Pi Network Experiences Significant Price Drop Following Whale Withdrawal

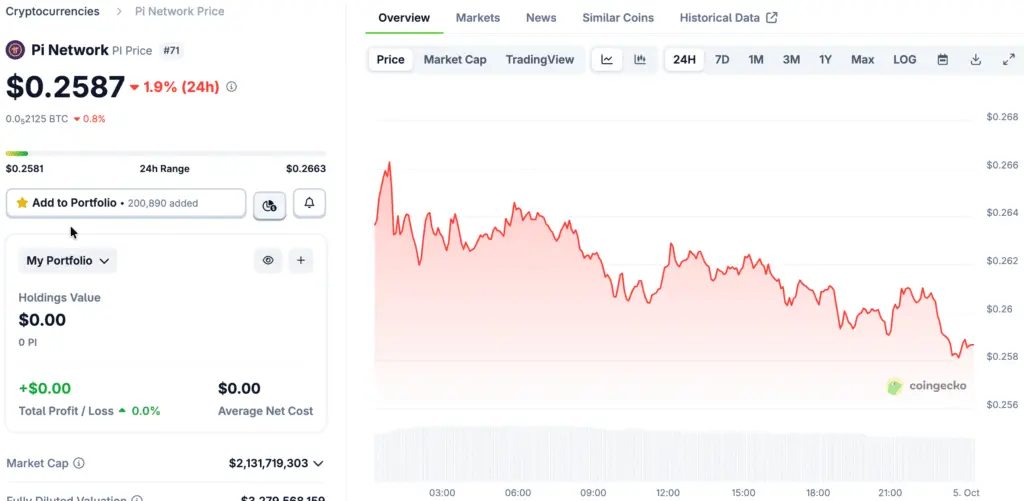

The Pi Network has faced a staggering 90% decline in price since its mainnet launch earlier this year, leaving many retail investors taken aback. The market capitalization of the token has plummeted from $20 billion to a mere $2 billion, resulting in a significant loss of value in a remarkably brief period.

Market analysts are currently cautioning that Pi Network may decline further if the bearish momentum continues to affect weakened support levels. Investor sentiment has undergone a significant transformation, as traders who were once optimistic are now expressing doubts about the network’s long-term sustainability and foundational principles.

Whale Accumulation Previously Drove Pi Network Price Action

For several months, the persistent accumulation by a single whale significantly contributed to maintaining the high market price structure of Pi Network. Data from PiScan indicated that this particular whale acquired tokens nearly every day, swiftly establishing itself as the largest private holder of PI worldwide.

He ultimately gathered 383M tokens, valued at over $101M, placing him in a position just behind the substantial reserves of the Pi Foundation. This phase of accumulation created a sense of artificial scarcity, leading to a temporary stabilization of prices and drawing in speculative traders in search of momentum.

Pi Network Faces Selling Pressure After Whale Stops Buying Activity

The sudden halt in the whale’s aggressive accumulation 10 days ago has ignited widespread speculation and panic among investors in the Pi Network. His last significant transaction entailed the discreet transfer of 1.4M PI, valued at around $380,100, from OKX to his self-custody wallet.

Since that time, there has been a noticeable absence of substantial purchasing activity, which has rendered the market susceptible to increased selling pressures and anxiety. Experts point out that abrupt inactivity among large investors frequently signals steep downturns, as speculative traders tend to lose their confidence rapidly.

Recommended Article: Pi Network Faces Collapse Fears as Remittix Gains Trust

Analysts Offer Multiple Explanations for Whale’s Abrupt Pause

Experts have identified various possible explanations for the whale’s abrupt choice to completely cease his long-standing accumulation strategy. Initially, he may have just hit his desired allocation goal, taking a brief pause in purchases after exceeding $100M already invested.

Additionally, strategies for taking profits might clarify the actions observed, as he could be anticipating more favorable entry points before continuing to accumulate. Third, discreet token transfers indicate a waning confidence, potentially hinting at a readiness for upcoming partial liquidation efforts over time.

Token2049 Speech Fails To Reignite Market Confidence

A significant number of Pi Network investors were eager for Dr. Fan’s keynote at Token2049 to provide essential updates on tokenomics and exchange listings. Regrettably, the presentation lacked any substantial new insights, leaving investors disheartened and unable to rekindle their waning enthusiasm.

The absence of action intensified negative sentiment, with traders viewing the lack of response as a sign of weakness in crucial market conditions. In the absence of fresh catalysts, Pi Network faced challenges in regaining its momentum, resulting in prices being susceptible to further downward pressure and potential capitulation.

Trading Volume Declines Confirm Weakening Market Participation

Trading volumes across exchanges have seen a significant decline in recent weeks, highlighting a decrease in interest and overall liquidity conditions. Reduced trading volumes often lead to decreased price stability, causing assets to be more vulnerable to sudden drops during panic-induced sell-offs or large investor withdrawals.

The decline in activity within the Pi Network reflects a wider trend, as retail traders tend to withdraw swiftly when they sense that momentum has abruptly vanished. The decrease in trading involvement heightens volatility, strengthening bearish trends that grow progressively harder to reverse without outside action.

Pi Network Breakdown Below $0.10 Could Trigger Rapid Liquidations

Experts are paying close attention to the $0.10 support level, which serves as Pi Network’s last major technical barrier against further declines. A significant drop below this level could initiate a series of liquidations, leading to a swift acceleration of declines into unknown bearish territory.

Market participants highlight that the overall market structure has significantly deteriorated since the conclusion of whale accumulation, resulting in a diminished number of protective bid walls remaining intact. If sentiment does not improve, Pi Network could face prolonged declines, making it difficult to sustain its market relevance in the long run.