The Ascendance of Pepe in the Meme Coin Ecosystem

The cryptocurrency market is a landscape of constant flux, and few sectors embody this dynamism more than meme coins. Recently, Pepe (PEPE) has captured the spotlight by overtaking two of the most established players, Dogecoin (DOGE) and Shiba Inu (SHIB), in trading volume. This shift is not merely a statistical anomaly; it represents a significant change in investor sentiment and a potential reordering of the meme coin hierarchy.

The surge in PEPE’s activity underscores the persistent appeal of these community-driven assets, which thrive on viral narratives and speculative enthusiasm. While DOGE and SHIB have long been household names, their recent performance has been less volatile, a factor that may be pushing traders towards newer, more explosive opportunities like PEPE. This trend suggests that while older meme coins offer a degree of stability, the appetite for high-risk, high-reward assets remains strong.

Navigating Price Challenges and Potential for a Pepe Rally

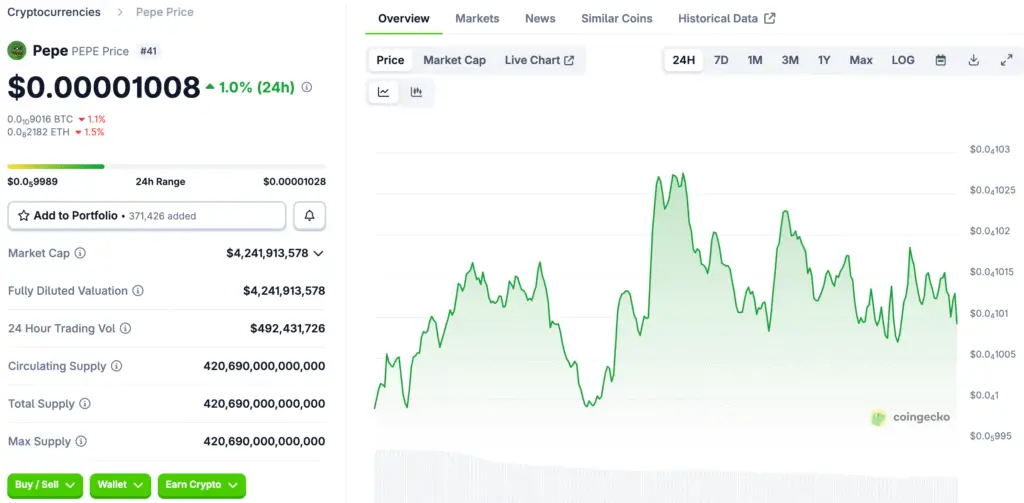

Despite its impressive rise in trading volume, Pepe’s price has been subject to volatility, experiencing an 8% decline over the past week. However, traders are closely monitoring key technical levels that could trigger a major reversal. The current price range of PEPE, between $0.000009864 and $0.000011744, is a consolidation zone. A decisive breakout above the crucial resistance level of $0.000012657 is viewed as a potential catalyst for a significant upward move.

If Pepe can overcome this barrier, it could pave the way for a 30% surge, with analysts eyeing a new resistance target at $0.000014537. The relative strength index (RSI) and stochastic indicators, which measure momentum and overbought/oversold conditions, are approaching oversold territory. This technical signal often precedes a short-term rebound, suggesting that the recent selling pressure may be temporary and that a bounce could be imminent.

Dogecoin and Shiba Inu Face Their Own Market Pressures

While Pepe has been making headlines, its predecessors, Dogecoin and Shiba Inu, are facing their own set of challenges. Dogecoin, the originator of the meme coin craze, has been struggling to break past its resistance level at $0.26. The price action has been constrained within a narrow range of 21 to 25 cents, reflecting a lack of strong directional momentum. Over the last month, DOGE has seen a 7.5% decline, and its RSI remains below 40, indicating persistent but moderate selling pressure.

For DOGE to regain its bullish footing, it would need a significant influx of capital to break the 26-cent barrier and target the next resistance at 30 cents. On the other hand, Shiba Inu shows more promising technical signs. SHIB is currently consolidating near its resistance level of $0.00001433. A successful push above this level could lead to a 16% increase, with a potential price target of $0.00001583. With an RSI of 36.48, SHIB appears underbought, which could signal an impending rally if market sentiment improves.

Read More: PEPE Token Price Prediction: Will Whales Drive a 65 Percent Rally?

The Underlying Narrative of Meme Coin Volatility

The meme coin sector’s performance is driven by a unique blend of speculative trading, community engagement, and viral narratives. Unlike traditional assets, their value is often derived from social media buzz and the collective belief of their communities. The rise of PEPE, in particular, demonstrates how a strong narrative and timely market entry can create a significant impact. This behavior is a direct reflection of a persistent niche market that remains appealing to investors seeking outsized returns.

The dynamics of these coins, from their rapid pumps to their sudden dumps, can be a barometer for broader market sentiment. When risk appetite is high, capital tends to flow into these speculative assets, amplifying their movements. Conversely, during periods of market uncertainty, investors often retreat to more stable assets, leaving meme coins vulnerable to sharp corrections.

Technical Indicators Hinting at Future Price Movements

For those looking to trade meme coins, understanding technical indicators is crucial. The RSI (Relative Strength Index) and stochastic oscillator are two tools that provide insight into potential short-term price reversals. When a coin’s RSI drops below 30, it is considered oversold, a signal that selling pressure may be exhausted and a rebound is likely. In the case of Pepe, the RSI has been trending lower, suggesting that a buying opportunity may be on the horizon.

Similarly, the stochastic indicator measures the momentum of a price move. When both indicators point toward an oversold condition, it can be a strong signal for a potential short-term bounce. Conversely, when a coin’s RSI rises above 70, it is considered overbought, which often precedes a price correction. For DOGE and SHIB, monitoring these indicators is key to identifying potential breakouts or breakdowns.

The Role of Community and PR in Meme Coin Success

The success of a meme coin is intrinsically linked to the strength and engagement of its community. The rise of PEPE and the enduring popularity of DOGE and SHIB are testaments to the power of collective action. These communities act as de facto marketing teams, creating and sharing content that builds hype and attracts new investors.

This grassroots momentum is often amplified by strategic public relations, which leverages data-driven insights to build visibility and drive engagement. By aligning campaigns with market dynamics, PR firms can amplify narratives and influence short-term performance. This symbiotic relationship between community and professional marketing has become a defining characteristic of the meme coin space.

Pepe Challenges Dogecoin and Shiba Inu

The meme coin market is undergoing a significant shift, with Pepe emerging as a formidable challenger to established players like Dogecoin and Shiba Inu. While DOGE and SHIB are grappling with their own price challenges, PEPE’s surge in trading volume and its potential for a major price breakout highlight a renewed interest in highly speculative assets.

The market’s current behavior underscores the ongoing relevance of community-driven narratives and the importance of technical analysis for traders. As PEPE continues to challenge for dominance, the meme coin sector remains a barometer of market sentiment, signaling a persistent role for speculative assets in shaping trading patterns.