel a significant upward move.

The Importance of Technical Analysis

Technical analysis, despite the unpredictable nature of meme coins, remains a vital tool for traders. Patterns like the descending wedge and the identification of demand zones can provide a framework for making informed decisions. By analysing these patterns, traders can identify potential entry and exit points, set stop-loss orders to manage risk, and project potential price targets.

While technical analysis is not a foolproof system, it provides a probabilistic framework that can help traders navigate the market more effectively. The fact that Pepe’s price action is showing classic patterns suggests that even a meme coin is subject to the same market dynamics as other assets. This makes technical analysis a valuable tool for understanding the potential paths that Pepe’s price could take in the coming days and weeks.

Pepe’s Price Awaiting a Catalyst from Demand Zone

The path ahead for Pepe is at a critical juncture. The price is consolidating within a descending wedge, with a strong demand zone just below the current range. The outcome of this standoff will determine whether Pepe can make a bullish reversal or if it will consolidate further. If buyers step in at the demand zone, it could trigger a significant upward movement, potentially leading to a new rally. However, if the demand zone is broken, a deeper correction could be on the horizon.

The market is waiting for a decisive shift, and the next few days will be crucial in determining which direction Pepe’s price will take. The token’s future performance will depend on its ability to sustain community engagement, navigate market volatility, and break out of its current technical pattern. For traders, this is a moment to watch closely, as the outcome of this consolidation could be the catalyst for the next major move.