PENGU Price Climbs Amid Smart Money Accumulation

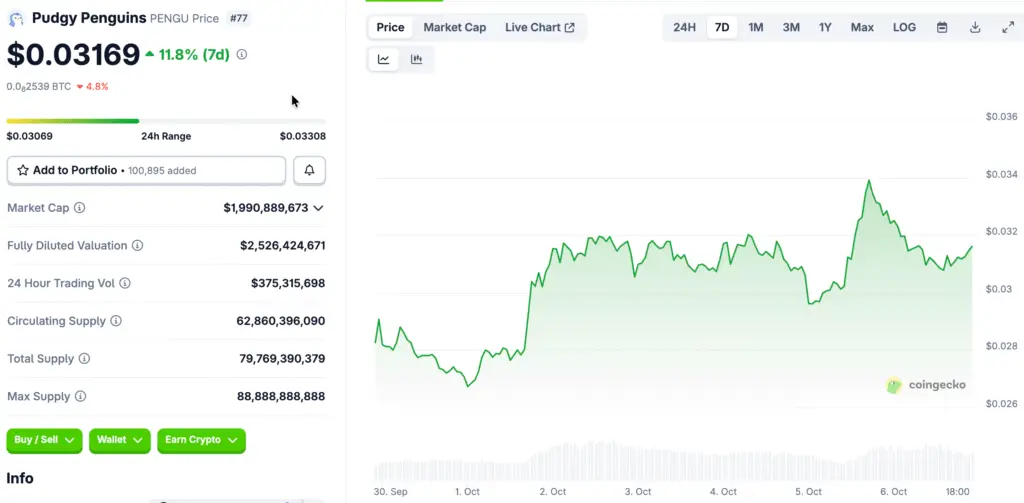

Pudgy Penguins experienced a remarkable price surge of 8.2% within just 24 hours, climbing to $0.03388 as notable crypto investors ramped up their accumulation efforts. This notable surge came after consistent buying efforts that established PENGU as the top memecoin among various prominent trading communities.

During the session, trading volumes surged, reflecting a growing market interest in this Solana-based memecoin. Experts see this accumulation phase as a possible signal for a significant breakout, driven by a mix of speculative excitement and the strategic moves of seasoned traders.

Pudgy Penguins Surpasses Rival Memecoins

Insights from Solana’s vibrant crypto community revealed that Pudgy Penguins have outperformed BONK, Jupiter, Moo Deng, and Useless in terms of smart money acquisitions. This notable rise highlights the increasing confidence among investors that PENGU may spearhead forthcoming speculative trends in the memecoin arena.

The token continued to show resilience against Bitcoin, achieving a 6.6% increase as the wider markets displayed varied trends. The current relative strength indicates that Pudgy Penguins could be entering a phase of momentum-driven accumulation, akin to the early-stage rallies seen in other memecoins throughout history.

Technical Breakout Opens Path Toward $0.040

PENGU successfully surpassed a significant resistance level at $0.03217 after four days of consistent testing, indicating a strengthening bullish momentum. After this breakout, the price action moved higher, establishing a brief consolidation area between the resistance at $0.03394 and the support at $0.02947.

Technical analysts pinpoint $0.040 as the next significant upside target, indicating around 20% more growth potential. Consistent daily closes above prior resistance levels could confirm this target, assuming that buying pressure stays steady and momentum indicators show improvement.

Recommended Article: Pudgy Penguins Hold Support as Bulls Target Breakout

Momentum Indicators Show Mixed Market Signals

The four-hour Supertrend indicator continues to show red, suggesting that the overall market trend has not completely shifted into bullish territory at this time. Furthermore, the Average Directional Index is presently at 15, staying below the 25 threshold needed to validate strong directional momentum.

To ensure a bullish continuation, experts emphasize the necessity for PENGU to maintain a strong position above the $0.0338 support levels. A drop below this threshold could undermine the setup, possibly leading to short-term corrections and momentarily reducing trader enthusiasm.

Pudgy Penguins Traders Show 5:1 Bullish Bias

The liquidation data from CoinGlass reveals significant levels at $0.03182 on the downside and $0.03442 on the upside, suggesting a strong presence of leveraged positions. Traders are generally anticipating a continuation of upward movement instead of downward retests, as indicated by the clustering patterns observed in the liquidation heatmap.

Long positions amount to $6.48 million, significantly outpacing $1.35 million in shorts, indicating a nearly five-to-one bullish stance. This disparity indicates a robust belief among traders that Pudgy Penguins will uphold support levels and may soon progress toward significant resistance targets.

Weekly Chart Shows Tight Consolidation Pattern

Weekly timeframes show a period of consolidation after a notable bullish candle, creating clear support and resistance levels within a tightening structure. Fluctuating candles indicate uncertainty while simultaneously showcasing a rise in engagement, as trading volume consistently gathers around these established price points.

This consolidation reflects previous accumulation phases that came before significant upward movements earlier this year. Market watchers are noting possible bullish engulfing patterns, indicating that buyers could be subtly preparing to make a significant move beyond the existing trading range.

Marketing Initiatives Enhance Worldwide Recognition for PENGU

The international marketing campaigns of Pudgy Penguins have greatly enhanced visibility, drawing increased interest from both retail traders and institutional participants. This expanded understanding boosts liquidity and supports technical indicators, strengthening the optimistic stories developing among trading communities worldwide.

The combination of strategic financial accumulation and refined technical frameworks creates an environment ripe for either ongoing consolidation or a potential breakout expansion. Traders are keeping a keen eye on the $0.040 resistance level, anticipating increased volatility should momentum pick up in the forthcoming trading sessions.