PEPE Encounters Significant Selling Pressure During Market Volatility

In mid-October 2025, the memecoin market experienced significant declines, primarily driven by PEPE’s ongoing downward trend. The token experienced a decline of about 5% in just 1 day, bringing its weekly losses to almost 25% as it trades around $0.0000074.

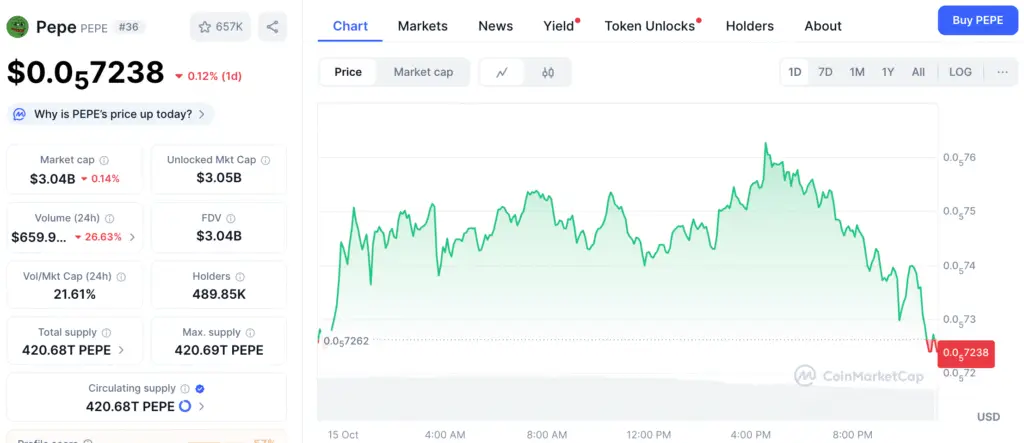

The market capitalization currently stands at approximately $3 billion, reflecting a 31% decline since the beginning of the year, sparking extensive conversations among traders. Experts link the decline to macroeconomic fluctuations and a heightened sense of risk aversion among investors, following a significant $500 billion correction in the cryptocurrency market.

Whale Activity Introduces Ambiguity to Market Forecast

Recent on-chain data indicates that whale addresses have reduced their holdings by approximately 0.5% in the last week. This coincided with a 0.33% decline in exchange reserves, indicating a mix of careful adjustments and restricted new inflows.

The recent changes have created a sense of unease among retail traders. Some perceive this as a beneficial consolidation phase, while others are concerned that ongoing whale selling might hinder recovery momentum as we approach late October.

PEPE Trading Volume Soars to $927M as Volatility Fuels Market Activity

Even with declining prices, PEPE experienced a significant increase in daily trading volume, reaching almost $927 million, which reflects a surge in activity among both buyers and sellers. This trend indicates that short-term traders are actively adjusting their strategies in pursuit of profits driven by volatility.

Market analysts emphasize that high volumes during downturns may signal potential reversals ahead. Nonetheless, they warn that the existing liquidity is heavily focused on substantial trades, which could heighten short-term volatility and lead to significant price fluctuations.

Recommended Article: Pepe Price Holds Steady As Traders Watch Key Support Levels

Broader Memecoin Sector Suffers Parallel Declines

PEPE’s decline reflects a broader downturn in the sector, as evidenced by the CoinDesk Memecoin Index, which has fallen by 23.4% in that timeframe. Dogecoin and Shiba Inu experienced comparable declines, highlighting a shared sense of caution among speculative investments.

This coordinated decline highlights underlying vulnerabilities in the memecoin market. The current market sentiment is delicate, and any recovery is largely contingent upon a stabilization of the broader market and a resurgence in retail participation.

PEPE Accumulation From Small Holders Offsets Impact of Whale Activity

Despite the caution indicated by whale activity, long-term holders seem to retain a steady level of confidence in PEPE’s potential for recovery. Data shows a steady buildup from smaller investors, even in the face of ongoing volatility.

Proponents contend that this behavior reflects a strong belief in the asset’s potential recovery. However, market observers caution that if large-scale selling continues, the ensuing imbalance might hinder significant recovery initiatives.

Key Market Thresholds Define Investor Sentiment

Traders are paying close attention to the $3 billion capitalization mark, viewing it as a significant psychological threshold. Maintaining this valuation might lead to an emphasis on relief rallies, particularly if liquidity is enhanced across exchanges.

On the other hand, a drop below $2 billion could prompt increased selling, possibly resulting in wider repercussions throughout speculative tokens. These thresholds serve as crucial sentiment indicators that inform short-term trading strategies.

Forecast for PEPE and the Memecoin Market

Predictions for PEPE’s path differ significantly, showcasing the diverse risk viewpoints present in the crypto community. Optimistic analysts suggest that the token might recover to $0.00001 or potentially $0.00002 by 2026 if there is a resurgence in buying pressure.

Nonetheless, ongoing selling by large holders or a general downturn in the sector may push prices down to $0.000005 in the upcoming weeks. Ultimately, the decline of PEPE highlights the volatility that characterizes memecoin markets, where excitement is constantly weighed against inherent risk.