Pi Network Price Faces Challenges in Maintaining Crucial Support Level

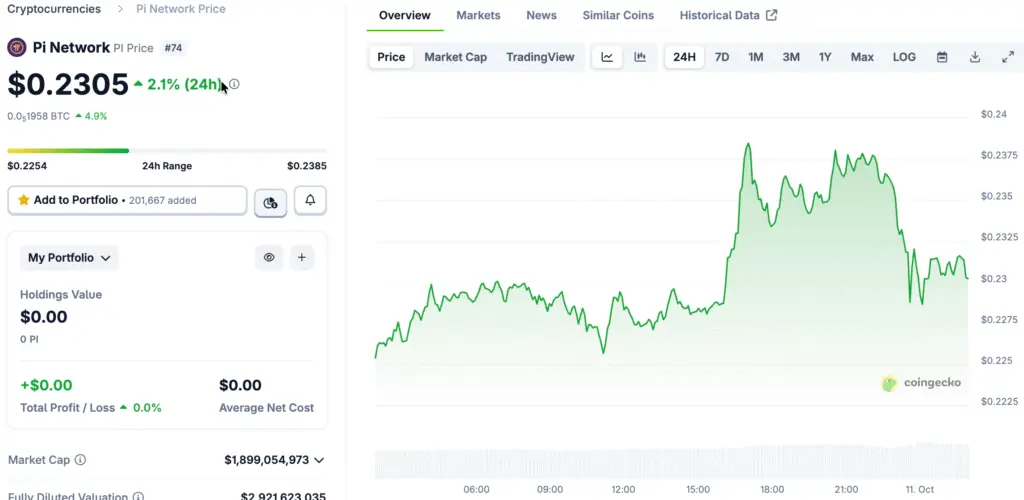

The Pi Network remains around $0.23, showing a delicate balance as it faces ongoing selling pressure and low trading volume. Market data indicates that the average daily turnover is now below $30 million, underscoring a decline in participation relative to earlier quarters.

The market capitalization of the token is considerably lower than it was last year, with Pi losing over 90% of its all-time valuation. This downturn highlights a drop in confidence, as traders look for new catalysts that could spark a revival in on-chain activity.

Investor Confidence Hinges On Protocol 23 Upgrade

Protocol 23 stands out as the crucial update that may shape the upcoming market phase for Pi Network. The upgrade corresponds with Stellar Core v23.0.1, bringing enhancements in security, scalability, and transaction efficiency.

Developers anticipate the integration of a decentralized exchange (DEX) and automated market maker (AMM), which will enhance DeFi functionality significantly. Should execution be successful, Protocol 23 has the potential to rebuild community trust and draw in fresh liquidity across various trading pairs.

Pi Network Trades in Oversold Zone as RSI Hits 24, Signaling Possible Relief Rally

Recent chart data indicates that Pi Network is currently trading in an oversold region, with the Relative Strength Index (RSI) positioned around 24. In the past, these conditions have often led to brief recoveries in comparable altcoin markets.

Nonetheless, experts warn that for a relief rally to occur, there must be clear signs of demand growth, given the current thin liquidity. A consistent volume exceeding $50 million would indicate interest from major buyers looking to take speculative positions ahead of the upgrade launch.

Recommended Article: Pi Network Faces 23% Downside as Price Momentum Weakens

Weak Liquidity Remains Core Market Challenge

Liquidity remains a significant vulnerability within the structural framework of Pi Network. Limited order books have rendered the token susceptible to significant price fluctuations with relatively minor trades. This unpredictability deters long-term investors from increasing their stakes.

Professionals contend that innovative liquidity strategies, such as token buybacks or regular coin burns, may enhance market stability. Clear and open actions from the development team may alleviate community doubts and restore trust in Pi’s long-term vision.

Pi Network Community Divided As Calls For Clearer Roadmaps And Updates Intensify

The online community of Pi Network continues to engage, yet it is marked by divisions. Proponents highlight the initiative’s ability to make digital payments more accessible, whereas detractors raise concerns about the postponed timelines for development. Social discussions indicate a clear transition from enthusiasm to a more measured sense of hope.

Updates are consistently being rolled out by developers via official channels; however, a significant number of users are seeking more transparent roadmaps that detail specific milestones. Experts concur that maintaining regular communication will be crucial for fostering engagement as the wider cryptocurrency market evolves.

Market Outlook Depends on Network Utility Expansion

For Pi Network to attain a lasting recovery, it needs to showcase real adoption that goes beyond mere speculative trading. Incorporating practical applications such as remittance tools, staking modules, or partner integrations has the potential to boost demand driven by utility.

Investors are paying close attention to transaction metrics in the wake of the Protocol 23 rollout. An ongoing increase in daily on-chain activity would indicate a resurgence in participation and bolster price momentum as we approach late October.

Pi Network Could Rebound Toward $0.32 If Support Holds and Protocol 23 Launch Succeeds

Experts predict a possible rebound to the $0.28 to $0.32 range if Pi remains stable above $0.23. A successful Protocol 23 launch has the potential to drive prices upward, creating a new local floor at approximately $0.30.

On the other hand, not achieving measurable progress might lead to another test around $0.18, especially if liquidity continues to be limited. In both cases, the direction of the market will depend on Pi Network’s capacity to turn its roadmap commitments into tangible adoption.