Analysts Turn Bearish as Pi Network Faces Intense Price Scrutiny

Pi Network faces growing scrutiny as experts raise alarms about possible collapse scenarios emerging by 2026. Recent bearish forecasts underscore worries regarding supply unlocks, weak liquidity, and diminishing investor sentiment.

More than half of specialists foresee that PI may plummet to zero between 2026 and 2027, pointing to inherent weaknesses. A significant portion anticipates a comprehensive downturn within the next year, triggering concerns throughout the cryptocurrency landscape.

Price Decline Amplifies Collapse Forecasts for Pi Network

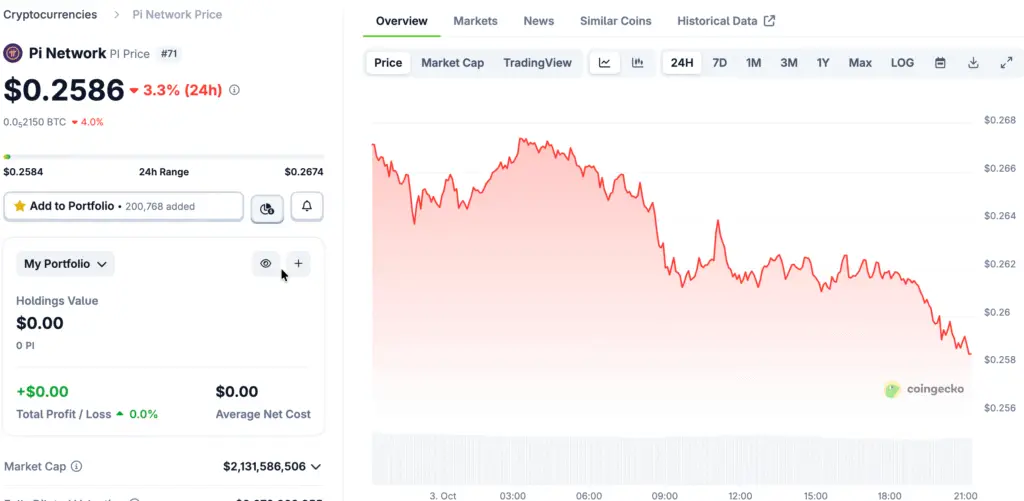

The price of Pi Network has recently experienced a significant decline of 20% in just 24 hours, hitting a new all-time low of approximately $0.27. This abrupt decline occurred amidst a wider market downturn, revealing PI’s vulnerability to fluctuations and liquidity challenges.

Experts contend that these abrupt shifts reveal more profound systemic vulnerabilities, such as leveraged liquidations and insufficient exchange backing. The presence of these structural flaws raises significant worries that Pi Network could face challenges in maintaining its value if selling intensifies further.

Remittix Stands Out As A Robust Option For Prudent Investors

Amidst the uncertainty surrounding PI, Remittix is steadily gaining traction as a more reliable, payment-focused initiative that is drawing interest from investors. Remittix provides practical solutions with its crypto-to-bank transfer system, tailored for freelancers, remitters, and individuals earning globally.

The project has successfully sold more than 673 million tokens, generating $26.8 million in funding, with a current price of $0.113 as it continues through its pre-launch phase. CertiK audits confirm the integrity of its team, while Remittix proudly stands as the top-ranked pre-launch token, bolstering investor trust.

Recommended Article: Pi Network Price Targets Rebound as DeFi Momentum Builds

Exchange Listings and Incentives Bolster Remittix Appeal

Remittix has achieved two significant centralized exchange listings following its successful fundraising milestones of over $20M and $22M. A third listing is in the works, indicating increasing market backing and broader liquidity options for holders.

The platform’s $250,000 community giveaway and 15% USDT referral rewards program encourage swift adoption. The community testing of the wallet beta enhances its utility narrative, standing in stark contrast to PI’s uncertain path.

Comparing Pi Network Weakness Against Remittix Fundamentals

The absence of robust listings and well-defined real-world applications for Pi Network raises concerns about its potential for collapse. Remittix stands out by merging practical use, verified security, and broad market attraction, establishing a more robust base in times of volatility.

The payments architecture enables direct crypto-to-bank transfers in over 30 countries, providing practical benefits compared to speculative tokens. This operational strength is the reason some analysts currently see Remittix as a more secure option in comparison to Pi Network.

Wider Market Developments Impact Market Mood

The decline of Pi Network occurs in a changing crypto environment where investors are increasingly looking for tokens that offer real utility and concrete value propositions. Initiatives such as Remittix resonate with this movement, drawing interest from investors who seek opportunities beyond mere hype.

Meme coins and speculative assets have demonstrated susceptibility to tightening liquidity, whereas PayFi tokens are gaining increasing momentum. As stories develop, the shift of capital towards infrastructure and utility projects may become more pronounced through 2026.

Pi Network Outlook Hinges On Market Confidence And Structural Reforms

The future of Pi Network hinges on its ability to restore trust by enhancing liquidity and reinforcing its foundational elements. Experts highlight that without significant reforms, PI may continue to face vulnerabilities to the collapse scenarios anticipated for 2026.

In the meantime, options such as Remittix could gain from changing attitudes, providing utility- and security-oriented approaches for investors. If expectations of collapse continue, Pi Network may encounter heightened competition from more strategically positioned projects in the changing crypto environment.