Pi Network Stays Steady Despite Market Fluctuations

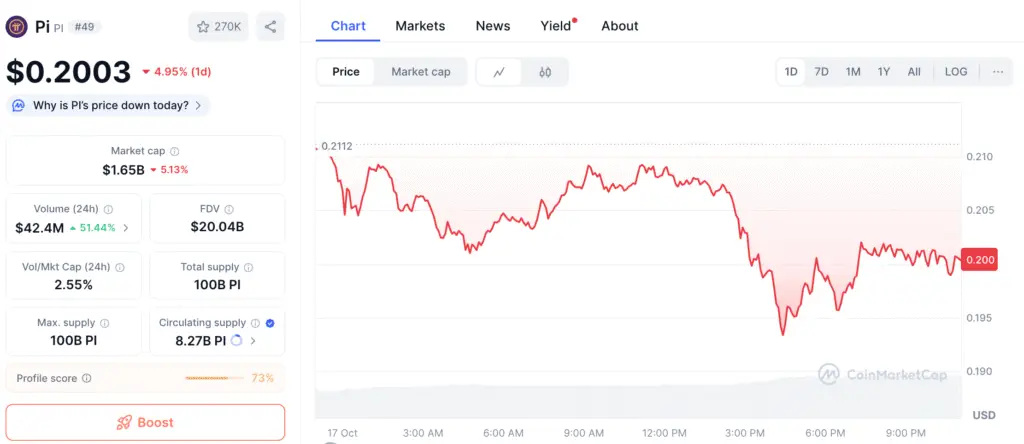

Pi Network (PI) maintains a consistent trading position above the $0.20 threshold, demonstrating notable strength in the face of a wider market decline. Amid the turbulence experienced by leading cryptocurrencies, the relatively stable price actions of PI indicate that investors are subtly gathering assets in this climate of uncertainty.

As of the latest update, PI has recorded a 1% daily increase following three consecutive days of decline. This recovery reflects indications of diminished selling pressure, providing optimism for a potential short-term rebound should market sentiment take a positive turn over the weekend.

Pi Network Exchange Outflows Signal Rising Retail and Holder Confidence

Recent figures from PiScan indicate a net withdrawal of 2.58 million PI from centralized exchanges in the last 24 hours. This signifies a significant transition towards individual ownership and sustained retention, a trend commonly observed during periods of accumulation.

A decline in exchange reserves typically indicates that asset holders are withdrawing their funds from trading platforms, which leads to a decrease in immediate sell-side liquidity. This indicates robust demand, especially from retail investors or early adopters eager to secure tokens ahead of the anticipated momentum from Pi’s forthcoming Mainnet expansion.

Restricted Exchange Listings Heighten Market Reactivity

A limited number of exchanges are currently offering PI, which simplifies the tracking of liquidity flows but also makes them more susceptible to fluctuations. Given that a majority of PI tokens are held in user wallets rather than being traded on exchanges, these outflows significantly amplify the impact of minor trading activities on price movements.

FXStreet has highlighted that the current correction is primarily influenced by off-exchange transactions, with supply from centralized exchanges remaining constrained. The scarcity of inflows indicates that any increase in withdrawals signifies a growing confidence among holders, rather than actions driven by speculation.

Recommended Article: Pi Network v23 Expands Mainnet With DeFi, DEX, and Contracts

Pi Network Technicals Hint at Stabilization Near Key Support Levels

From a technical perspective, the chart structure of Pi Network suggests a potential stabilization around crucial support levels. The Moving Average Convergence Divergence (MACD) is showing signs of flattening in relation to its signal line, suggesting that the downward momentum is diminishing. A bullish crossover could signal a possible shift in the trend, indicating a move toward recovery.

In the meantime, the Relative Strength Index (RSI) has risen to 29, recovering from significantly oversold levels. This rebound indicates that the selling pressure may be running out of steam, hinting at a potential shift in the market towards balance or a possible upward movement.

Important Price Levels to Monitor

The PI/USDT pair is currently confined within the trading range established by the October 10 candle, oscillating between a support level of $0.1996 and a resistance level of $0.2295. A significant drop below $0.1996 may reveal the subsequent target at $0.1731 (S1 Pivot Point), whereas surpassing $0.2295 could pave the way for a rebound towards the $0.2755 Pivot level.

Maintaining a position above $0.20 is essential for sustaining investor trust. Ongoing consolidation in this area may establish a foundation for upward movement, provided it is supported by steady buying activity.

Pi Network Indicators Point to Growing Accumulation and Bullish Setup

While the price movement of Pi Network seems to be quiet, the on-chain and exchange indicators suggest an increasing demand that could signal an upcoming recovery phase. Provided that exchange reserves keep diminishing and momentum indicators show improvement, PI may experience a steady rise toward the mid-$0.20s range in the near future.

From a wider perspective, the integration of Pi into decentralized finance and the growing activity within its ecosystem may significantly boost the utility of the token. The current emphasis is on whether purchasers can uphold the $0.20 psychological threshold, transforming short-term consolidation into a base for a resurgence of bullish momentum.